Abdulnasser Hatemi-J

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

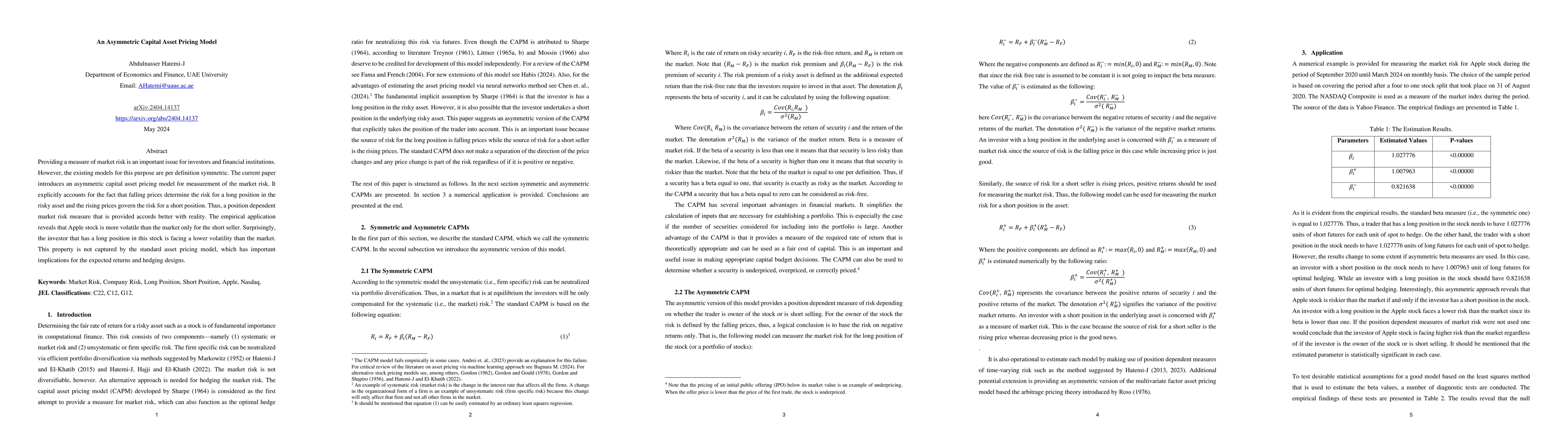

An Asymmetric Capital Asset Pricing Model

Providing a measure of market risk is an important issue for investors and financial institutions. However, the existing models for this purpose are per definition symmetric. The current paper intro...

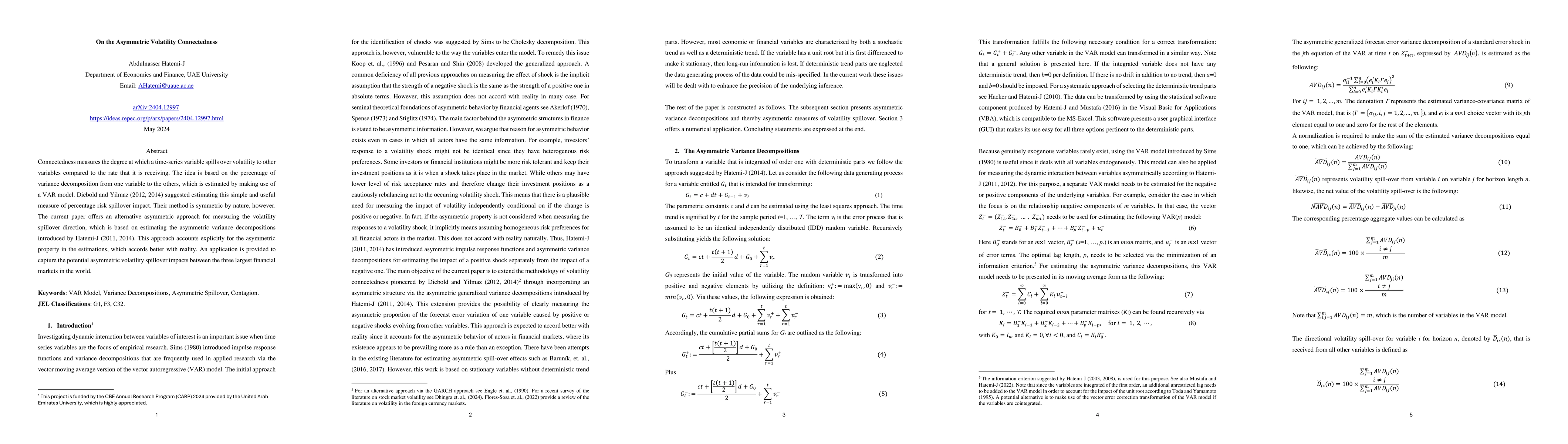

On the Asymmetric Volatility Connectedness

Connectedness measures the degree at which a time-series variable spills over volatility to other variables compared to the rate that it is receiving. The idea is based on the percentage of variance...

