Jean-Philippe Bouchaud

49 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Emergent Inequalities in a Primitive Agent-Based Good-Exchange Model

Rising inequalities around the globe bring into question our economic systems and the origin of such inequalities. Here we propose a toy agent-based model where each entity is simultaneously produci...

Ponzi Funds

Many active funds hold concentrated portfolios. Flow-driven trading in these securities causes price pressure, which pushes up the funds' existing positions resulting in realized returns. We decompo...

"Microstructure Modes" -- Disentangling the Joint Dynamics of Prices & Order Flow

Understanding the micro-dynamics of asset prices in modern electronic order books is crucial for investors and regulators. In this paper, we use an order by order Eurostoxx database spanning over 3 ...

Riding Wavelets: A Method to Discover New Classes of Price Jumps

Cascades of events and extreme occurrences have garnered significant attention across diverse domains such as financial markets, seismology, and social physics. Such events can stem either from the ...

Revisiting Granular Models of Firm Growth

We revisit granular models that represent the size of a firm as the sum of the sizes of multiple constituents or sub-units. Originally developed to address the unexpectedly slow reduction in volatil...

Revisiting Elastic String Models of Forward Interest Rates

Twenty five years ago, several authors proposed to model the forward interest rate curve (FRC) as an elastic string along which idiosyncratic shocks propagate, accounting for the peculiar structure ...

Why is the Dynamics of Glasses Super-Arrhenius?

The steep increase of the relaxation time of glass forming liquids upon cooling is traditionally ascribed to an impending entropy crisis: since the system has "nowhere to go", dynamics must come to ...

Unlearnable Games and "Satisficing'' Decisions: A Simple Model for a Complex World

As a schematic model of the complexity economic agents are confronted with, we introduce the ``SK-game'', a discrete time binary choice model inspired from mean-field spin-glasses. We show that even...

The Spectral Boundary of Block Structured Random Matrices

Economic and ecological models can be extremely complex, with a large number of agents/species each featuring multiple interacting dynamical quantities. In an attempt to understand the generic stabi...

Wrapping and unwrapping multifractal fields

We develop a powerful yet simple method that generates multifractal fields with fully controlled scaling properties. Adopting the Multifractal Random Walk (MRW) model of Bacry et al. (2001), synthet...

Timeliness criticality in complex systems

In complex systems, external parameters often determine the phase in which the system operates, i.e., its macroscopic behavior. For nearly a century, statistical physics has extensively studied syst...

From Statistical Physics to Social Sciences: The Pitfalls of Multi-disciplinarity

This is the English version of my inaugural lecture at Coll\`ege de France in 2021, available at https://www.youtube.com/watch?v=bxktplKMhKU. I reflect on the difficulty of multi-disciplinary resear...

Path Shadowing Monte-Carlo

We introduce a Path Shadowing Monte-Carlo method, which provides prediction of future paths, given any generative model. At any given date, it averages future quantities over generated price paths w...

Application of spin glass ideas in social sciences, economics and finance

Classical economics has developed an arsenal of methods, based on the idea of representative agents, to come up with precise numbers for next year's GDP, inflation and exchange rates, among (many) o...

Post-COVID Inflation & the Monetary Policy Dilemma: An Agent-Based Scenario Analysis

The economic shocks that followed the COVID-19 pandemic have brought to light the difficulty, both for academics and policy makers, of describing and predicting the dynamics of inflation. This paper...

The Cost of Misspecifying Price Impact

Portfolio managers' orders trade off return and trading cost predictions. Return predictions rely on alpha models, whereas price impact models quantify trading costs. This paper studies what happens...

