Summary

We compute exactly the overlap between the eigenvectors of two large empirical covariance matrices computed over intersecting time intervals, generalizing the results obtained previously for non-intersecting intervals. Our method relies on a particular form of Girko linearisation and extended local laws. We check our results numerically and apply them to financial data.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study employs a combination of Girko linearisation and extended local laws to analyze eigenvector overlaps in sample covariance matrices with intersecting time periods. It constructs a combined block random matrix and uses two-resolvent local laws to derive deterministic approximations for the overlaps.

Key Results

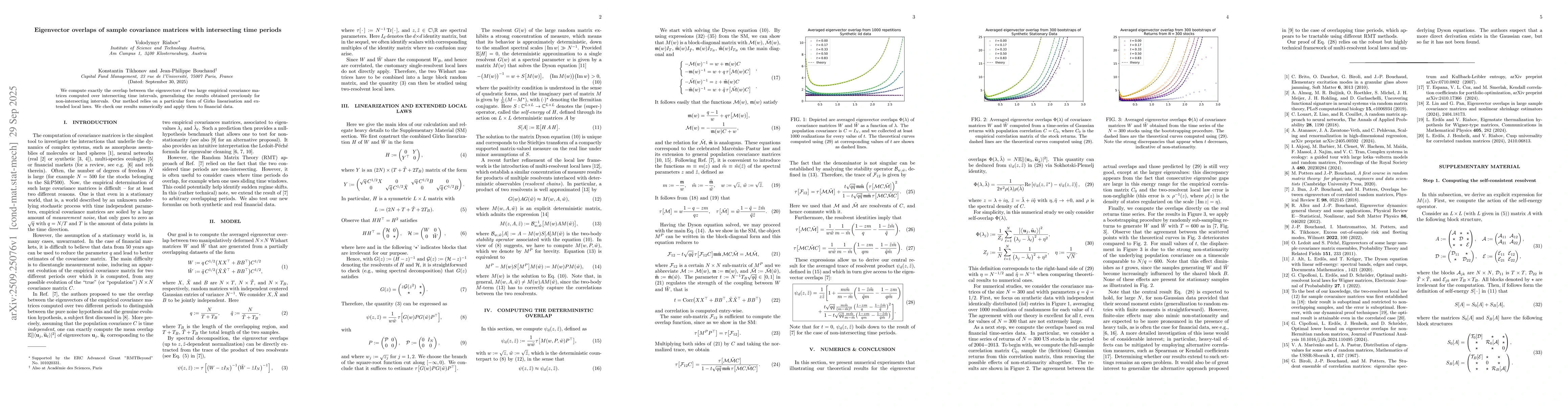

- The research derives an exact expression for the averaged trace of resolvent products, which quantifies eigenvector overlaps between correlated covariance matrices.

- Numerical experiments on synthetic and financial data show excellent agreement with theoretical predictions for eigenvector overlaps across various correlation strengths.

- The overlap function is shown to depend on the correlation between the matrices, with deviations observed at large eigenvalues due to non-stationarity in empirical data.

Significance

This work advances the understanding of eigenvector overlaps in correlated financial data, providing a framework to analyze how overlapping time periods affect covariance matrix properties. It has implications for risk modeling and portfolio optimization in finance.

Technical Contribution

The paper introduces a novel framework combining multi-resolvent local laws and Dyson equations to compute eigenvector overlaps in correlated covariance matrices, providing a deterministic approximation for the overlaps.

Novelty

This work generalizes previous results for non-intersecting time intervals to intersecting intervals, introducing a new method that accounts for correlations between overlapping covariance matrices through a combined block random matrix approach.

Limitations

- The theoretical results assume large N and may not fully capture finite-size effects, which can mimic non-stationarity in financial data.

- The analysis is primarily focused on Gaussian data, and extensions to non-Gaussian distributions with heavy tails require further investigation.

Future Work

- Investigating the impact of heavy-tailed distributions on eigenvector overlaps using alternative correlation measures like Spearman or Kendall coefficients.

- Extending the methodology to non-Gaussian data and exploring its applicability to real-world financial datasets with more complex structures.

- Generalizing the approach to other correlated random matrix models and overlapping time period scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEigenvector overlaps in large sample covariance matrices and nonlinear shrinkage estimators

Zeqin Lin, Guangming Pan

Eigenvector Overlaps of Random Covariance Matrices and their Submatrices

Elie Attal, Romain Allez

Comments (0)