Summary

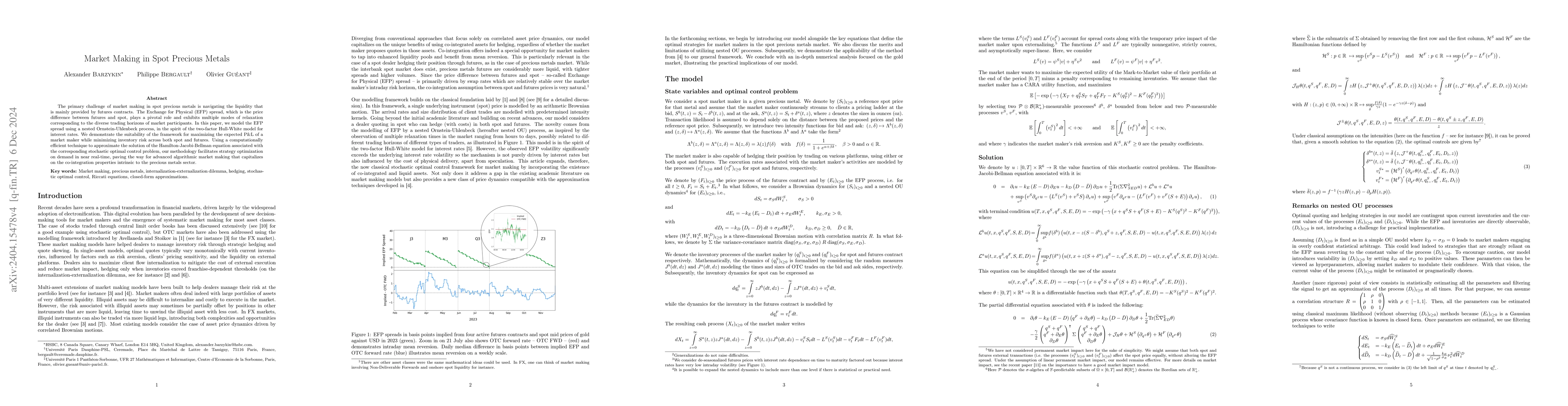

The primary challenge of market making in spot precious metals is navigating the liquidity that is mainly provided by futures contracts. The Exchange for Physical (EFP) spread, which is the price difference between futures and spot, plays a pivotal role and exhibits multiple modes of relaxation corresponding to the diverse trading horizons of market participants. In this paper, we introduce a novel framework utilizing a nested Ornstein-Uhlenbeck process to model the EFP spread. We demonstrate the suitability of the framework for maximizing the expected P\&L of a market maker while minimizing inventory risk across both spot and futures. Using a computationally efficient technique to approximate the solution of the Hamilton-Jacobi-Bellman equation associated with the corresponding stochastic optimal control problem, our methodology facilitates strategy optimization on demand in near real-time, paving the way for advanced algorithmic market making that capitalizes on the co-integration properties intrinsic to the precious metals sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersAlgorithmic market making in dealer markets with hedging and market impact

Philippe Bergault, Olivier Guéant, Alexander Barzykin

| Title | Authors | Year | Actions |

|---|

Comments (0)