Summary

Dealers make money by providing liquidity to clients but face flow uncertainty and thus price risk. They can efficiently skew their prices and wait for clients to mitigate risk (internalization), or trade with other dealers in the open market to hedge their position and reduce their inventory (externalization). Of course, the better control associated with externalization comes with transaction costs and market impact. The internalization vs. externalization dilemma has been a topic of recent active discussion within the foreign exchange (FX) community. This paper offers an optimal control framework for market making tackling both pricing and hedging, thus answering a question well known to dealers: `to hedge, or not to hedge?'

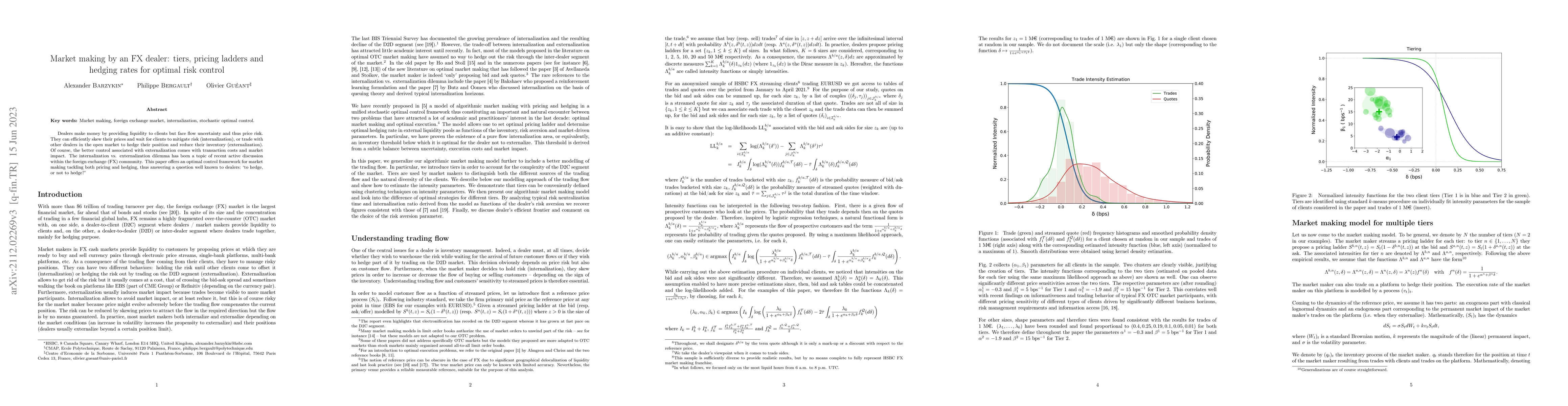

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlgorithmic market making in dealer markets with hedging and market impact

Philippe Bergault, Olivier Guéant, Alexander Barzykin

Dealing with multi-currency inventory risk in FX cash markets

Philippe Bergault, Olivier Guéant, Alexander Barzykin

| Title | Authors | Year | Actions |

|---|

Comments (0)