Philippe Bergault

25 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Price-Aware Automated Market Makers: Models Beyond Brownian Prices and Static Liquidity

In this paper, we introduce a suite of models for price-aware automated market making platforms willing to optimize their quotes. These models incorporate advanced price dynamics, including stochast...

Algorithmic Market Making in Spot Precious Metals

The primary challenge of market making in spot precious metals is navigating the liquidity that is mainly provided by futures contracts. The Exchange for Physical (EFP) spread, which is the price di...

Dispensing with optimal control: a new approach for the pricing and management of share buyback contracts

This paper introduces a novel methodology for the pricing and management of share buyback contracts, overcoming the limitations of traditional optimal control methods, which frequently encounter dif...

A Mean Field Game between Informed Traders and a Broker

We find closed-form solutions to the stochastic game between a broker and a mean-field of informed traders. In the finite player game, the informed traders observe a common signal and a private sign...

Mean Field Games in a Stackelberg problem with an informed major player

We investigate a stochastic differential game in which a major player has a private information (the knowledge of a random variable), which she discloses through her control to a population of small...

Liquidity Dynamics in RFQ Markets and Impact on Pricing

To assign a value to a portfolio, it is common to use Mark-to-Market prices. However, how should one proceed when the securities are illiquid? When transaction prices are scarce, how can one use all...

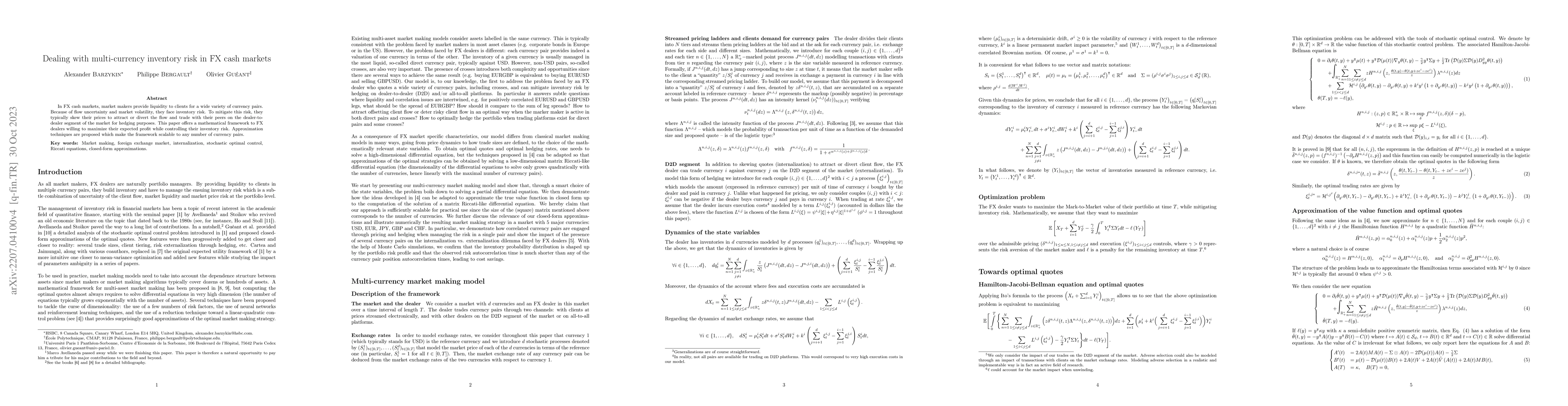

Automated Market Makers: Mean-Variance Analysis of LPs Payoffs and Design of Pricing Functions

With the emergence of decentralized finance, new trading mechanisms called Automated Market Makers have appeared. The most popular Automated Market Makers are Constant Function Market Makers. They h...

Dealing with multi-currency inventory risk in FX cash markets

In FX cash markets, market makers provide liquidity to clients for a wide variety of currency pairs. Because of flow uncertainty and market volatility, they face inventory risk. To mitigate this ris...

