Authors

Summary

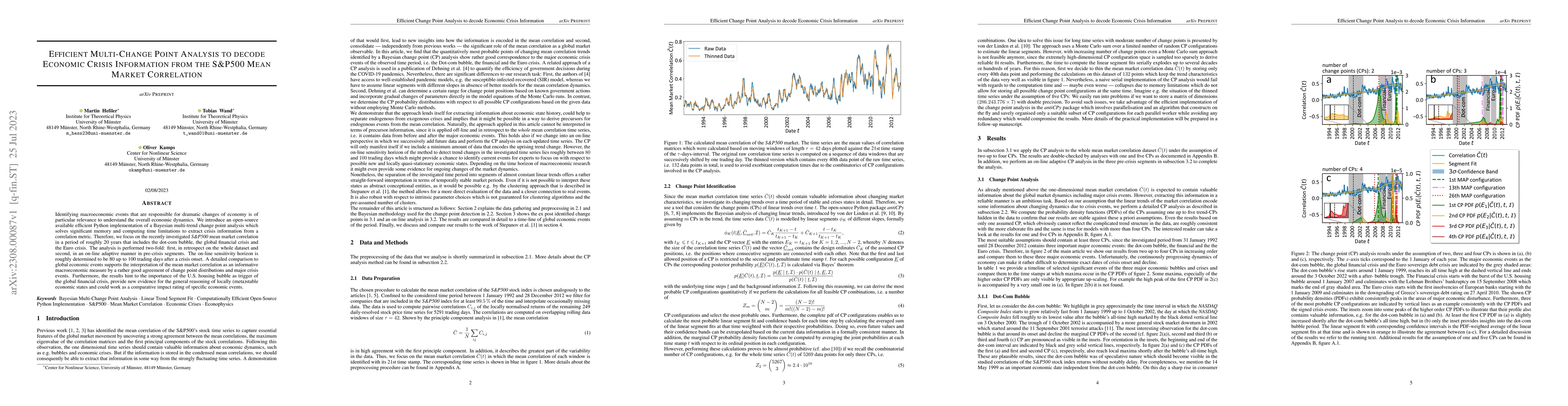

Identifying macroeconomic events that are responsible for dramatic changes of economy is of particular relevance to understand the overall economic dynamics. We introduce an open-source available efficient Python implementation of a Bayesian multi-trend change point analysis which solves significant memory and computing time limitations to extract crisis information from a correlation metric. Therefore, we focus on the recently investigated S&P500 mean market correlation in a period of roughly 20 years that includes the dot-com bubble, the global financial crisis and the Euro crisis. The analysis is performed two-fold: first, in retrospect on the whole dataset and second, in an on-line adaptive manner in pre-crisis segments. The on-line sensitivity horizon is roughly determined to be 80 up to 100 trading days after a crisis onset. A detailed comparison to global economic events supports the interpretation of the mean market correlation as an informative macroeconomic measure by a rather good agreement of change point distributions and major crisis events. Furthermore, the results hint to the importance of the U.S. housing bubble as trigger of the global financial crisis, provide new evidence for the general reasoning of locally (meta)stable economic states and could work as a comparative impact rating of specific economic events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMemory Effects, Multiple Time Scales and Local Stability in Langevin Models of the S&P500 Market Correlation

Tobias Wand, Oliver Kamps, Martin Heßler

| Title | Authors | Year | Actions |

|---|

Comments (0)