Oliver Kamps

16 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Cooperation in a non-Ergodic World on a Network -- Insurance and Beyond

Cooperation between individuals is emergent in all parts of society, yet mechanistic reasons for this emergence is ill understood in the literature. A specific example of this is insurance. Recent w...

Anticipation of Oligocene's climate heartbeat by simplified eigenvalue estimation

The Eocene-Oligocene transition marks a watershed point of earth's climate history. The climate shifts from a greenhouse state to an icehouse state in which Antarctica glaciated for the first time a...

Estimating Stable Fixed Points and Langevin Potentials for Financial Dynamics

The Geometric Brownian Motion (GBM) is a standard model in quantitative finance, but the potential function of its stochastic differential equation (SDE) cannot include stable nonzero prices. This a...

Efficient Multi-Change Point Analysis to decode Economic Crisis Information from the S&P500 Mean Market Correlation

Identifying macroeconomic events that are responsible for dramatic changes of economy is of particular relevance to understand the overall economic dynamics. We introduce an open-source available ef...

Memory Effects, Multiple Time Scales and Local Stability in Langevin Models of the S&P500 Market Correlation

The analysis of market correlations is crucial for optimal portfolio selection of correlated assets, but their memory effects have often been neglected. In this work, we analyse the mean market corr...

Non-linear, bivariate stochastic modelling of power-grid frequency applied to islands

Mitigating climate change requires a transition away from fossil fuels towards renewable energy. As a result, power generation becomes more volatile and options for microgrids and islanded power-gri...

Quantifying Tipping Risks in Power Grids and beyond

Critical transitions, ubiquitous in nature and technology, necessitate anticipation to avert adverse outcomes. While many studies focus on bifurcation-induced tipping, where a control parameter chan...

Identifying Dominant Industrial Sectors in Market States of the S&P 500 Financial Data

Understanding and forecasting changing market conditions in complex economic systems like the financial market is of great importance to various stakeholders such as financial institutions and regul...

Efficient Bayesian estimation of a non-Markovian Langevin model driven by correlated noise

Data-driven modeling of non-Markovian dynamics is a recent topic of research with applications in many fields such as climate research, molecular dynamics, biophysics, or wind power modeling. In the...

Quantifying resilience and the risk of regime shifts under strong correlated noise

Early warning indicators often suffer from the shortness and coarse-graining of real-world time series. Furthermore, the typically strong and correlated noise contributions in real applications are ...

Bayesian on-line anticipation of critical transitions

The design of reliable indicators to anticipate critical transitions in complex systems is an im portant task in order to detect a coming sudden regime shift and to take action in order to either pr...

Efficient Bayesian estimation of the generalized Langevin equation from data

Modeling non-Markovian time series is a recent topic of research in many fields such as climate modeling, biophysics, molecular dynamics, or finance. The generalized Langevin equation (GLE), given n...

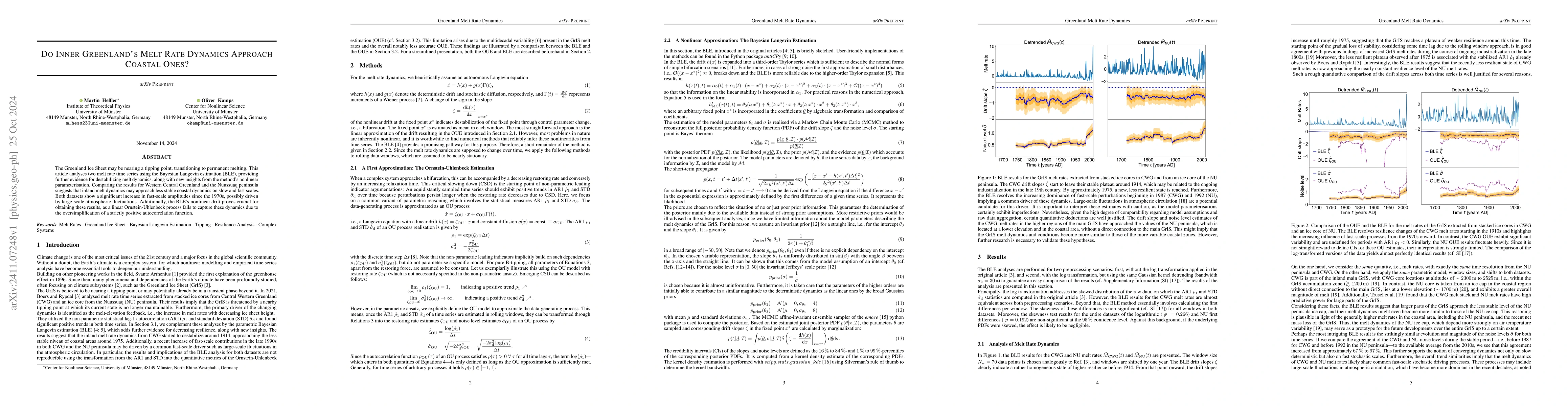

Do Inner Greenland's Melt Rate Dynamics Approach Coastal Ones?

