Summary

We study strategic interactions in a broker-mediated market. A broker provides liquidity to an informed trader and to noise traders while managing inventory in the lit market. The broker and the informed trader maximise their trading performance while filtering each other's private information; the trader estimates the broker's trading activity in the lit market while the broker estimates the informed trader's private signal. Brokers hold a strategic advantage over traders who rely solely on prices to filter information. We find that information leakage in the client's trading flow yields an economic value to the broker that is comparable to transaction costs; she speculates profitably and mitigates risk effectively, which, in turn, adversely impacts the informed trader's performance. In contrast, low signal-to-noise sources, such as prices, result in the broker's trading performance being indistinguishable from that of a naive strategy that internalises noise flow, externalises informed flow, and offloads inventory at a constant rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

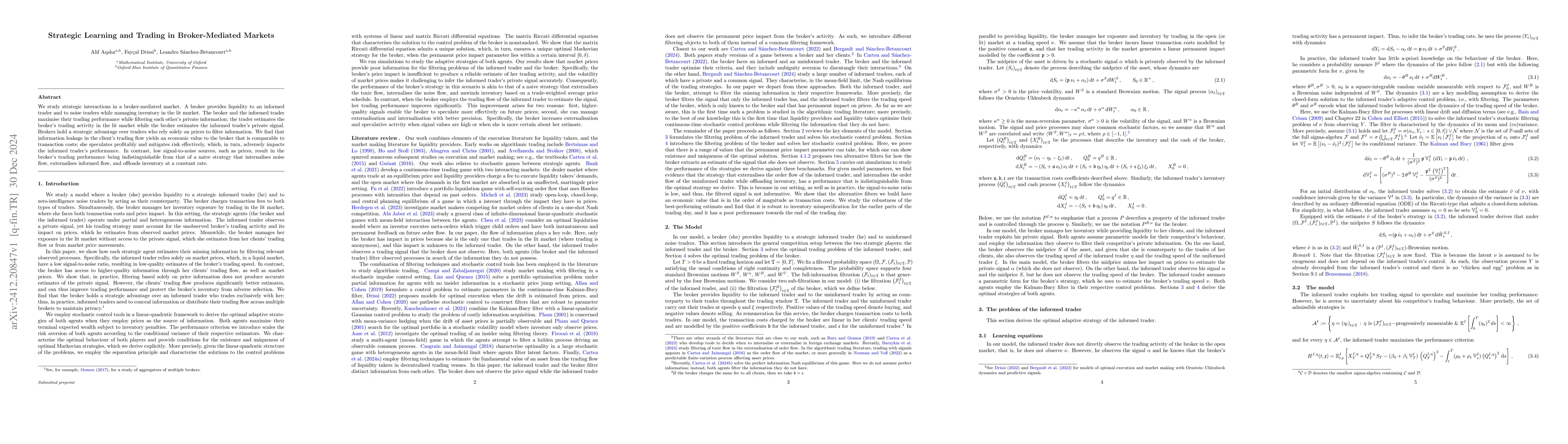

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Trading Strategies in Quantitative Markets using Multi-Agent Reinforcement Learning

Wenbo Ding, Xiao-Ping Zhang, Ercan E. Kuruoglu et al.

No citations found for this paper.

Comments (0)