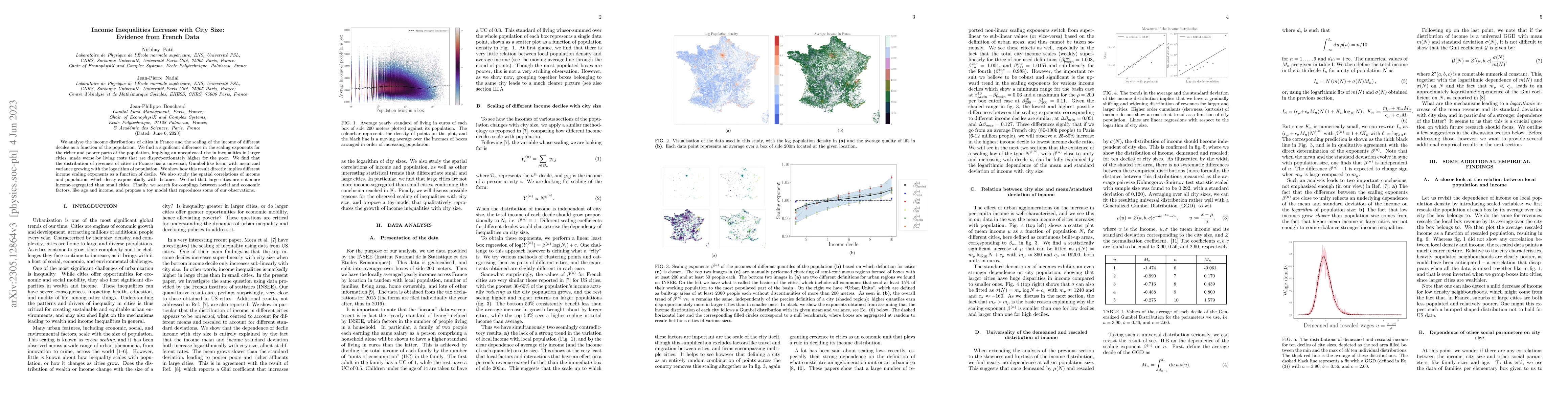

Income Inequalities Increase with City Size: Evidence from French Data

We analyse the income distributions of cities in France and the scaling of the income of different deciles as a function of the population. We find a significant difference in the scaling exponents ...

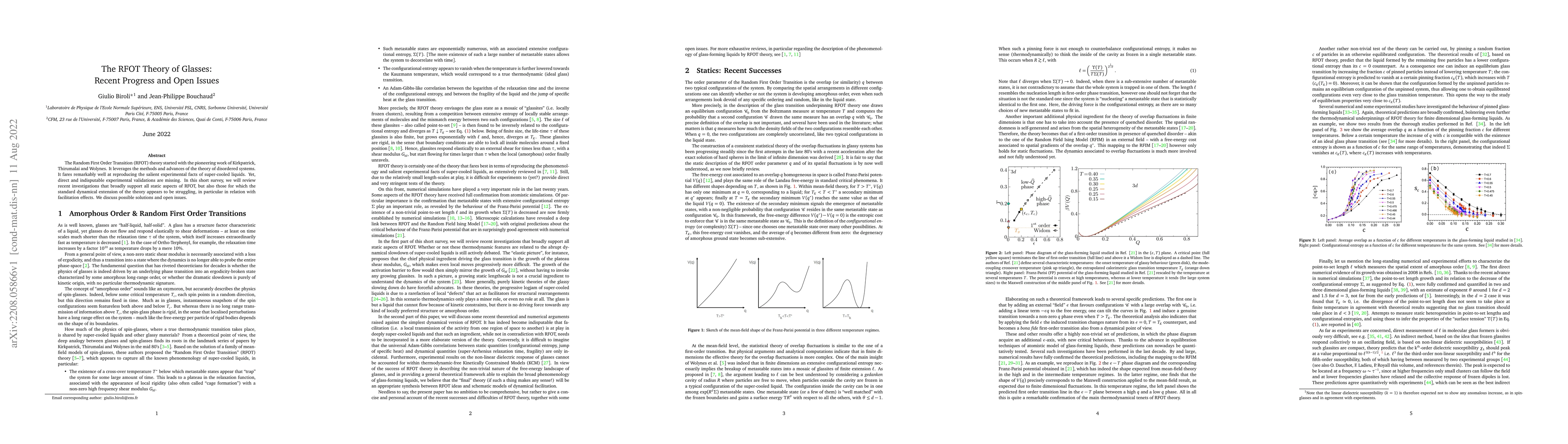

The RFOT Theory of Glasses: Recent Progress and Open Issues

The Random First Order Transition (RFOT) theory started with the pioneering work of Kirkpatrick, Thirumalai and Wolynes. It leverages the methods and advances of the theory of disordered systems. It...