A mean-field game of market-making against strategic traders

We design a market-making model \`a la Avellaneda-Stoikov in which the market-takers act strategically, in the sense that they design their trading strategy based on an exogenous trading signal. The...

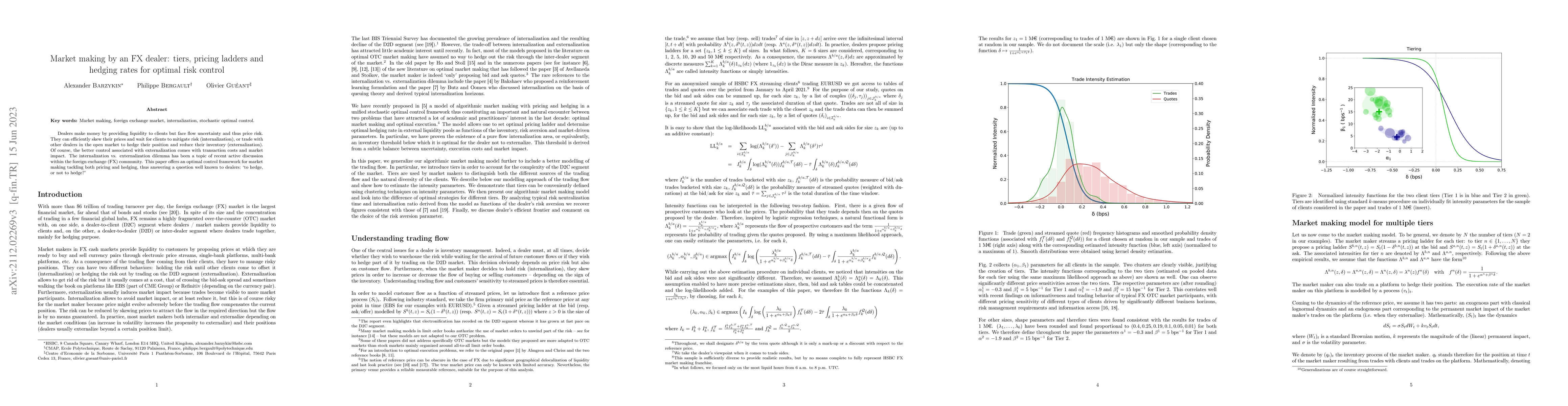

Market making by an FX dealer: tiers, pricing ladders and hedging rates for optimal risk control

Dealers make money by providing liquidity to clients but face flow uncertainty and thus price risk. They can efficiently skew their prices and wait for clients to mitigate risk (internalization), or...

Optimal incentives in a limit order book: a SPDE control approach

With the fragmentation of electronic markets, exchanges are now competing in order to attract trading activity on their platform. Consequently, they developed several regulatory tools to control liq...

