Summary

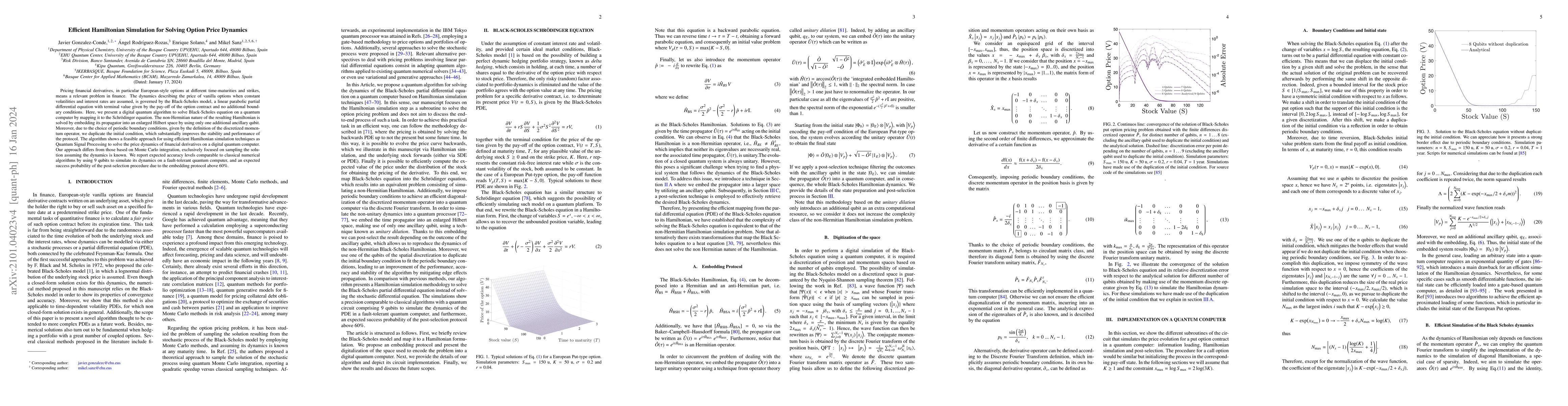

Pricing financial derivatives, in particular European-style options at different time-maturities and strikes, means a relevant problem in finance. The dynamics describing the price of vanilla options when constant volatilities and interest rates are assumed, is governed by the Black-Scholes model, a linear parabolic partial differential equation with terminal value given by the pay-off of the option contract and no additional boundary conditions. Here, we present a digital quantum algorithm to solve Black-Scholes equation on a quantum computer by mapping it to the Schr\"odinger equation. The non-Hermitian nature of the resulting Hamiltonian is solved by embedding its propagator into an enlarged Hilbert space by using only one additional ancillary qubit. Moreover, due to the choice of periodic boundary conditions, given by the definition of the discretized momentum operator, we duplicate the initial condition, which substantially improves the stability and performance of the protocol. The algorithm shows a feasible approach for using efficient Hamiltonian simulation techniques as Quantum Signal Processing to solve the price dynamics of financial derivatives on a digital quantum computer. Our approach differs from those based on Monte Carlo integration, exclusively focused on sampling the solution assuming the dynamics is known. We report expected accuracy levels comparable to classical numerical algorithms by using 9 qubits to simulate its dynamics on a fault-tolerant quantum computer, and an expected success probability of the post-selection procedure due to the embedding protocol above 60%.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Hamiltonian Approach to Floating Barrier Option Pricing

Qi Chen, Chao Guo, Hong-tao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)