Summary

This paper investigates the optimal hedging strategies of an informed broker interacting with multiple traders in a financial market. We develop a theoretical framework in which the broker, possessing exclusive information about the drift of the asset's price, engages with traders whose trading activities impact the market price. Using a mean-field game approach, we derive the equilibrium strategies for both the broker and the traders, illustrating the intricate dynamics of their interactions. The broker's optimal strategy involves a Stackelberg equilibrium, where the broker leads and the traders follow. Our analysis also addresses the mean field limit of finite-player models and shows the convergence to the mean-field solution as the number of traders becomes large.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

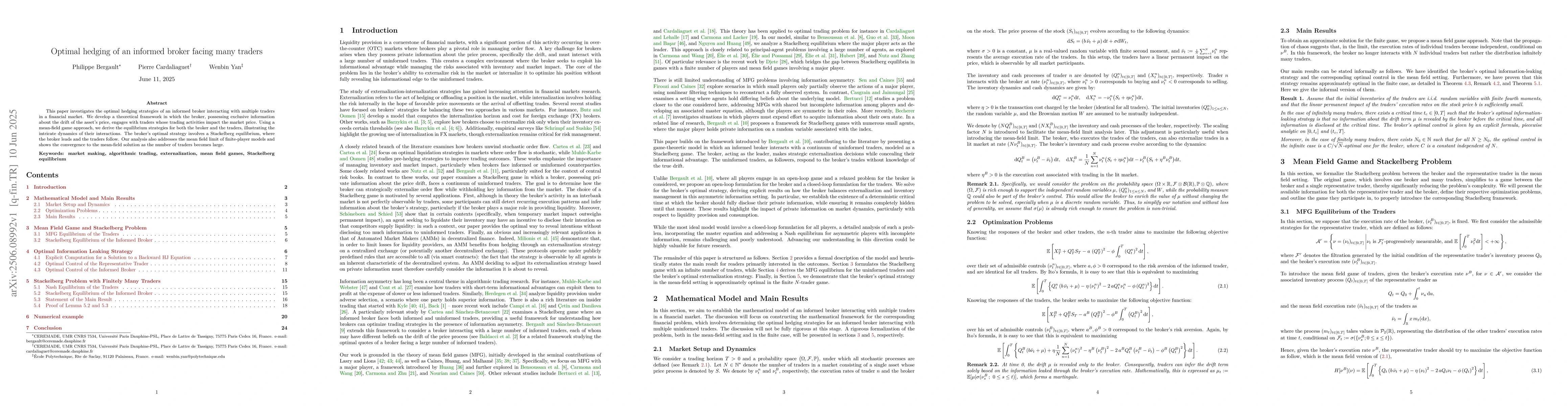

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Mean Field Game between Informed Traders and a Broker

Philippe Bergault, Leandro Sánchez-Betancourt

Market Making with Fads, Informed, and Uninformed Traders

Leandro Sánchez-Betancourt, Emilio Barucci, Adrien Mathieu

Strategic Learning and Trading in Broker-Mediated Markets

Fayçal Drissi, Leandro Sánchez-Betancourt, Alif Aqsha

No citations found for this paper.

Comments (0)