Lech A. Grzelak

15 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Basket Options with Volatility Skew: Calibrating a Local Volatility Model by Sample Rearrangement

The pricing of derivatives tied to baskets of assets demands a sophisticated framework that aligns with the available market information to capture the intricate non-linear dependency structure amon...

Consistent asset modelling with random coefficients and switches between regimes

We explore a stochastic model that enables capturing external influences in two specific ways. The model allows for the expression of uncertainty in the parametrisation of the stochastic dynamics an...

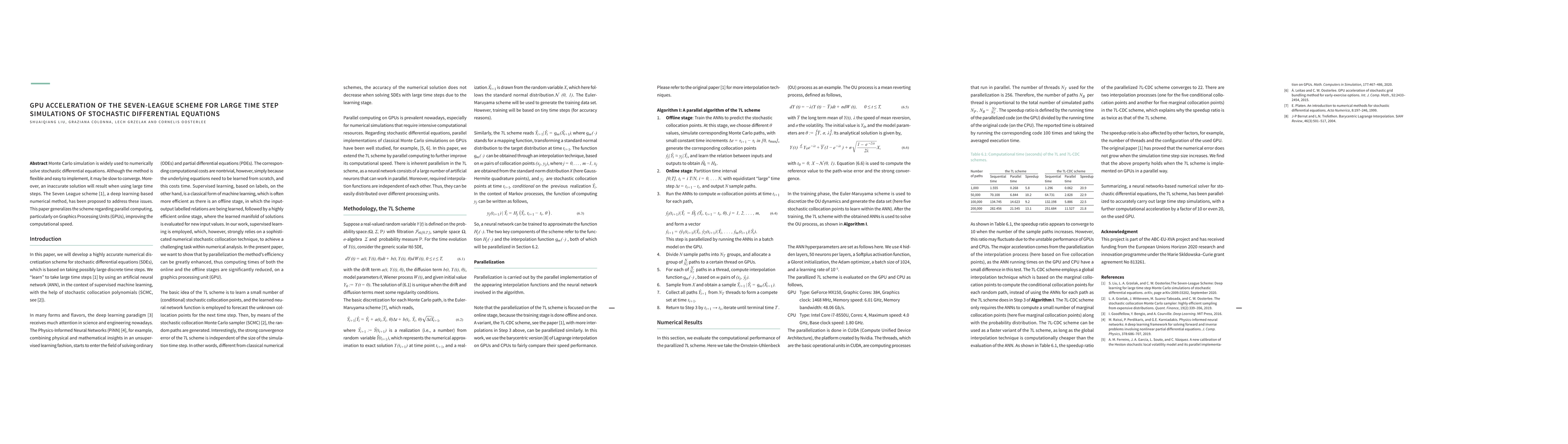

GPU acceleration of the Seven-League Scheme for large time step simulations of stochastic differential equations

Monte Carlo simulation is widely used to numerically solve stochastic differential equations. Although the method is flexible and easy to implement, it may be slow to converge. Moreover, an inaccura...

