Authors

Summary

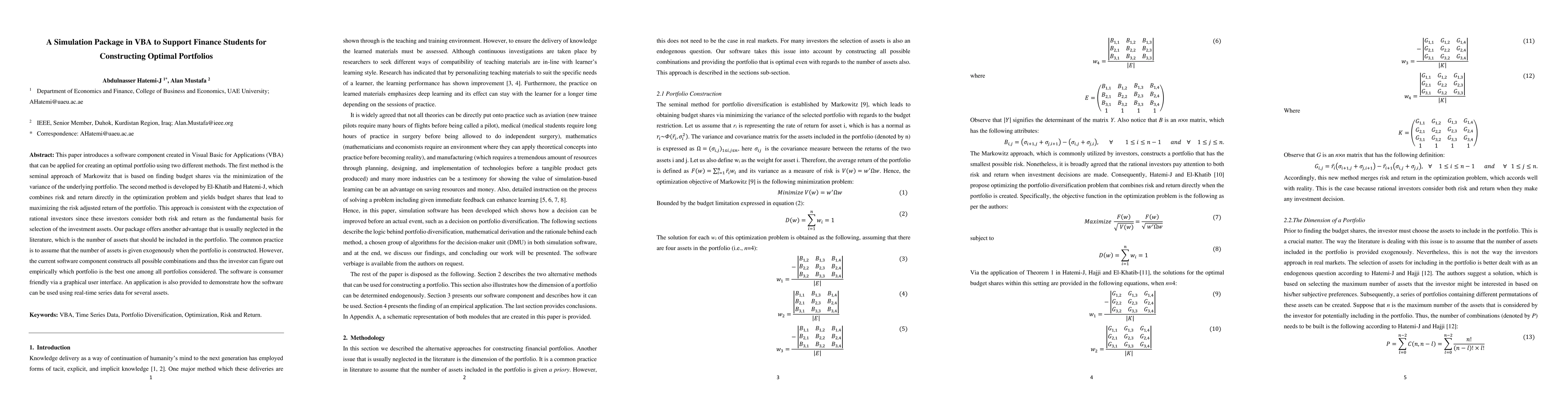

This paper introduces a software component created in Visual Basic for Applications (VBA) that can be applied for creating an optimal portfolio using two different methods. The first method is the seminal approach of Markowitz that is based on finding budget shares via the minimization of the variance of the underlying portfolio. The second method is developed by El-Khatib and Hatemi-J, which combines risk and return directly in the optimization problem and yields budget shares that lead to maximizing the risk adjusted return of the portfolio. This approach is consistent with the expectation of rational investors since these investors consider both risk and return as the fundamental basis for selection of the investment assets. Our package offers another advantage that is usually neglected in the literature, which is the number of assets that should be included in the portfolio. The common practice is to assume that the number of assets is given exogenously when the portfolio is constructed. However, the current software component constructs all possible combinations and thus the investor can figure out empirically which portfolio is the best one among all portfolios considered. The software is consumer friendly via a graphical user interface. An application is also provided to demonstrate how the software can be used using real-time series data for several assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFormulations to select assets for constructing sparse index tracking portfolios

Yutaka Sakurai, Daiki Wakabayashi, Fumio Ishizaki

| Title | Authors | Year | Actions |

|---|

Comments (0)