Summary

Exposure simulations are fundamental to many xVA calculations and are a nested expectation problem where repeated portfolio valuations create a significant computational expense. Sensitivity calculations which require shocked and unshocked valuations in bump-and-revalue schemes exacerbate the computational load. A known reduction of the portfolio valuation cost is understood to be found in polynomial approximations, which we apply in this article to interest rate sensitivities of expected exposures. We consider a method based on the approximation of the shocked and unshocked valuation functions, as well as a novel approach in which the difference between these functions is approximated. Convergence results are shown, and we study the choice of interpolation nodes. Numerical experiments with interest rate derivatives are conducted to demonstrate the high accuracy and remarkable computational cost reduction. We further illustrate how the method can be extended to more general xVA models using the example of CVA with wrong-way risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

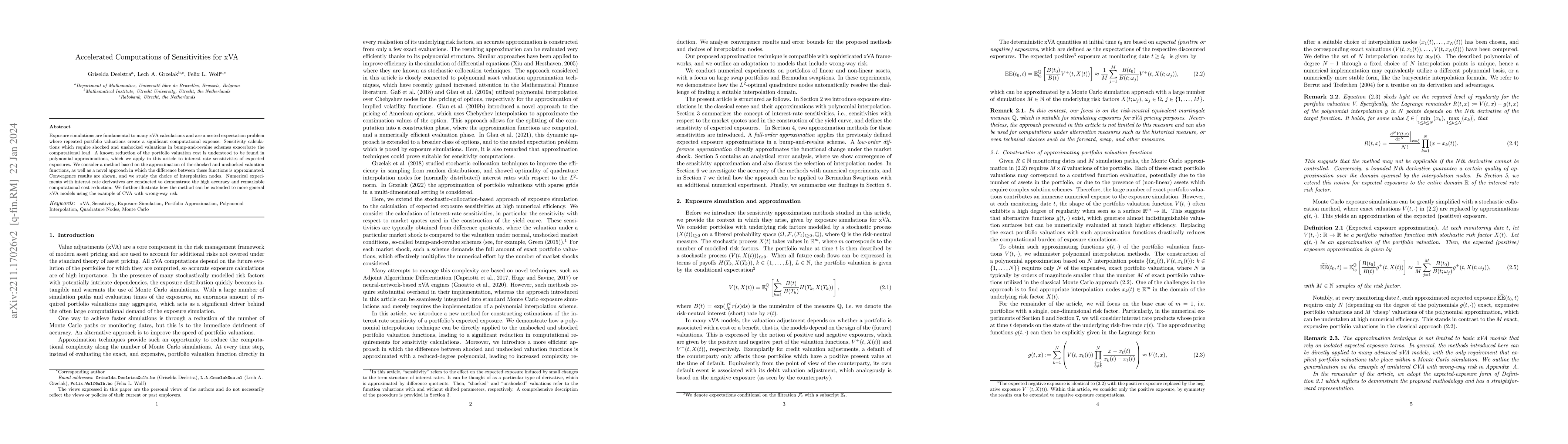

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Explicit Scheme for Pathwise XVA Computations

Botao Li, Stéphane Crépey, Lokman Abbas-Turki et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)