Michael Benzaquen

33 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

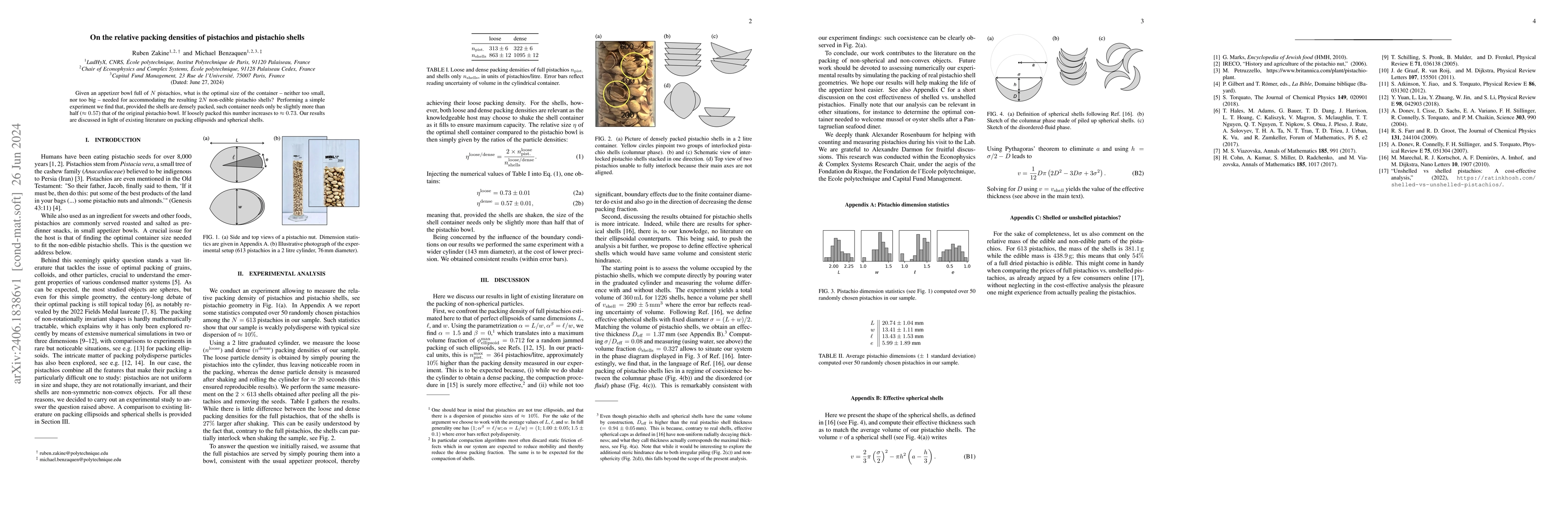

On the relative packing densities of pistachios and pistachio shells

Given an appetizer bowl full of $N$ pistachios, what is the optimal size of the container -- neither too small, nor too big -- needed for accommodating the resulting $2N$ non-edible pistachio shells...