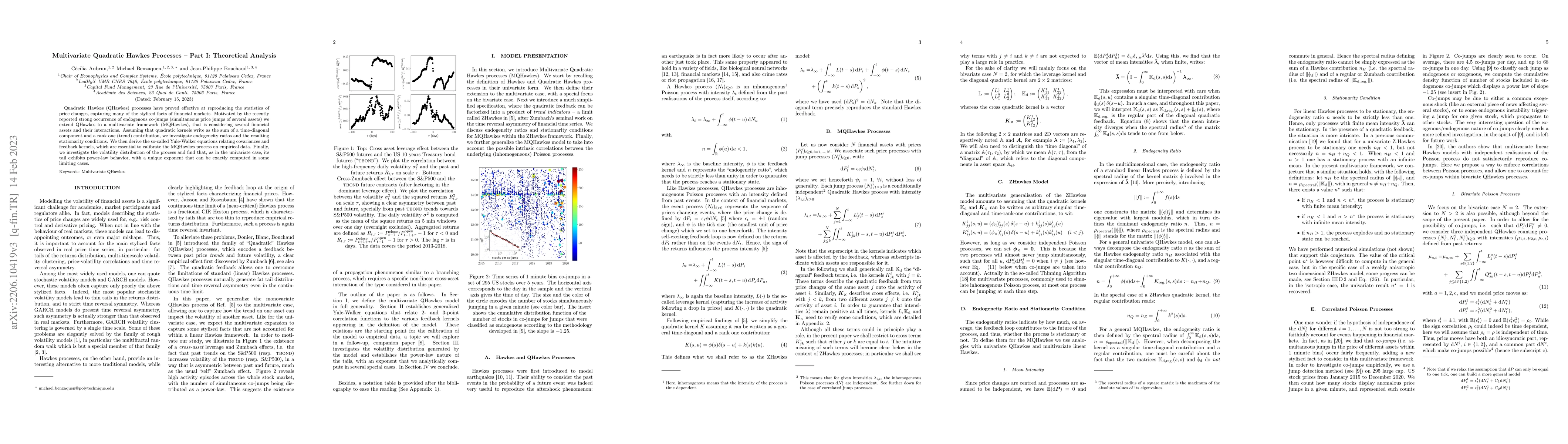

Multivariate Quadratic Hawkes Processes -- Part I: Theoretical Analysis

Quadratic Hawkes (QHawkes) processes have proved effective at reproducing the statistics of price changes, capturing many of the stylised facts of financial markets. Motivated by the recently report...

