Authors

Summary

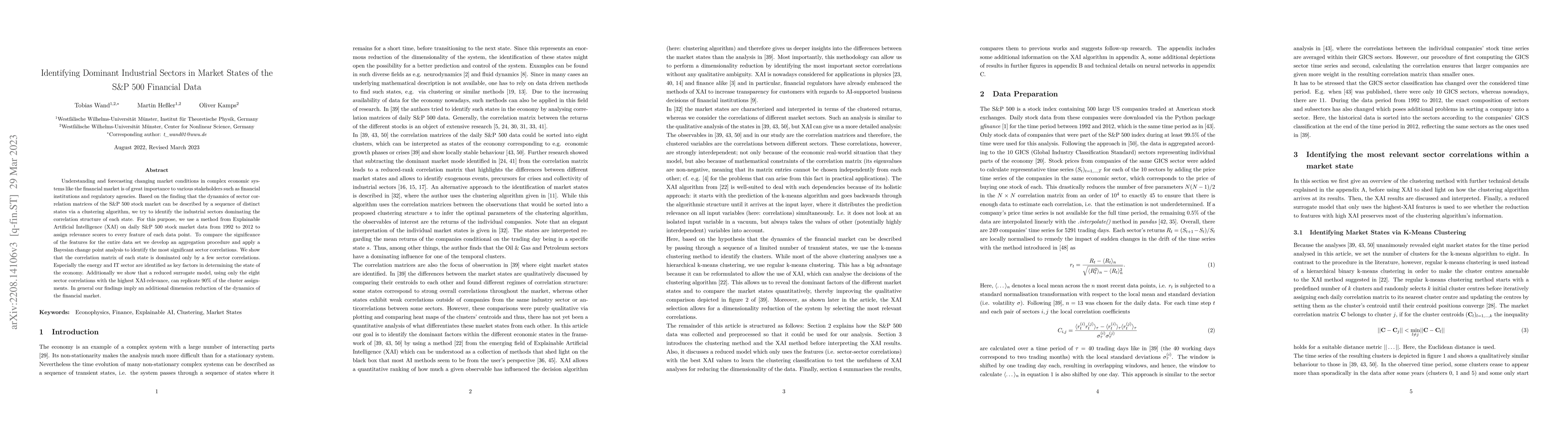

Understanding and forecasting changing market conditions in complex economic systems like the financial market is of great importance to various stakeholders such as financial institutions and regulatory agencies. Based on the finding that the dynamics of sector correlation matrices of the S&P 500 stock market can be described by a sequence of distinct states via a clustering algorithm, we try to identify the industrial sectors dominating the correlation structure of each state. For this purpose, we use a method from Explainable Artificial Intelligence (XAI) on daily S&P 500 stock market data from 1992 to 2012 to assign relevance scores to every feature of each data point. To compare the significance of the features for the entire data set we develop an aggregation procedure and apply a Bayesian change point analysis to identify the most significant sector correlations. We show that the correlation matrix of each state is dominated only by a few sector correlations. Especially the energy and IT sector are identified as key factors in determining the state of the economy. Additionally we show that a reduced surrogate model, using only the eight sector correlations with the highest XAI-relevance, can replicate 90% of the cluster assignments. In general our findings imply an additional dimension reduction of the dynamics of the financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCOVID anomaly in the correlation analysis of S&P 500 market states

M. Mijaíl Martínez-Ramos, Manan Vyas, Parisa Majai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)