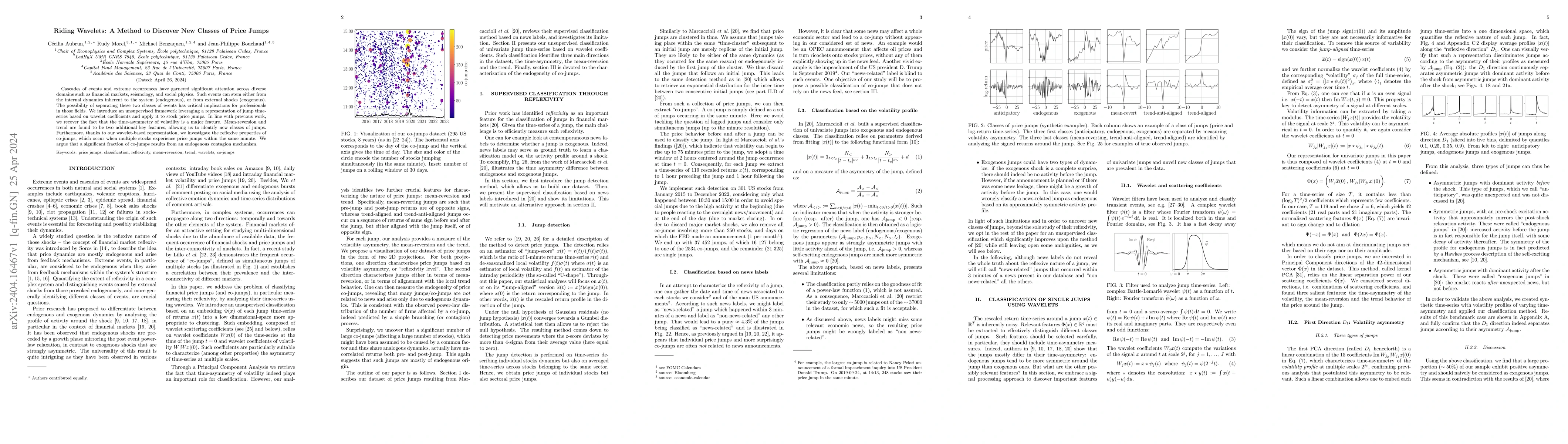

Riding Wavelets: A Method to Discover New Classes of Price Jumps

Cascades of events and extreme occurrences have garnered significant attention across diverse domains such as financial markets, seismology, and social physics. Such events can stem either from the ...

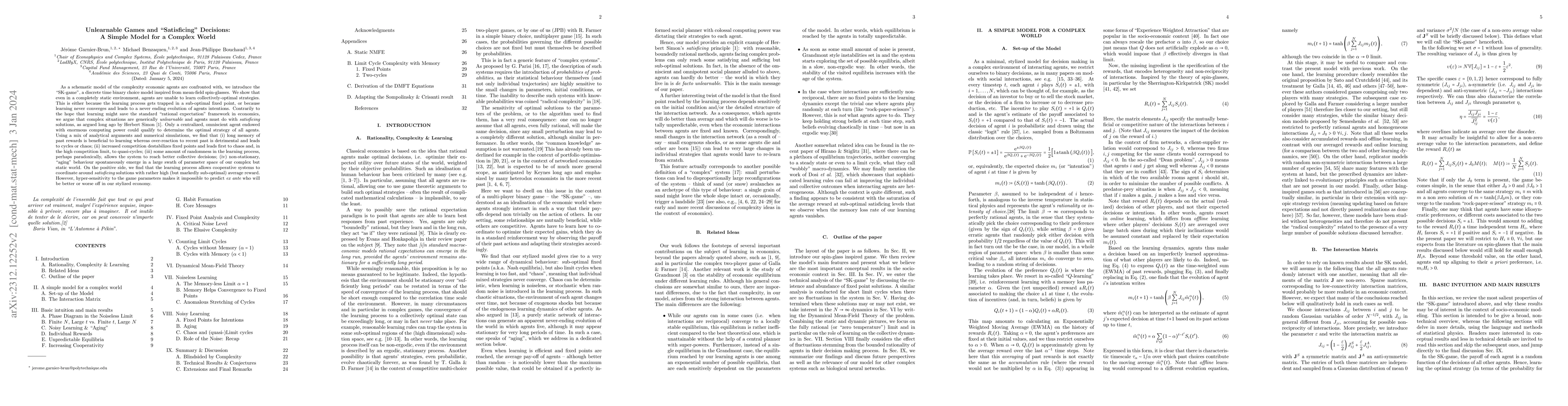

Unlearnable Games and "Satisficing'' Decisions: A Simple Model for a Complex World

As a schematic model of the complexity economic agents are confronted with, we introduce the ``SK-game'', a discrete time binary choice model inspired from mean-field spin-glasses. We show that even...