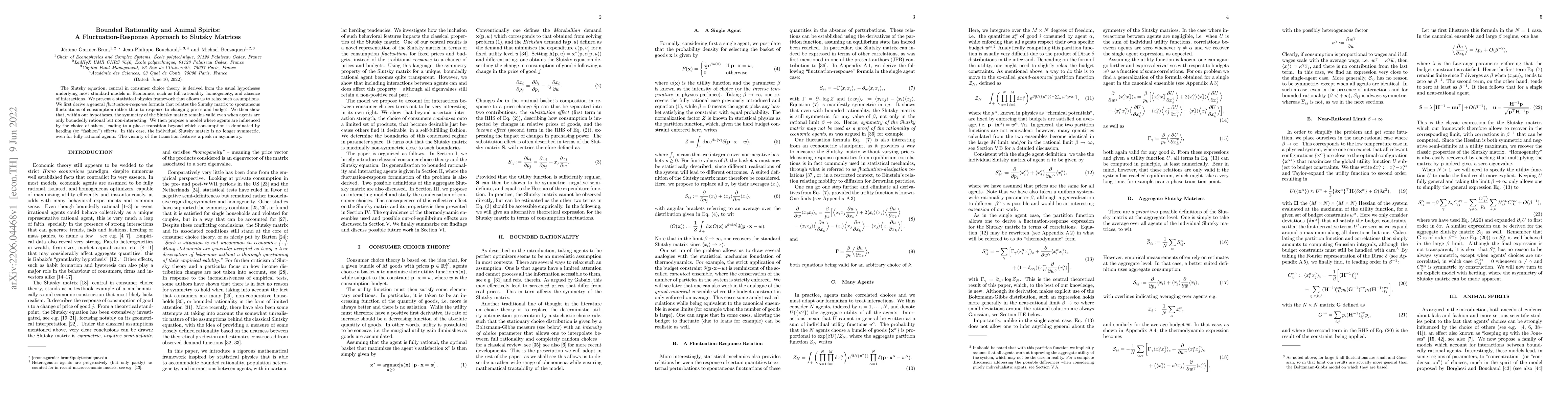

Bounded Rationality and Animal Spirits: A Fluctuation-Response Approach to Slutsky Matrices

The Slutsky equation, central in consumer choice theory, is derived from the usual hypotheses underlying most standard models in Economics, such as full rationality, homogeneity, and absence of inte...

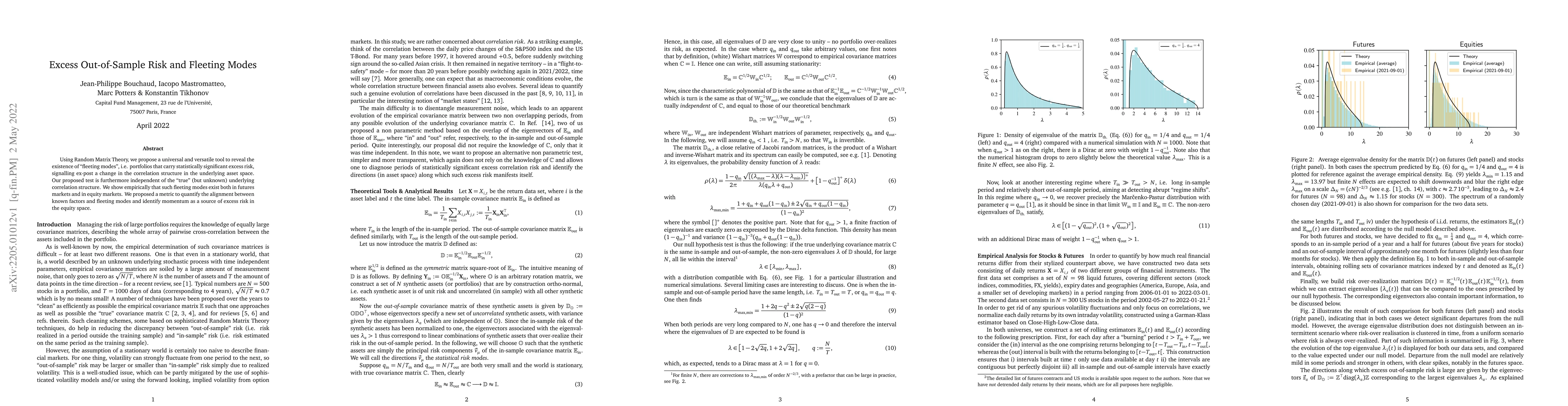

Excess Out-of-Sample Risk and Fleeting Modes

Using Random Matrix Theory, we propose a universal and versatile tool to reveal the existence of "fleeting modes", i.e. portfolios that carry statistically significant excess risk, signalling ex-pos...

Occupation time of a renewal process coupled to a discrete Markov chain

A semi-Markov process is one that changes states in accordance with a Markov chain but takes a random amount of time between changes. We consider the generalisation to semi-Markov processes of the c...

Scale Dependencies and Self-Similar Models with Wavelet Scattering Spectra

We introduce the wavelet scattering spectra which provide non-Gaussian models of time-series having stationary increments. A complex wavelet transform computes signal variations at each scale. Depen...

