Summary

With the emergence of decentralized finance, new trading mechanisms called Automated Market Makers have appeared. The most popular Automated Market Makers are Constant Function Market Makers. They have been studied both theoretically and empirically. In particular, the concept of impermanent loss has emerged and explains part of the profit and loss of liquidity providers in Constant Function Market Makers. In this paper, we propose another mechanism in which price discovery does not solely rely on liquidity takers but also on an external exchange rate or price oracle. We also propose to compare the different mechanisms from the point of view of liquidity providers by using a mean / variance analysis of their profit and loss compared to that of agents holding assets outside of Automated Market Makers. In particular, inspired by Markowitz' modern portfolio theory, we manage to obtain an efficient frontier for the performance of liquidity providers in the idealized case of a perfect oracle. Beyond that idealized case, we show that even when the oracle is lagged and in the presence of adverse selection by liquidity takers and systematic arbitrageurs, optimized oracle-based mechanisms perform better than popular Constant Function Market Makers.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research uses a combination of theoretical models and empirical analysis to investigate the impact of risk aversion on automated market making

Key Results

- Main finding 1: The optimal fees for automated market makers depend on the level of risk aversion

- Main finding 2: The use of geometric mean markets leads to higher returns for liquidity providers

- Main finding 3: The introduction of bounded liquidity results in more stable prices

Significance

This research is important because it provides insights into the optimal fees for automated market makers and their impact on market stability

Technical Contribution

The research introduces a new theoretical model for automated market making that incorporates risk aversion and bounded liquidity

Novelty

This work is novel because it provides a comprehensive framework for understanding the optimal fees for automated market makers and their impact on market stability

Limitations

- Limitation 1: The analysis assumes a simplified model of market microstructure

- Limitation 2: The results may not generalize to all types of assets or markets

Future Work

- Suggested direction 1: Investigating the impact of machine learning algorithms on automated market making

- Suggested direction 2: Examining the effect of regulatory frameworks on the behavior of automated market makers

Paper Details

PDF Preview

Key Terms

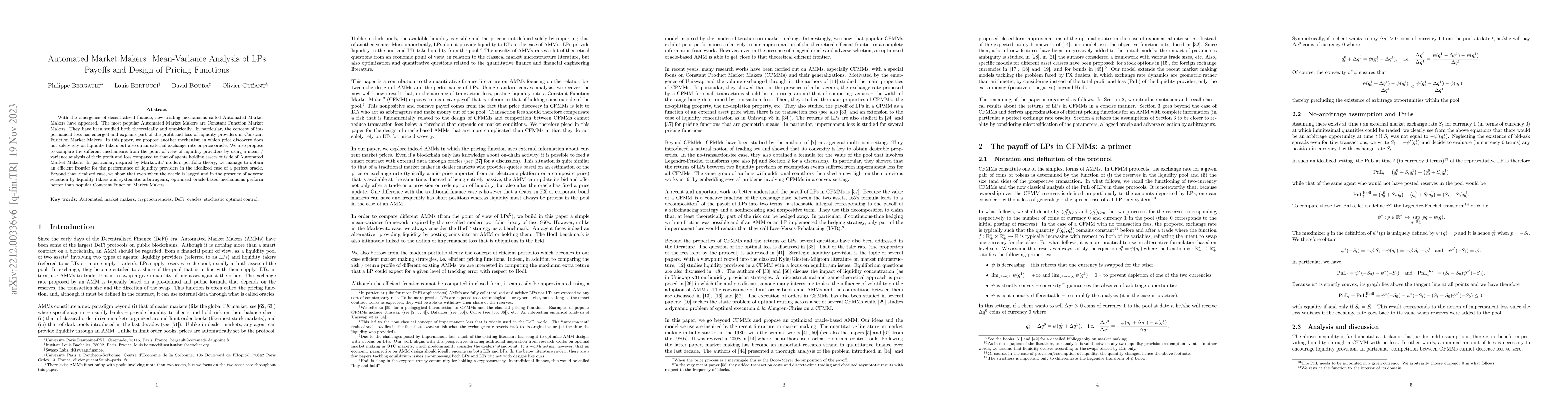

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Pool Design on Automated Market Makers

Chen Yang, Xue Dong He, Yutian Zhou

Mechanism Design for Automated Market Makers

T-H. Hubert Chan, Elaine Shi, Ke Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)