Summary

Quadratic Hawkes (QHawkes) processes have proved effective at reproducing the statistics of price changes, capturing many of the stylised facts of financial markets. Motivated by the recently reported strong occurrence of endogenous co-jumps (simultaneous price jumps of several assets) we extend QHawkes to a multivariate framework (MQHawkes), that is considering several financial assets and their interactions. Assuming that quadratic kernels write as the sum of a time-diagonal component and a rank one (trend) contribution, we investigate endogeneity ratios and the resulting stationarity conditions. We then derive the so-called Yule-Walker equations relating covariances and feedback kernels, which are essential to calibrate the MQHawkes process on empirical data. Finally, we investigate the volatility distribution of the process and find that, as in the univariate case, it exhibits power-law behavior, with an exponent that can be exactly computed in some limiting cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

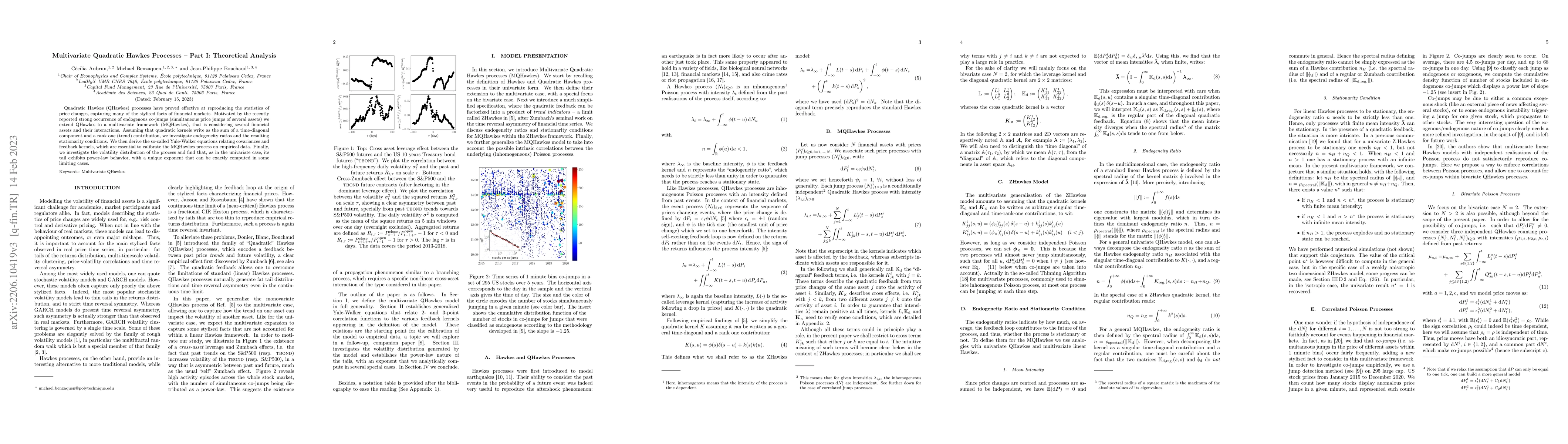

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Quadratic Hawkes Processes -- Part II: Non-Parametric Empirical Calibration

Michael Benzaquen, Jean-Philippe Bouchaud, Cecilia Aubrun

Multivariate Representations of Univariate Marked Hawkes Processes

Ting Wang, Louis Davis, Boris Baeumer et al.

Mixing properties for multivariate Hawkes processes

Felix Cheysson, Ousmane Boly, Thi Hien Nguyen

| Title | Authors | Year | Actions |

|---|

Comments (0)