Summary

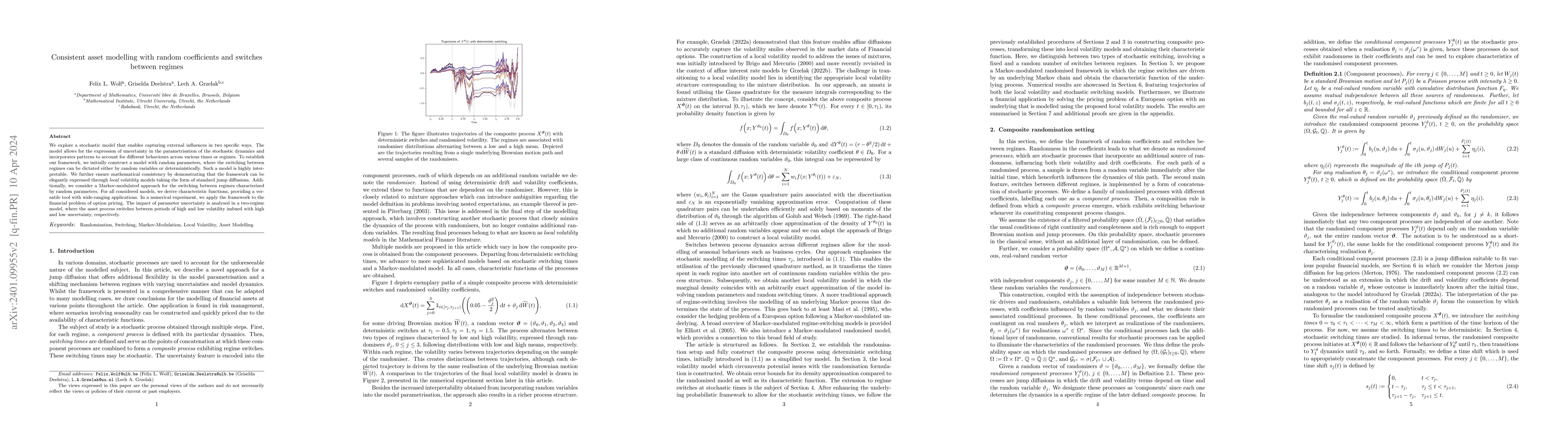

We explore a stochastic model that enables capturing external influences in two specific ways. The model allows for the expression of uncertainty in the parametrisation of the stochastic dynamics and incorporates patterns to account for different behaviours across various times or regimes. To establish our framework, we initially construct a model with random parameters, where the switching between regimes can be dictated either by random variables or deterministically. Such a model is highly interpretable. We further ensure mathematical consistency by demonstrating that the framework can be elegantly expressed through local volatility models taking the form of standard jump diffusions. Additionally, we consider a Markov-modulated approach for the switching between regimes characterised by random parameters. For all considered models, we derive characteristic functions, providing a versatile tool with wide-ranging applications. In a numerical experiment, we apply the framework to the financial problem of option pricing. The impact of parameter uncertainty is analysed in a two-regime model, where the asset process switches between periods of high and low volatility imbued with high and low uncertainty, respectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReturns-Driven Macro Regimes and Characteristic Lead-Lag Behaviour between Asset Classes

Mihai Cucuringu, Deborah Miori

No citations found for this paper.

Comments (0)