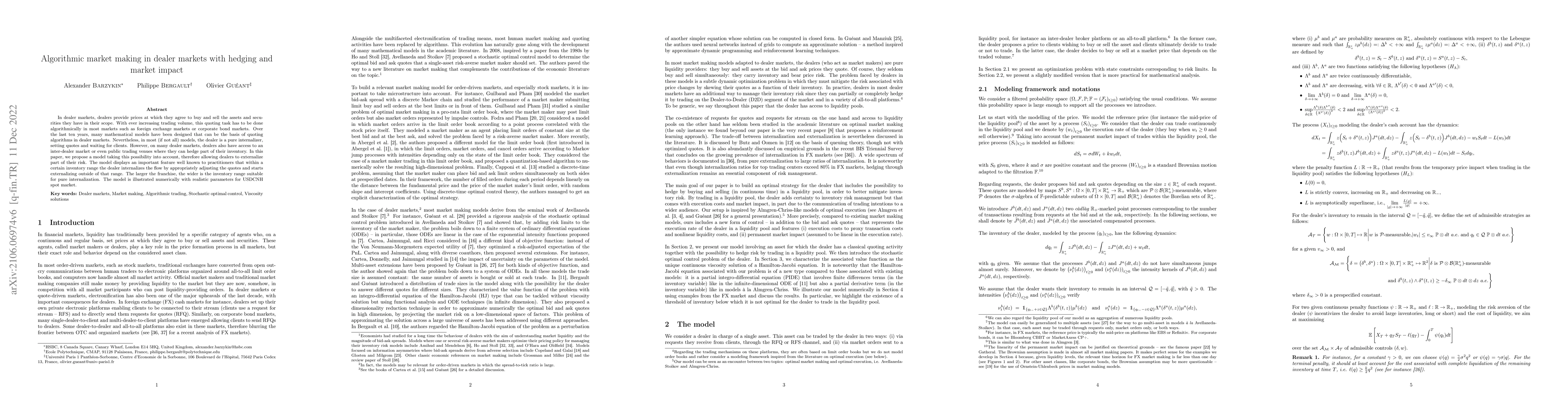

Algorithmic market making in dealer markets with hedging and market impact

In dealer markets, dealers provide prices at which they agree to buy and sell the assets and securities they have in their scope. With ever increasing trading volume, this quoting task has to be don...

Multi-asset optimal execution and statistical arbitrage strategies under Ornstein-Uhlenbeck dynamics

In recent years, academics, regulators, and market practitioners have increasingly addressed liquidity issues. Amongst the numerous problems addressed, the optimal execution of large orders is proba...

Size matters for OTC market makers: general results and dimensionality reduction techniques

In most OTC markets, a small number of market makers provide liquidity to other market participants. More precisely, for a list of assets, they set prices at which they agree to buy and sell. Market...

Closed-form approximations in multi-asset market making

A large proportion of market making models derive from the seminal model of Avellaneda and Stoikov. The numerical approximation of the value function and the optimal quotes in these models remains a...

Simulating and analyzing a sparse order book: an application to intraday electricity markets

This paper presents a novel model for simulating and analyzing sparse limit order books (LOBs), with a specific application to the European intraday electricity market. In illiquid markets, characteri...

Automated Market Making: the case of Pegged Assets

In this paper, we introduce a novel framework to model the exchange rate dynamics between two intrinsically linked cryptoassets, such as stablecoins pegged to the same fiat currency or a liquid stakin...

To Hedge or Not to Hedge: Optimal Strategies for Stochastic Trade Flow Management

This paper addresses the trade-off between internalisation and externalisation in the management of stochastic trade flows. We consider agents who must absorb flows and manage risk by deciding whether...

Equilibrium Reward for Liquidity Providers in Automated Market Makers

We find the equilibrium contract that an automated market maker (AMM) offers to their strategic liquidity providers (LPs) in order to maximize the order flow that gets processed by the venue. Our mode...

Optimal hedging of an informed broker facing many traders

This paper investigates the optimal hedging strategies of an informed broker interacting with multiple traders in a financial market. We develop a theoretical framework in which the broker, possessing...

Optimal Fees for Liquidity Provision in Automated Market Makers

Passive liquidity providers (LPs) in automated market makers (AMMs) face losses due to adverse selection (LVR), which static trading fees often fail to offset in practice. We study the key determinant...

Cryptocurrencies and Interest Rates: Inferring Yield Curves in a Bondless Market

In traditional financial markets, yield curves are widely available for countries (and, by extension, currencies), financial institutions, and large corporates. These curves are used to calibrate stoc...

Optimal Quoting under Adverse Selection and Price Reading

Over the past decade, many dealers have implemented algorithmic models to automatically respond to RFQs and manage flows originating from their electronic platforms. In parallel, building on the found...

Optimal Exit Time for Liquidity Providers in Automated Market Makers

We study the problem of optimal liquidity withdrawal for a representative liquidity provider (LP) in an automated market maker (AMM). LPs earn fees from trading activity but are exposed to impermanent...

Competition and Incentives in a Shared Order Book

Recent regulation on intraday electricity markets has led to the development of shared order books with the intention to foster competition and increase market liquidity. In this paper, we address the...