Authors

Summary

We derive a closed-form approximation for the credit default swap (CDS) spread in the two-dimensional shifted square-root diffusion (SSRD) model using asymptotic coefficient expansion technique to approximate solutions of nonlinear partial differential equations. Specifically, we identify the Cauchy problems associated with two terms in the CDS spread formula that lack analytical solutions and derive asymptotic approximations for these terms. Our approximation does not require the assumption of uncorrelated interest rate and default intensity processes as typically required for calibration in the SSRD model. Through several calibration studies using market data on CDS spread, we demonstrate the accuracy and efficiency of our proposed formula.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

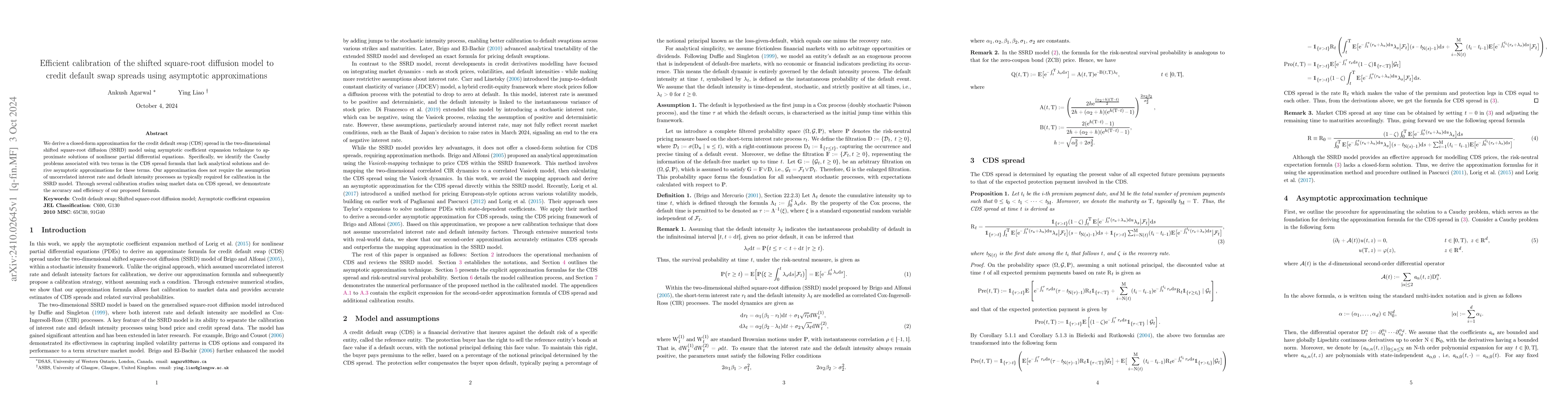

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)