The Greenland Ice Sheet may be nearing a tipping point, transitioning to permanent melting. This article analyses two melt rate time series using the Bayesian Langevin estimation (BLE), providing furt...

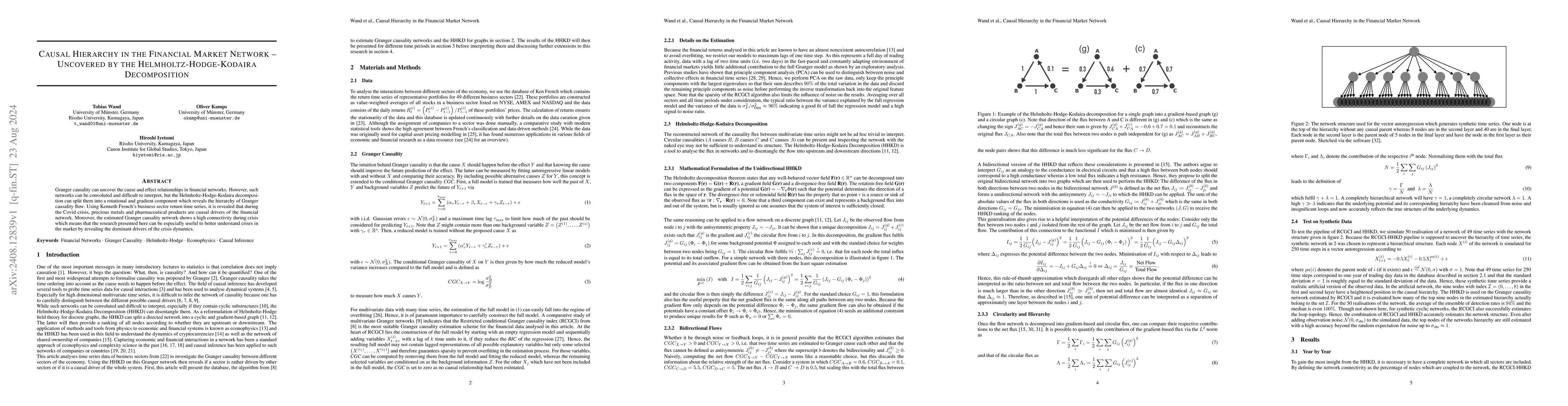

Causal Hierarchy in the Financial Market Network -- Uncovered by the Helmholtz-Hodge-Kodaira Decomposition

Granger causality can uncover the cause and effect relationships in financial networks. However, such networks can be convoluted and difficult to interpret, but the Helmholtz-Hodge-Kodaira decompositi...

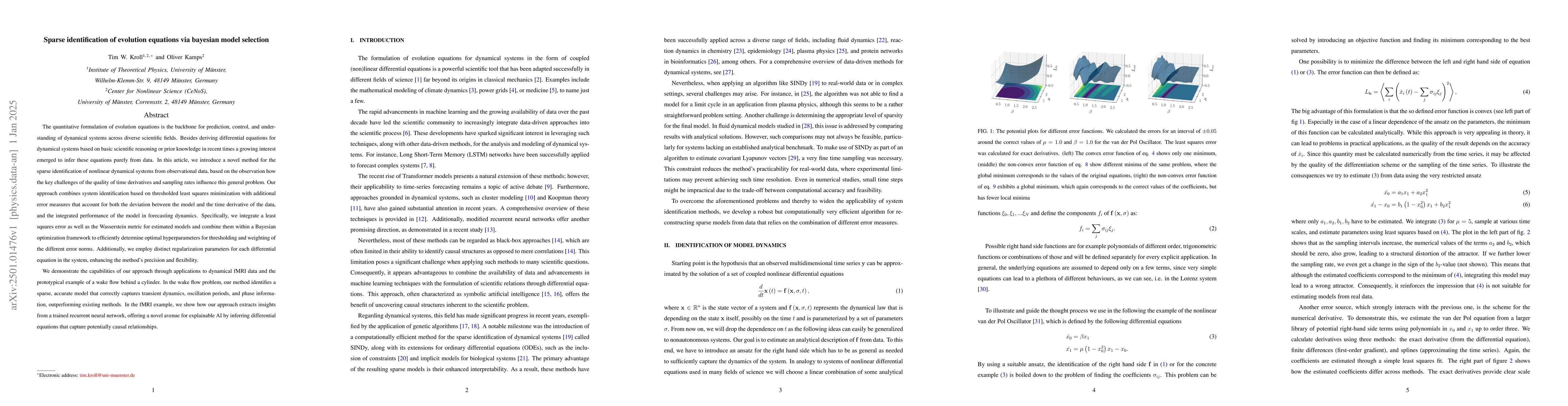

Sparse identification of evolution equations via Bayesian model selection

The quantitative formulation of evolution equations is the backbone for prediction, control, and understanding of dynamical systems across diverse scientific fields. Besides deriving differential equa...

Hyperparameter Optimization in the Estimation of PDE and Delay-PDE models from data

We propose an improved method for estimating partial differential equations and delay partial differential equations from data, using Bayesian optimization and the Bayesian information criterion to au...