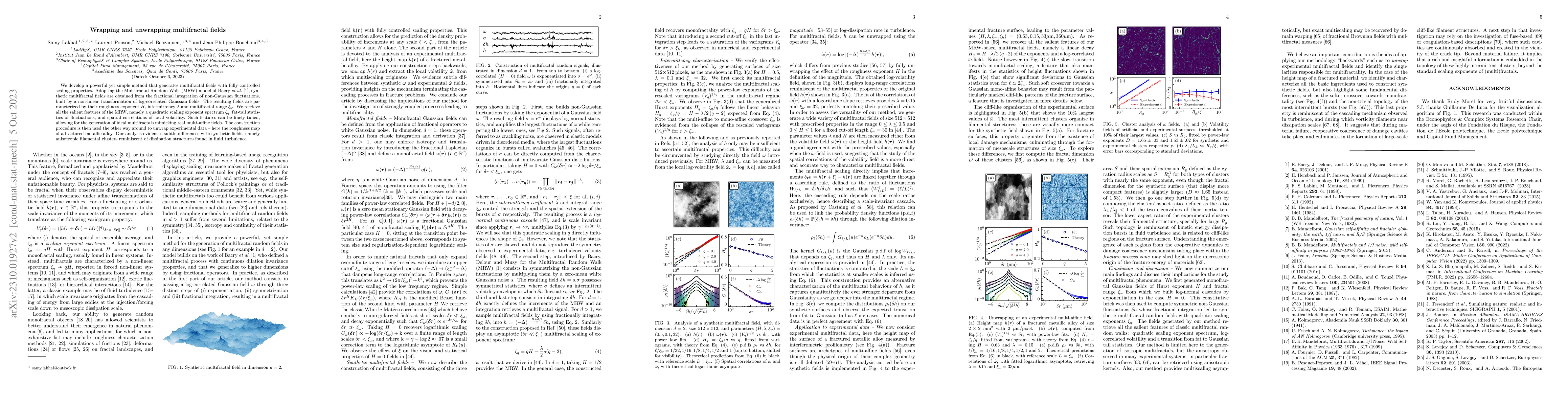

Wrapping and unwrapping multifractal fields

We develop a powerful yet simple method that generates multifractal fields with fully controlled scaling properties. Adopting the Multifractal Random Walk (MRW) model of Bacry et al. (2001), synthet...

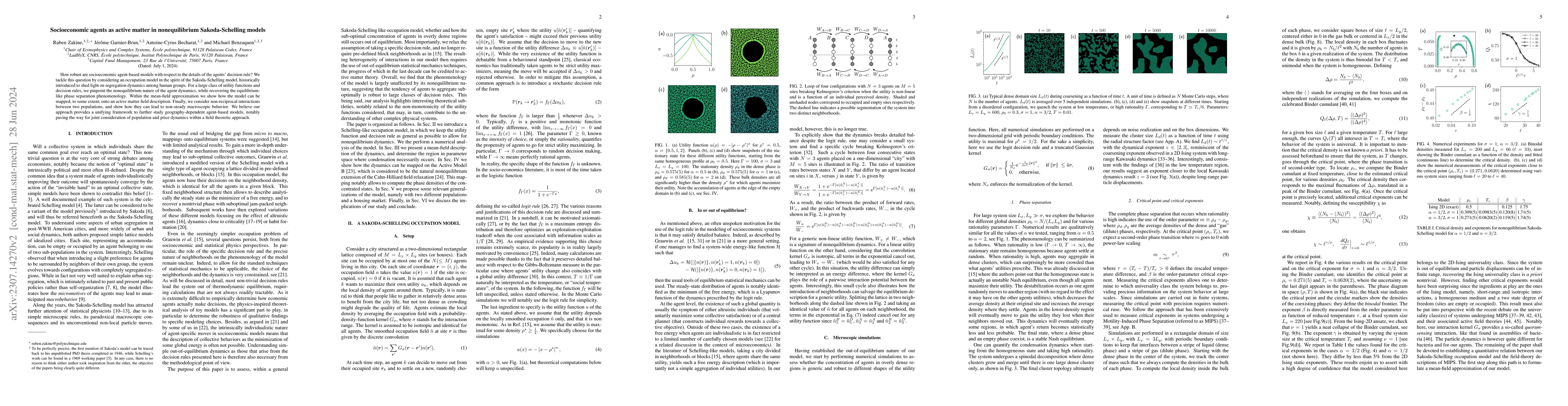

Socioeconomic agents as active matter in nonequilibrium Sakoda-Schelling models

How robust are socioeconomic agent-based models with respect to the details of the agents' decision rule? We tackle this question by considering an occupation model in the spirit of the Sakoda-Schel...

