Summary

This paper studies equity basket options -- i.e., multi-dimensional derivatives whose payoffs depend on the value of a weighted sum of the underlying stocks -- and develops a new and innovative approach to ensure consistency between options on individual stocks and on the index comprising them. Specifically, we show how to resolve a well-known problem that when individual constituent distributions of an equity index are inferred from the single-stock option markets and combined in a multi-dimensional local/stochastic volatility model, the resulting basket option prices will not generate a skew matching that of the options on the equity index corresponding to the basket. To address this ``insufficient skewness'', we proceed in two steps. First, we propose an ``effective'' local volatility model by mapping the general multi-dimensional basket onto a collection of marginal distributions. Second, we build a multivariate dependence structure between all the marginal distributions assuming a jump-diffusion model for the effective projection parameters, and show how to calibrate the basket to the index smile. Numerical tests and calibration exercises demonstrate an excellent fit for a basket of as many as 30 stocks with fast calculation time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

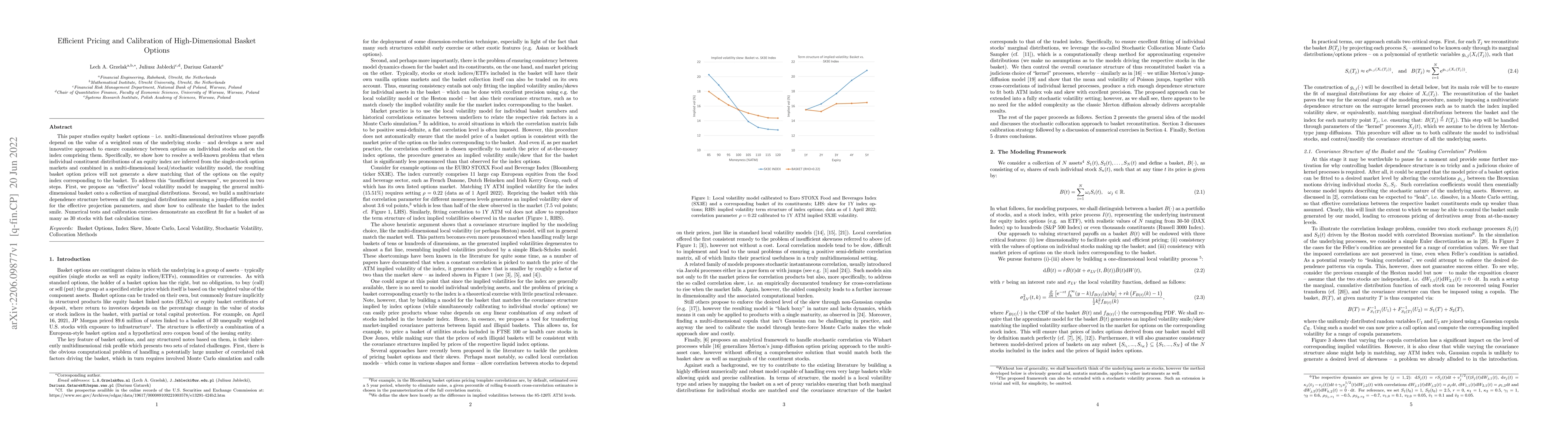

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)