Summary

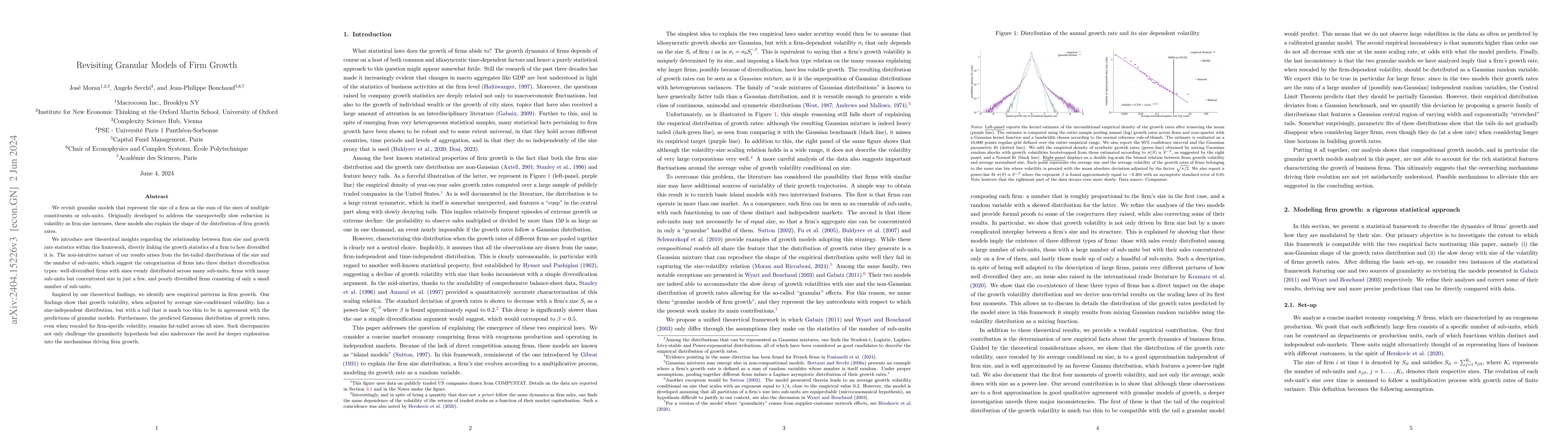

We revisit granular models that represent the size of a firm as the sum of the sizes of multiple constituents or sub-units. Originally developed to address the unexpectedly slow reduction in volatility as firm size increases, these models also explain the shape of the distribution of firm growth rates. We introduce new theoretical insights regarding the relationship between firm size and growth rate statistics within this framework, directly linking the growth statistics of a firm to how diversified it is. The non-intuitive nature of our results arises from the fat-tailed distributions of the size and the number of sub-units, which suggest the categorization of firms into three distinct diversification types: well-diversified firms with sizes evenly distributed across many sub-units, firms with many sub-units but concentrated size in just a few, and poorly diversified firms consisting of only a small number of sub-units. Inspired by our theoretical findings, we identify new empirical patterns in firm growth. Our findings show that growth volatility, when adjusted by average size-conditioned volatility, has a size-independent distribution, but with a tail that is much too thin to be in agreement with the predictions of granular models. Furthermore, the predicted Gaussian distribution of growth rates, even when rescaled for firm-specific volatility, remains fat-tailed across all sizes. Such discrepancies not only challenge the granularity hypothesis but also underscore the need for deeper exploration into the mechanisms driving firm growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)