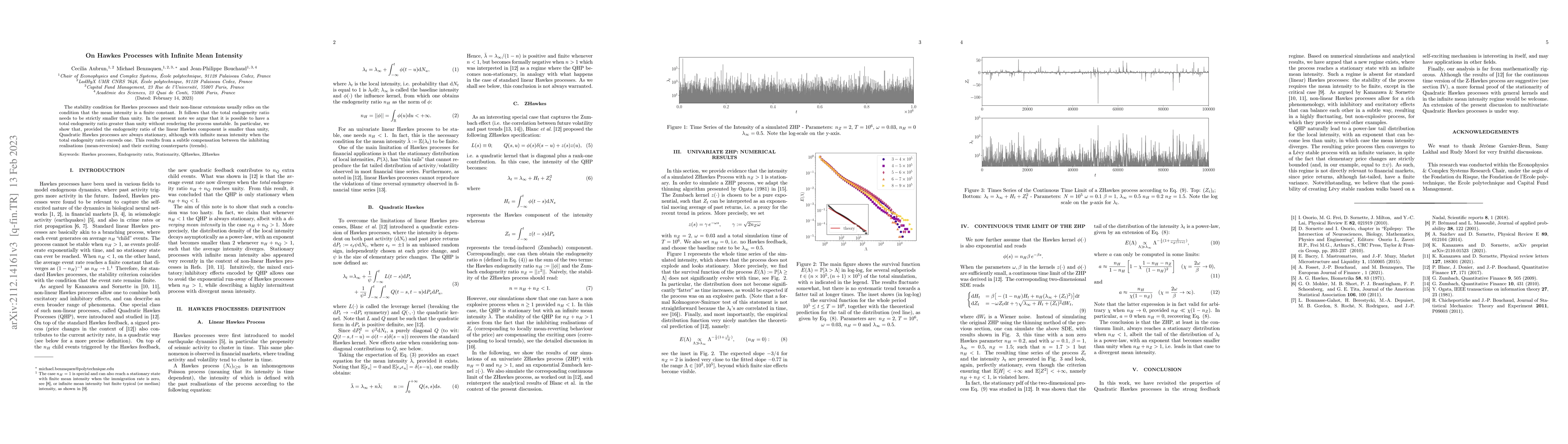

Will Random Cone-wise Linear Systems Be Stable?

We consider a simple model for multidimensional cone-wise linear dynamics around cusp-like equilibria. We assume that the local linear evolution is either $\mathbf{v}^\prime=\mathbb{A}\mathbf{v}$ or...

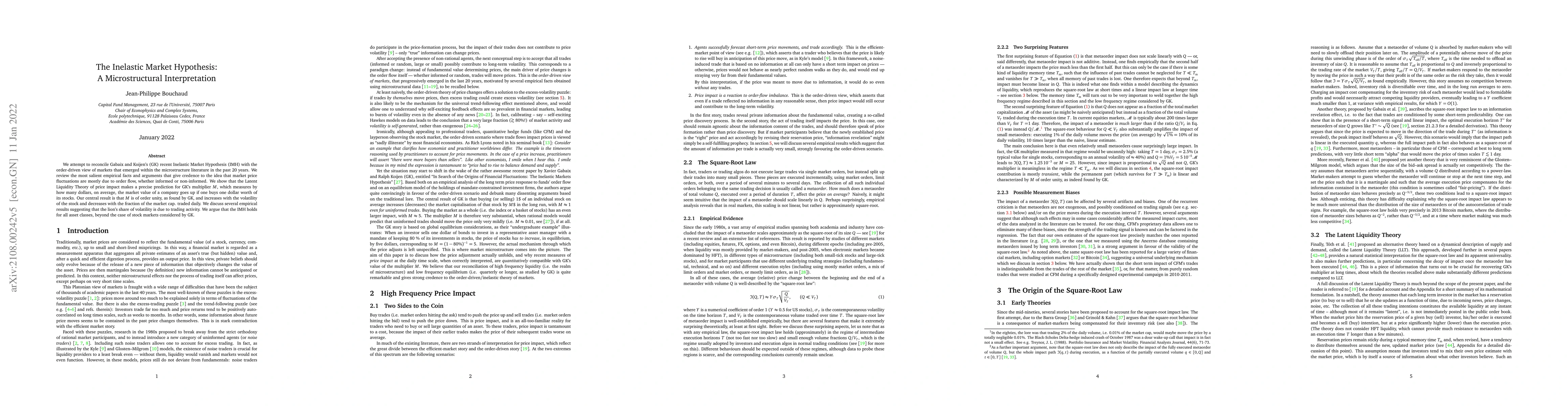

On Hawkes Processes with Infinite Mean Intensity

The stability condition for Hawkes processes and their non-linear extensions usually relies on the condition that the mean intensity is a finite constant. It follows that the total endogeneity ratio...