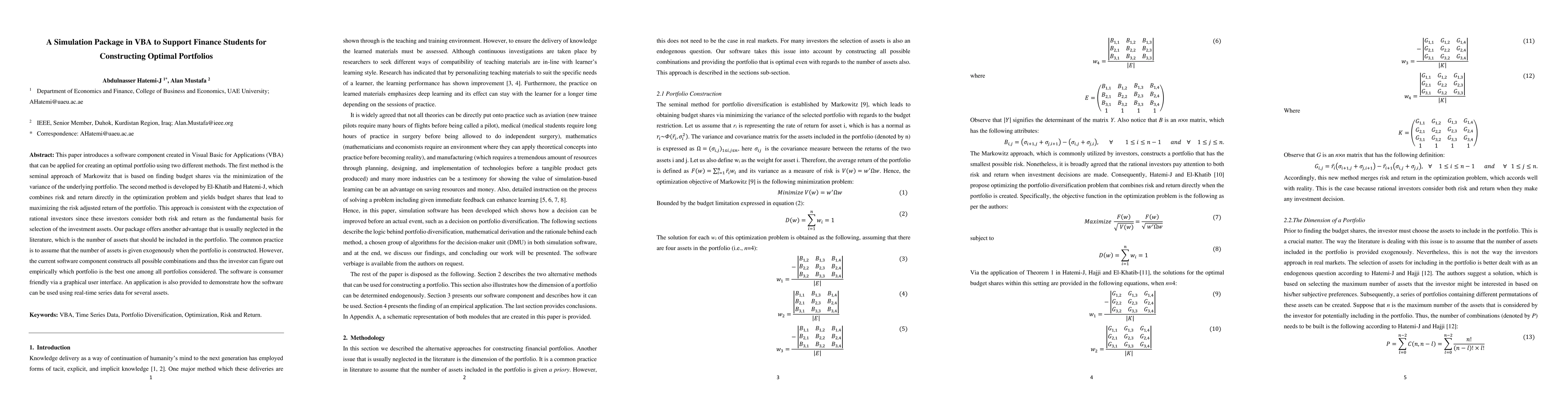

A Simulation Package in VBA to Support Finance Students for Constructing Optimal Portfolios

This paper introduces a software component created in Visual Basic for Applications (VBA) that can be applied for creating an optimal portfolio using two different methods. The first method is the s...

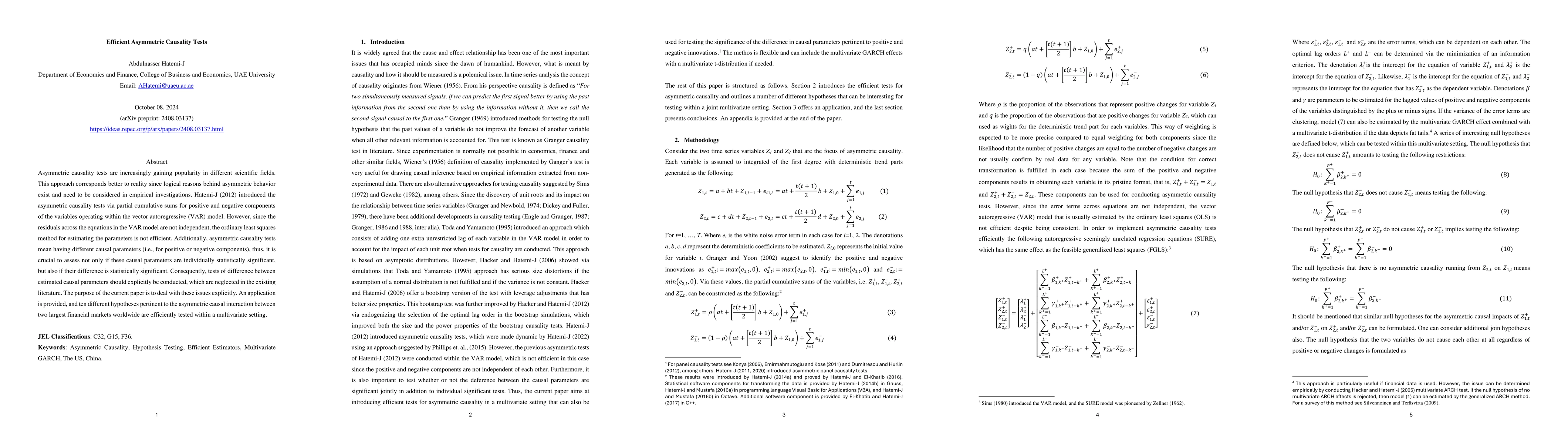

Efficient Asymmetric Causality Tests

Asymmetric causality tests are increasingly gaining popularity in different scientific fields. This approach corresponds better to reality since logical reasons behind asymmetric behavior exist and ne...

Testing for the Asymmetric Optimal Hedge Ratios: With an Application to Bitcoin

Reducing financial risk is of paramount importance to investors, financial institutions, and corporations. Since the pioneering contribution of Johnson (1960), the optimal hedge ratio based on futures...