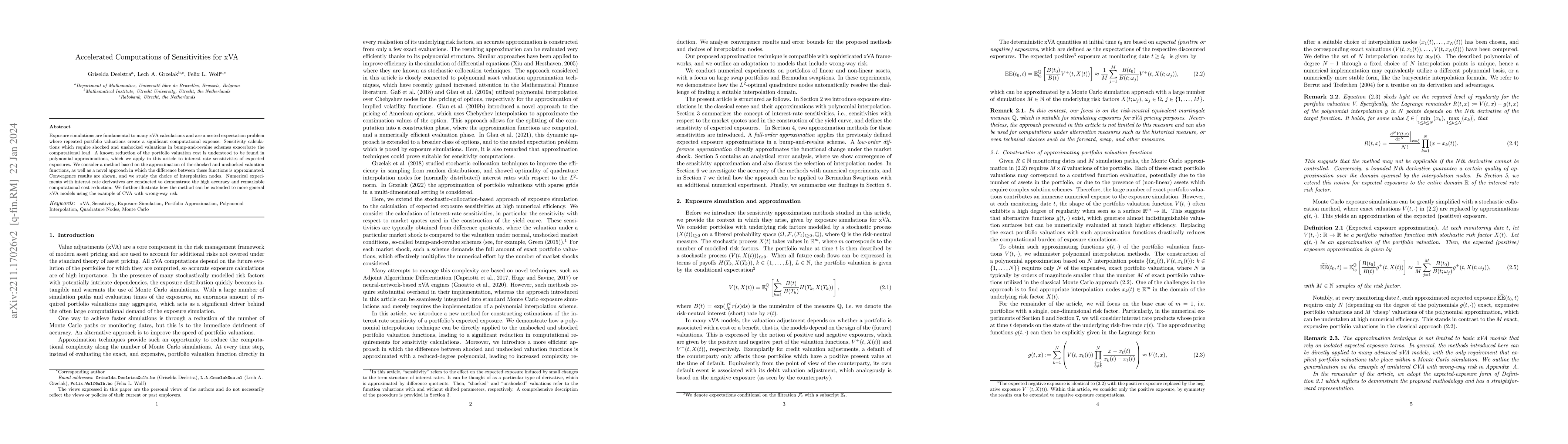

Accelerated Computations of Sensitivities for xVA

Exposure simulations are fundamental to many xVA calculations and are a nested expectation problem where repeated portfolio valuations create a significant computational expense. Sensitivity calcula...

Randomization of Short-Rate Models, Analytic Pricing and Flexibility in Controlling Implied Volatilities

We focus on extending existing short-rate models, enabling control of the generated implied volatility while preserving analyticity. We achieve this goal by applying the Randomized Affine Diffusion ...

On Pricing of Discrete Asian and Lookback Options under the Heston Model

We propose a new, data-driven approach for efficient pricing of - fixed- and float-strike - discrete arithmetic Asian and Lookback options when the underlying process is driven by the Heston model d...

On Randomization of Affine Diffusion Processes with Application to Pricing of Options on VIX and S&P 500

The class of Affine (Jump) Diffusion (AD) has, due to its closed form characteristic function (ChF), gained tremendous popularity among practitioners and researchers. However, there is clear evidenc...

Sensitivities and Hedging of the Collateral Choice Option

The collateral choice option allows a collateral-posting party the opportunity to change the type of security in which the collateral is deposited. Due to non-zero collateral basis spreads, this opt...

Efficient Pricing and Calibration of High-Dimensional Basket Options

This paper studies equity basket options -- i.e., multi-dimensional derivatives whose payoffs depend on the value of a weighted sum of the underlying stocks -- and develops a new and innovative appr...

Fast Sampling from Time-Integrated Bridges using Deep Learning

We propose a methodology to sample from time-integrated stochastic bridges, namely random variables defined as $\int_{t_1}^{t_2} f(Y(t))dt$ conditioned on $Y(t_1)\!=\!a$ and $Y(t_2)\!=\!b$, with $a,...

Sparse Grid Method for Highly Efficient Computation of Exposures for xVA

Every "x"-adjustment in the so-called xVA financial risk management framework relies on the computation of exposures. Considering thousands of Monte Carlo paths and tens of simulation steps, a finan...

Modeling and Replication of the Prepayment Option of Mortgages including Behavioral Uncertainty

Prepayment risk embedded in fixed-rate mortgages forms a significant fraction of a financial institution's exposure, and it receives particular attention because of the magnitude of the underlying mar...

Volatility Parametrizations with Random Coefficients: Analytic Flexibility for Implied Volatility Surfaces

It is a market practice to express market-implied volatilities in some parametric form. The most popular parametrizations are based on or inspired by an underlying stochastic model, like the Heston mo...

Pricing and hedging the prepayment option of mortgages under stochastic housing market activity

Prepayment risk embedded in fixed-rate mortgages forms a significant fraction of a financial institution's exposure. The embedded prepayment option bears the same interest rate risk as an exotic inter...

Lifted Heston Model: Efficient Monte Carlo Simulation with Large Time Steps

The lifted Heston model is a stochastic volatility model emerging as a Markovian lift of the rough Heston model and the class of rough volatility processes. The model encodes the path dependency of vo...