Summary

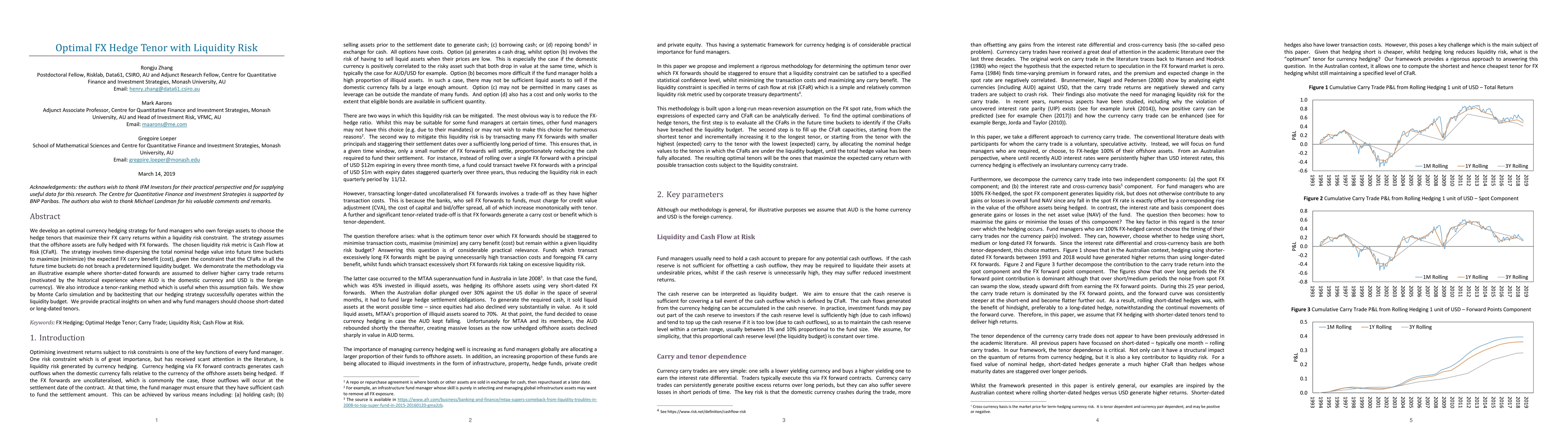

We develop an optimal currency hedging strategy for fund managers who own foreign assets to choose the hedge tenors that maximize their FX carry returns within a liquidity risk constraint. The strategy assumes that the offshore assets are fully hedged with FX forwards. The chosen liquidity risk metric is Cash Flow at Risk (CFaR). The strategy involves time-dispersing the total nominal hedge value into future time buckets to maximize (minimize) the expected FX carry benefit (cost), given the constraint that the CFaRs in all the future time buckets do not breach a predetermined liquidity budget. We demonstrate the methodology via an illustrative example where shorter-dated forwards are assumed to deliver higher carry trade returns (motivated by the historical experience where AUD is the domestic currency and USD is the foreign currency). We also introduce a tenor-ranking method which is useful when this assumption fails. We show by Monte Carlo simulation and by backtesting that our hedging strategy successfully operates within the liquidity budget. We provide practical insights on when and why fund managers should choose short-dated or long-dated tenors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket making by an FX dealer: tiers, pricing ladders and hedging rates for optimal risk control

Philippe Bergault, Olivier Guéant, Alexander Barzykin

Dealing with multi-currency inventory risk in FX cash markets

Philippe Bergault, Olivier Guéant, Alexander Barzykin

No citations found for this paper.

Comments (0)