Summary

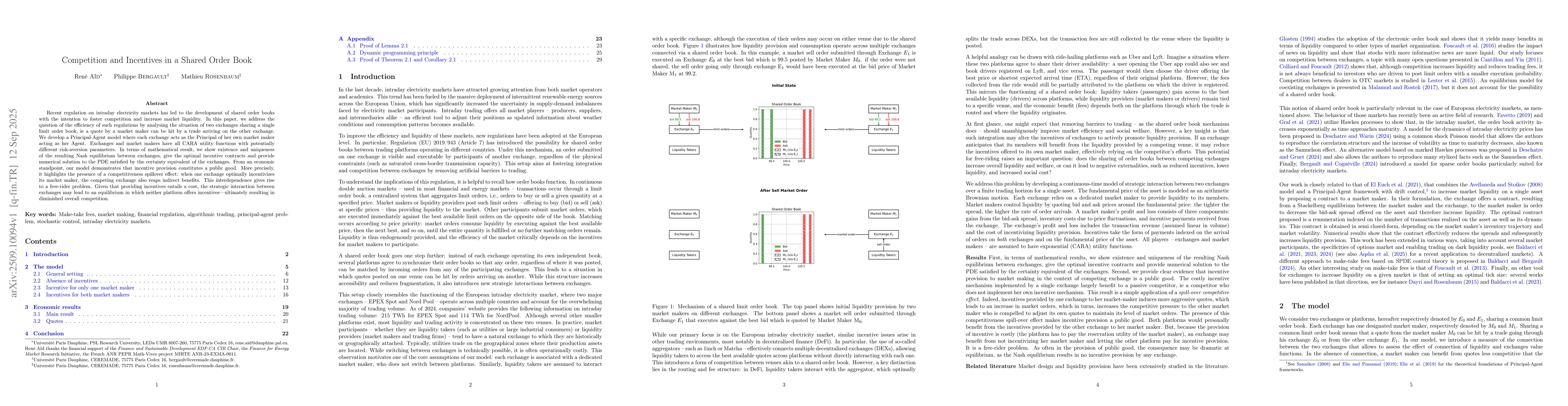

Recent regulation on intraday electricity markets has led to the development of shared order books with the intention to foster competition and increase market liquidity. In this paper, we address the question of the efficiency of such regulations by analysing the situation of two exchanges sharing a single limit order book, i.e. a quote by a market maker can be hit by a trade arriving on the other exchange. We develop a Principal-Agent model where each exchange acts as the Principal of her own market maker acting as her Agent. Exchanges and market makers have all CARA utility functions with potentially different risk-aversion parameters. In terms of mathematical result, we show existence and uniqueness of the resulting Nash equilibrium between exchanges, give the optimal incentive contracts and provide numerical solution to the PDE satisfied by the certainty equivalent of the exchanges. From an economic standpoint, our model demonstrates that incentive provision constitutes a public good. More precisely, it highlights the presence of a competitiveness spillover effect: when one exchange optimally incentivizes its market maker, the competing exchange also reaps indirect benefits. This interdependence gives rise to a free-rider problem. Given that providing incentives entails a cost, the strategic interaction between exchanges may lead to an equilibrium in which neither platform offers incentives -- ultimately resulting in diminished overall competition.

AI Key Findings

Generated Oct 18, 2025

Methodology

The research employs a combination of stochastic control theory, game-theoretic models, and empirical analysis to study market making strategies in automated trading environments. It uses a Stackelberg game framework to model interactions between market makers and liquidity providers, incorporating Hawkes processes for order book dynamics and optimal control techniques for decision-making.

Key Results

- The study identifies optimal market making strategies that balance inventory risk and profit maximization under asymmetric information.

- A novel equilibrium concept is developed that characterizes the interaction between market makers and liquidity providers in dark pools and limit order books.

- The analysis reveals that optimal tick sizes and pricing strategies depend on both market conditions and the strategic behavior of competing market makers.

Significance

This research provides critical insights into the design of market mechanisms and the strategic behavior of market participants in high-frequency trading environments. It has implications for regulatory policy, market design, and the development of algorithmic trading strategies.

Technical Contribution

The paper introduces a new mathematical framework combining stochastic control, game theory, and point process modeling to analyze market making strategies in complex trading environments.

Novelty

This work presents the first comprehensive analysis of market making in dark pools using a Stackelberg game approach, combined with Hawkes process modeling for order book dynamics, offering new insights into liquidity provision strategies.

Limitations

- The model assumes perfect information about order book dynamics, which may not hold in real-world markets.

- The analysis focuses on stylized market environments and may require calibration to specific market conditions.

Future Work

- Extension to multi-asset markets and heterogeneous market makers

- Incorporation of machine learning techniques for adaptive strategy optimization

- Empirical validation using real market data from dark pools and limit order books

Paper Details

PDF Preview

Similar Papers

Found 4 papersOptimal incentives in a limit order book: a SPDE control approach

Philippe Bergault, Bastien Baldacci

Shared Sequencing and Latency Competition as a Noisy Contest

Akaki Mamageishvili, Jan Christoph Schlegel

Comments (0)