Summary

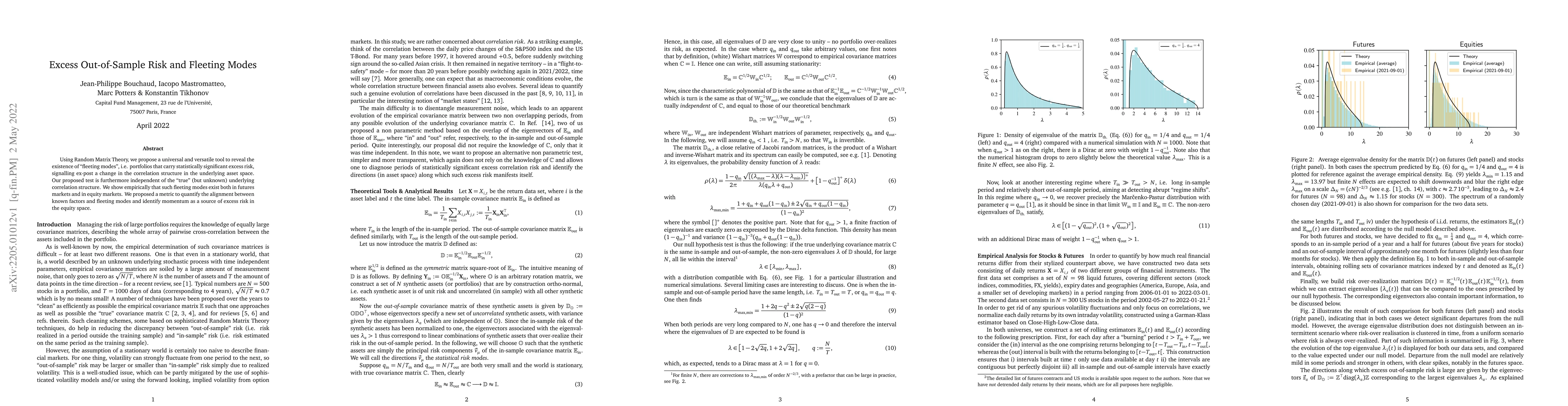

Using Random Matrix Theory, we propose a universal and versatile tool to reveal the existence of "fleeting modes", i.e. portfolios that carry statistically significant excess risk, signalling ex-post a change in the correlation structure in the underlying asset space. Our proposed test is furthermore independent of the "true" (but unknown) underlying correlation structure. We show empirically that such fleeting modes exist both in futures markets and in equity markets. We proposed a metric to quantify the alignment between known factors and fleeting modes and identify momentum as a source of excess risk in the equity space.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausal Regularization: On the trade-off between in-sample risk and out-of-sample risk guarantees

Ernst Wit, Lucas Kania

RandALO: Out-of-sample risk estimation in no time flat

Emmanuel J. Candès, Daniel LeJeune, Parth T. Nobel

No citations found for this paper.

Comments (0)