Summary

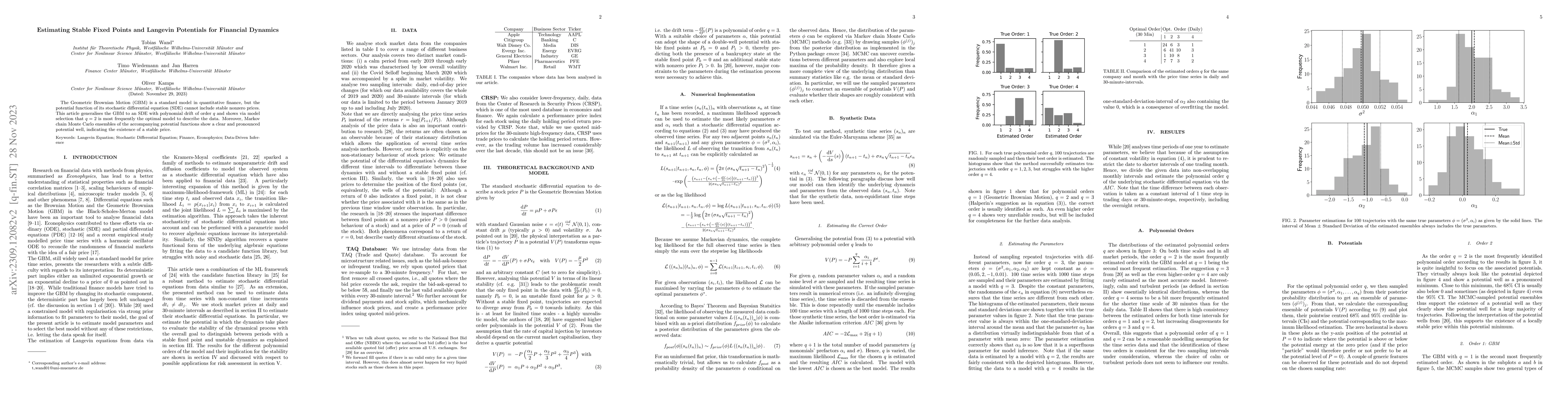

The Geometric Brownian Motion (GBM) is a standard model in quantitative finance, but the potential function of its stochastic differential equation (SDE) cannot include stable nonzero prices. This article generalises the GBM to an SDE with polynomial drift of order q and shows via model selection that q=2 is most frequently the optimal model to describe the data. Moreover, Markov chain Monte Carlo ensembles of the accompanying potential functions show a clear and pronounced potential well, indicating the existence of a stable price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStable fixed points of combinatorial threshold-linear networks

Jesse Geneson, Carina Curto, Katherine Morrison

Ergodicity of Langevin Dynamics and its Discretizations for Non-smooth Potentials

Andreas Habring, Lorenz Fruehwirth

| Title | Authors | Year | Actions |

|---|

Comments (0)