Authors

Summary

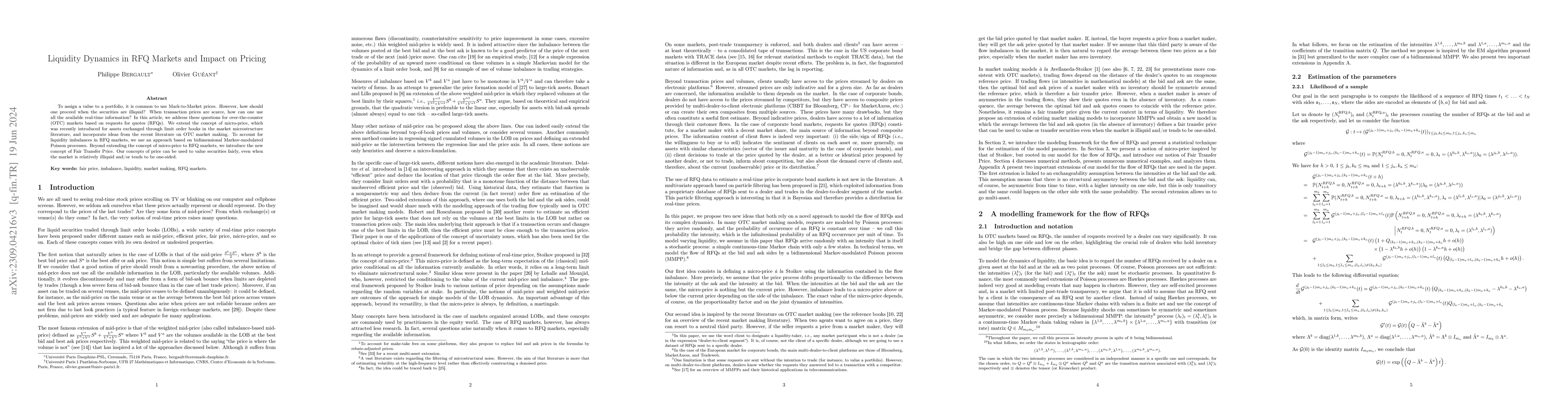

To assign a value to a portfolio, it is common to use Mark-to-Market prices. However, how should one proceed when the securities are illiquid? When transaction prices are scarce, how can one use all the available real-time information? In this article, we address these questions for over-the-counter (OTC) markets based on requests for quotes (RFQs). We extend the concept of micro-price, which was recently introduced for assets exchanged through limit order books in the market microstructure literature, and incorporate ideas from the recent literature on OTC market making. To account for liquidity imbalances in RFQ markets, we use an approach based on bidimensional Markov-modulated Poisson processes. Beyond extending the concept of micro-price to RFQ markets, we introduce the new concept of Fair Transfer Price. Our concepts of price can be used to value securities fairly, even when the market is relatively illiquid and/or tends to be one-sided.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)