Exploration of the Parameter Space in Macroeconomic Agent-Based Models

Agent-Based Models (ABM) are computational scenario-generators, which can be used to predict the possible future outcomes of the complex system they represent. To better understand the robustness of...

The Inelastic Market Hypothesis: A Microstructural Interpretation

We attempt to reconcile Gabaix and Koijen's (GK) recent Inelastic Market Hypothesis (IMH) with the order-driven view of markets that emerged within the microstructure literature in the past 20 years...

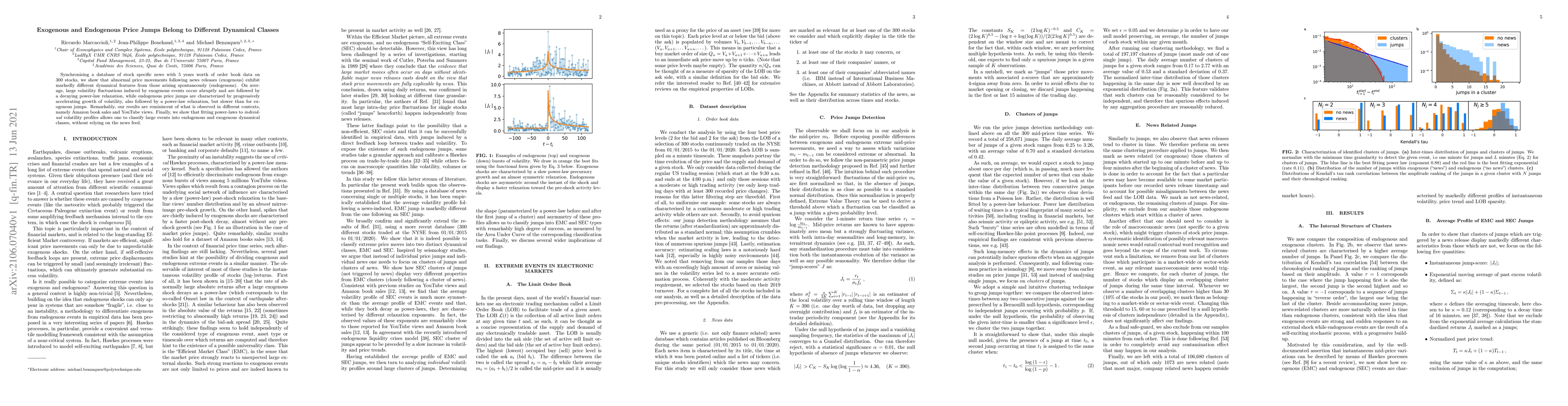

Exogenous and Endogenous Price Jumps Belong to Different Dynamical Classes

Synchronising a database of stock specific news with 5 years worth of order book data on 300 stocks, we show that abnormal price movements following news releases (exogenous) exhibit markedly differ...

Radical Complexity

This is an informal and sketchy review of six topical, somewhat unrelated subjects in quantitative finance: rough volatility models; random covariance matrix theory; copulas; crowded trades; high-fr...

Self-Fulfilling Prophecies, Quasi Non-Ergodicity and Wealth Inequality

We construct a model of an exchange economy in which agents trade assets contingent on an observable signal, the probability of which depends on public opinion. The agents in our model are replaced ...

Out-of-Equilibrium Dynamics and Excess Volatility in Firm Networks

We study the conditions under which input-output networks can dynamically attain a competitive equilibrium, where markets clear and profits are zero. We endow a classical firm network model with min...

Optimal cleaning for singular values of cross-covariance matrices

We give a new algorithm for the estimation of the cross-covariance matrix $\mathbb{E} XY'$ of two large dimensional signals $X\in\mathbb{R}^n$, $Y\in \mathbb{R}^p$ in the context where the number $T...

