Summary

It is a market practice to express market-implied volatilities in some parametric form. The most popular parametrizations are based on or inspired by an underlying stochastic model, like the Heston model (SVI method) or the SABR model (SABR parametrization). Their popularity is often driven by a closed-form representation enabling efficient calibration. However, these representations indirectly impose a model-specific volatility structure on observable market quotes. When the market's volatility does not follow the parametric model regime, the calibration procedure will fail or lead to extreme parameters, indicating inconsistency. This article addresses this critical limitation - we propose an arbitrage-free framework for letting the parameters from the parametric implied volatility formula be random. The method enhances the existing parametrizations and enables a significant widening of the spectrum of permissible shapes of implied volatilities while preserving analyticity and, therefore, computation efficiency. We demonstrate the effectiveness of the novel method on real data from short-term index and equity options, where the standard parametrizations fail to capture market dynamics. Our results show that the proposed method is particularly powerful in modeling the implied volatility curves of short expiry options preceding an earnings announcement, when the risk-neutral probability density function exhibits a bimodal form.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

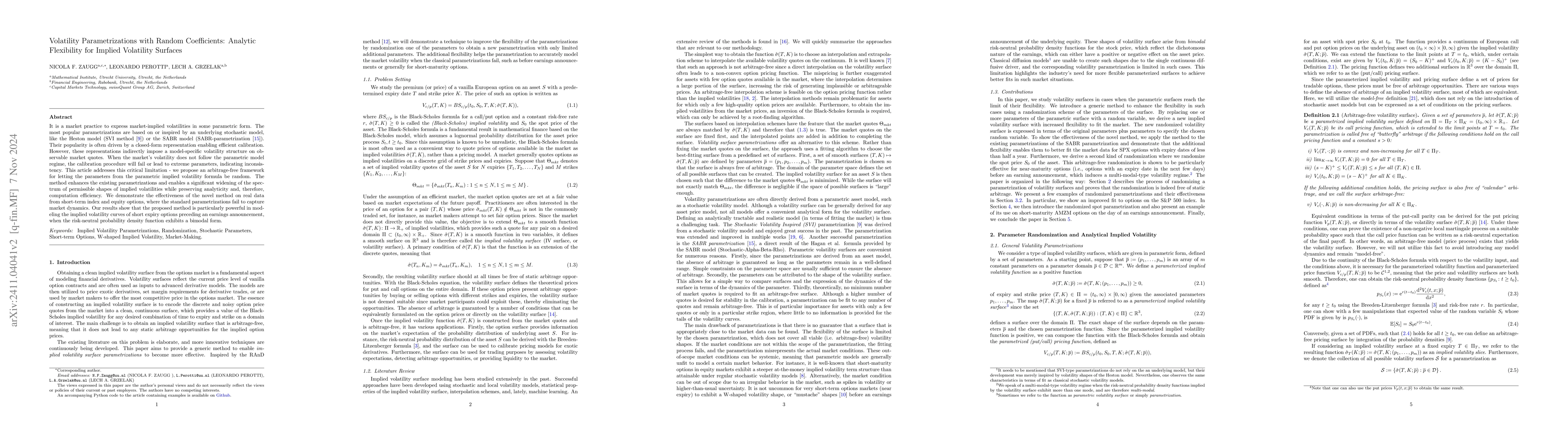

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)