Summary

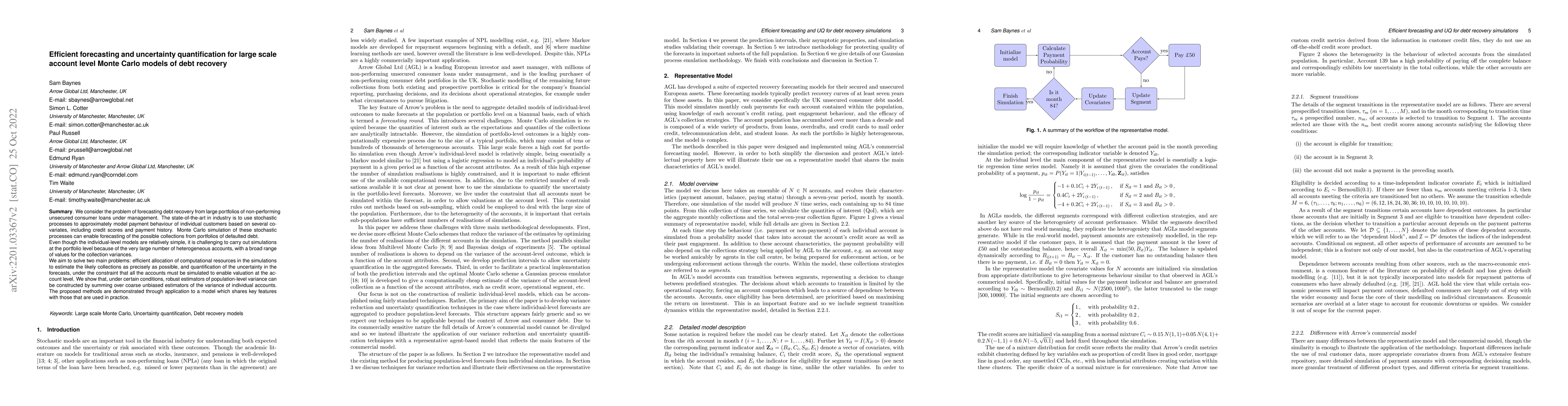

We consider the problem of forecasting debt recovery from large portfolios of non-performing unsecured consumer loans under management. The state of the art in industry is to use stochastic processes to approximately model payment behaviour of individual customers based on several covariates, including credit scores and payment history. Monte Carlo simulation of these stochastic processes can enable forecasting of the possible returns from portfolios of defaulted debt, and the quantification of uncertainty. Despite the fact that the individual-level models are relatively simple, it is challenging to carry out simulations at the portfolio level because of the very large number of accounts. The accounts are also heterogeneous, with a broad range of values for the collection variances. We aim to solve two main problems: efficient allocation of computational resources in the simulations to estimate the likely collections as precisely as possible, and quantification of the uncertainty in the forecasts. We show that under certain conditions, robust estimators of population-level variance can be constructed by summing over coarse unbiased estimators of the variance of individual accounts. The proposed methods are demonstrated through application to a model which shares key features with those that are used in practice.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Level Monte Carlo sampling with Parallel-in-Time Integration for Uncertainty Quantification in Electric Machine Simulation

Sebastian Schöps, Robert Hahn

Analyzing Uncertainty Quantification in Statistical and Deep Learning Models for Probabilistic Electricity Price Forecasting

Stephan Schlüter, Sven Pappert, Abhinav Das et al.

Enhancing Monte Carlo Dropout Performance for Uncertainty Quantification

Afshar Shamsi, Arash Mohammadi, Hamid Alinejad-Rokny et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)