The Self-Organized Criticality Paradigm in Economics & Finance

``Self-Organised Criticality'' (SOC) is the mechanism by which complex systems spontaneously settle close to a *critical point*, at the edge between stability and chaos, and characterized by fat-taile...

An Interacting Particle System Interpretation of Free Convolution

The eigenvalue spectrum of the sum of large random matrices that are mutually "free", i.e. randomly rotated, can be obtained using the formalism of R-transforms, with many applications in different fi...

Distribution of the Diagonal Entries of the Resolvent of a Complex Ginibre Matrix

The study of eigenvalue distributions in random matrix theory is often conducted by analyzing the resolvent matrix $ \mathbf{G}_{\mathbf{M}}^N(z) = (z \mathbf{1} - \mathbf{M})^{-1} $. The normalized t...

The Diffusive Nature of Housing Prices

We analyze the French housing market prices in the period 1970-2022, with high-resolution data from 2018 to 2022. The spatial correlation of the observed price field exhibits logarithmic decay charact...

Navigating through Economic Complexity: Phase Diagrams & Parameter Sloppiness

We argue that establishing the phase diagram of Agent Based Models (ABM) is a crucial first step, together with a qualitative understanding of how collective phenomena come about, before any calibrati...

Of Songs and Men: a Model for Multiple Choice with Herding

We propose a generic model for multiple choice situations in the presence of herding and compare it with recent empirical results from a Web-based music market experiment. The model predicts a phase t...

"Stiff" Field Theory of Interest Rates and Psychological Future Time

The simplest field theory description of the multivariate statistics of forward rate variations over time and maturities, involves a quadratic action containing a gradient squared rigidity term. Howev...

The "double" square-root law: Evidence for the mechanical origin of market impact using Tokyo Stock Exchange data

Understanding the impact of trades on prices is a crucial question for both academic research and industry practice. It is well established that impact follows a square-root impact as a function of tr...

Generating realistic metaorders from public data

This paper introduces a novel algorithm for generating realistic metaorders from public trade data, addressing a longstanding challenge in price impact research that has traditionally relied on propri...

A mean-field theory for heterogeneous random growth with redistribution

We study the competition between random multiplicative growth and redistribution/migration in the mean-field limit, when the number of sites is very large but finite. We find that for static random gr...

Why is the volatility of single stocks so much rougher than that of the S&P500?

The Nested factor model was introduced by Chicheportiche et al. to represent non-linear correlations between stocks. Stock returns are explained by a standard factor model, but the (log)-volatilities ...

Revisiting the Excess Volatility Puzzle Through the Lens of the Chiarella Model

We amend and extend the Chiarella model of financial markets to deal with arbitrary long-term value drifts in a consistent way. This allows us to improve upon existing calibration schemes, opening the...

The Subtle Interplay between Square-root Impact, Order Imbalance & Volatility: A Unifying Framework

In this work, we aim to reconcile several apparently contradictory observations in market microstructure: is the famous ''square-root law'' of metaorder impact that decays with time compatible with th...

The Subtle Interplay between Square-root Impact, Order Imbalance & Volatility II: An Artificial Market Generator

This work extends and complements our previous theoretical paper on the subtle interplay between impact, order flow and volatility. In the present paper, we generate synthetic market data following th...

Holdout cross-validation for large non-Gaussian covariance matrix estimation using Weingarten calculus

Cross-validation is one of the most widely used methods for model selection and evaluation; its efficiency for large covariance matrix estimation appears robust in practice, but little is known about ...

Multivariate Quadratic Hawkes Processes -- Part II: Non-Parametric Empirical Calibration

This is the second part of our work on Multivariate Quadratic Hawkes (MQHawkes) Processes, devoted to the calibration of the model defined and studied analytically in Aubrun, C., Benzaquen, M., & Bouc...

Eigenvector overlaps of sample covariance matrices with intersecting time periods

We compute exactly the overlap between the eigenvectors of two large empirical covariance matrices computed over intersecting time intervals, generalizing the results obtained previously for non-inter...