Authors

Summary

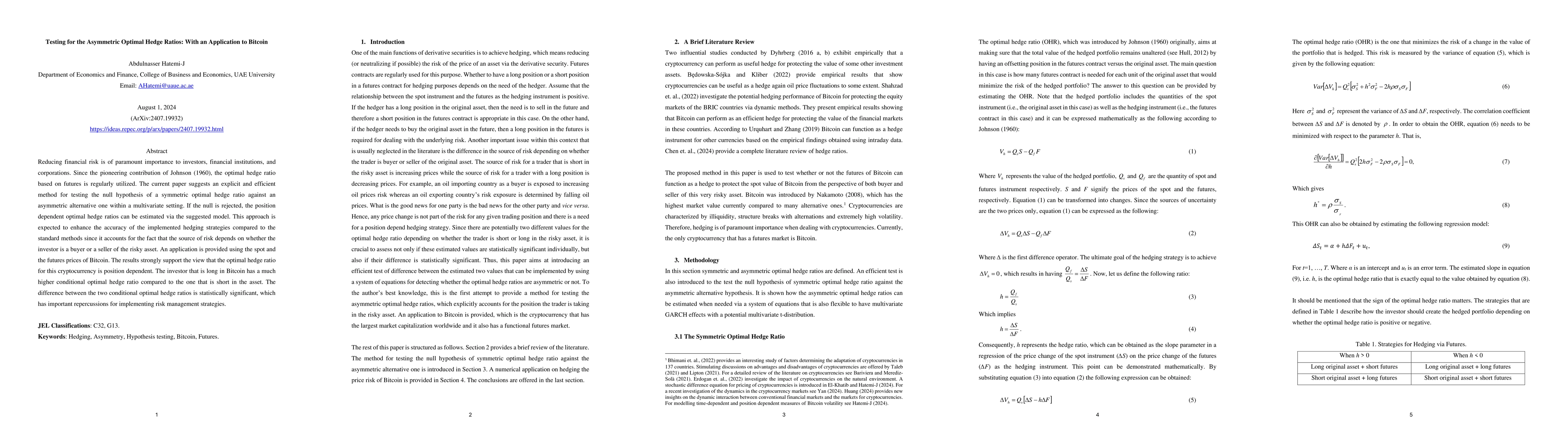

Reducing financial risk is of paramount importance to investors, financial institutions, and corporations. Since the pioneering contribution of Johnson (1960), the optimal hedge ratio based on futures is regularly utilized. The current paper suggests an explicit and efficient method for testing the null hypothesis of a symmetric optimal hedge ratio against an asymmetric alternative one within a multivariate setting. If the null is rejected, the position dependent optimal hedge ratios can be estimated via the suggested model. This approach is expected to enhance the accuracy of the implemented hedging strategies compared to the standard methods since it accounts for the fact that the source of risk depends on whether the investor is a buyer or a seller of the risky asset. An application is provided using spot and futures prices of Bitcoin. The results strongly support the view that the optimal hedge ratio for this cryptocurrency is position dependent. The investor that is long in Bitcoin has a much higher conditional optimal hedge ratio compared to the one that is short in the asset. The difference between the two conditional optimal hedge ratios is statistically significant, which has important repercussions for implementing risk management strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTo Hedge or Not to Hedge: Optimal Strategies for Stochastic Trade Flow Management

Philippe Bergault, Olivier Guéant, Hamza Bodor

No citations found for this paper.

Comments (0)