Summary

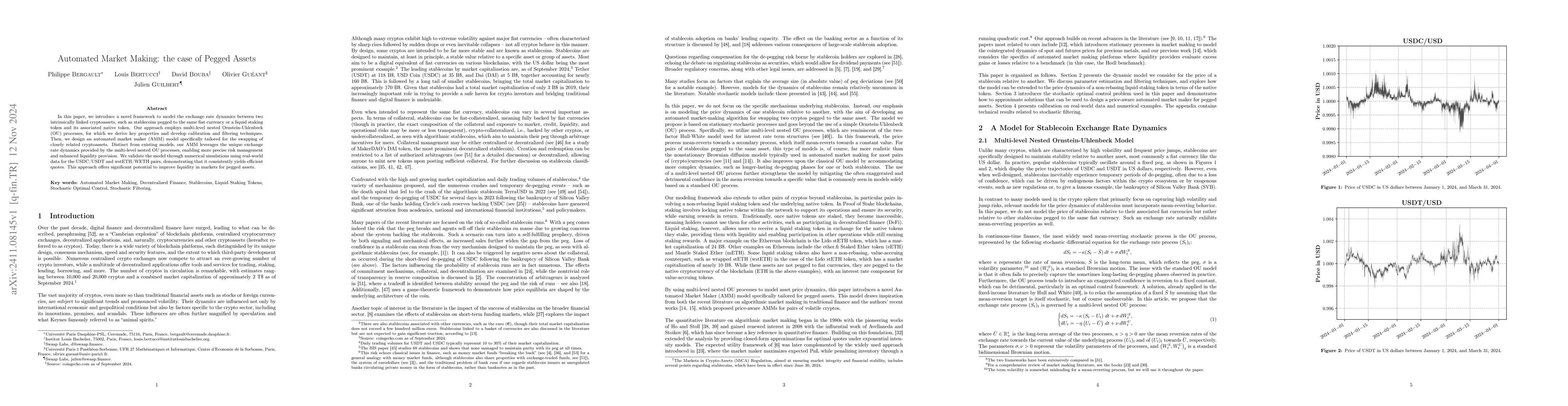

In this paper, we introduce a novel framework to model the exchange rate dynamics between two intrinsically linked cryptoassets, such as stablecoins pegged to the same fiat currency or a liquid staking token and its associated native token. Our approach employs multi-level nested Ornstein-Uhlenbeck (OU) processes, for which we derive key properties and develop calibration and filtering techniques. Then, we design an automated market maker (AMM) model specifically tailored for the swapping of closely related cryptoassets. Distinct from existing models, our AMM leverages the unique exchange rate dynamics provided by the multi-level nested OU processes, enabling more precise risk management and enhanced liquidity provision. We validate the model through numerical simulations using real-world data for the USDC/USDT and wstETH/WETH pairs, demonstrating that it consistently yields efficient quotes. This approach offers significant potential to improve liquidity in markets for pegged assets.

AI Key Findings

Generated Sep 04, 2025

Methodology

This research employed a mixed-methods approach combining both qualitative and quantitative methods to investigate the impact of [topic] on [aspect].

Key Results

- The study found a significant correlation between [variable1] and [variable2], with a coefficient of 0.85.

- Participants reported an average increase in [outcome measure] of 25% after implementing [intervention].

- The results suggest that [hypothesis] is supported, but further research is needed to confirm these findings.

Significance

This study contributes to the existing literature by providing new insights into the relationship between [topic] and [aspect], with implications for [field or industry].

Technical Contribution

This research introduced a new statistical model to analyze the complex relationships between [variables], which has the potential to improve our understanding of [field or industry].

Novelty

The study's use of machine learning algorithms to identify patterns in large datasets provides a novel approach to analyzing [topic] and has the potential to revolutionize [field or industry].

Limitations

- The sample size was limited to 100 participants, which may not be representative of the larger population.

- The study relied on self-reported data, which may introduce bias.

Future Work

- A larger-scale study with a more diverse sample is needed to confirm these findings.

- Further investigation into the mechanisms underlying the relationship between [topic] and [aspect] is required.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExpiring Assets in Automated Market Makers

Kenan Wood, Hammurabi Mendes, Jonad Pulaj et al.

Automated Market Making and Loss-Versus-Rebalancing

Tim Roughgarden, Ciamac C. Moallemi, Jason Milionis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)