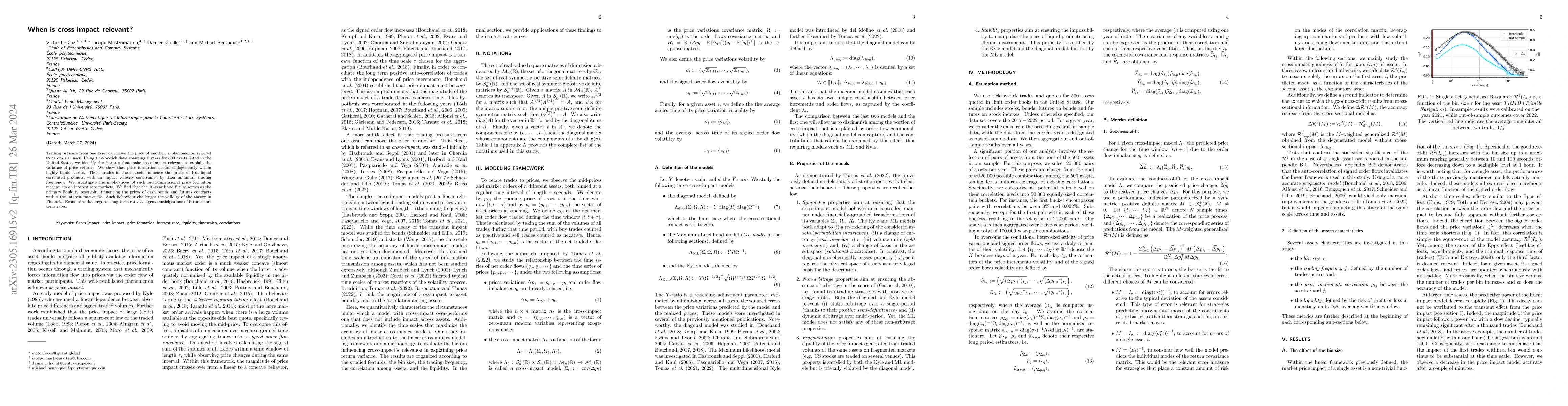

When is cross impact relevant?

Trading pressure from one asset can move the price of another, a phenomenon referred to as cross impact. Using tick-by-tick data spanning 5 years for 500 assets listed in the United States, we ident...

Multiscale Relevance of Natural Images

We use an agnostic information-theoretic approach to investigate the statistical properties of natural images. We introduce the Multiscale Relevance (MSR) measure to assess the robustness of images ...

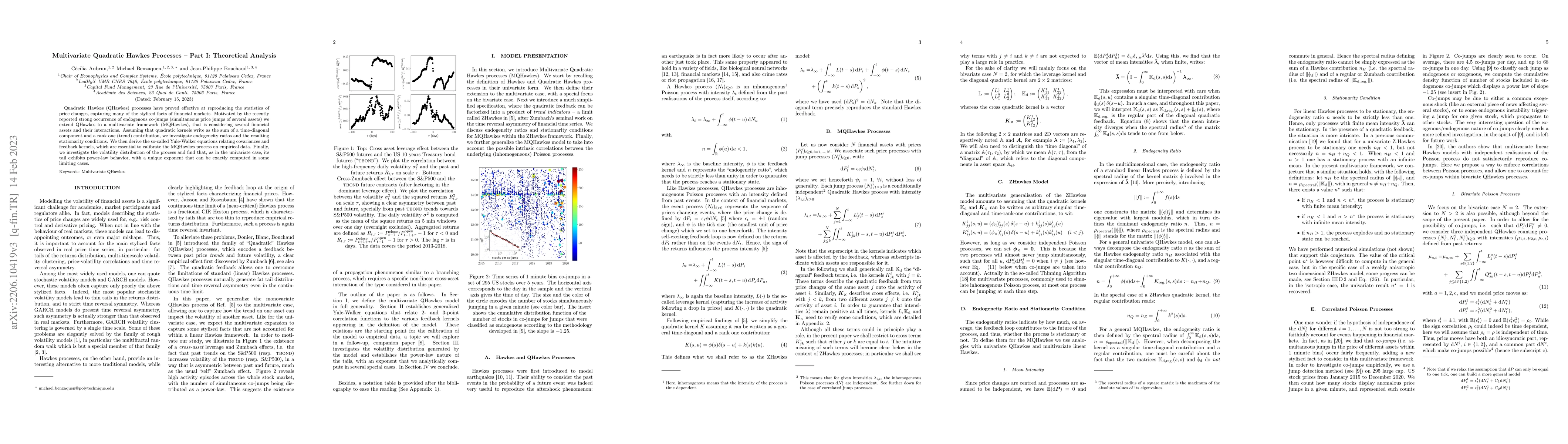

Multivariate Quadratic Hawkes Processes -- Part I: Theoretical Analysis

Quadratic Hawkes (QHawkes) processes have proved effective at reproducing the statistics of price changes, capturing many of the stylised facts of financial markets. Motivated by the recently report...

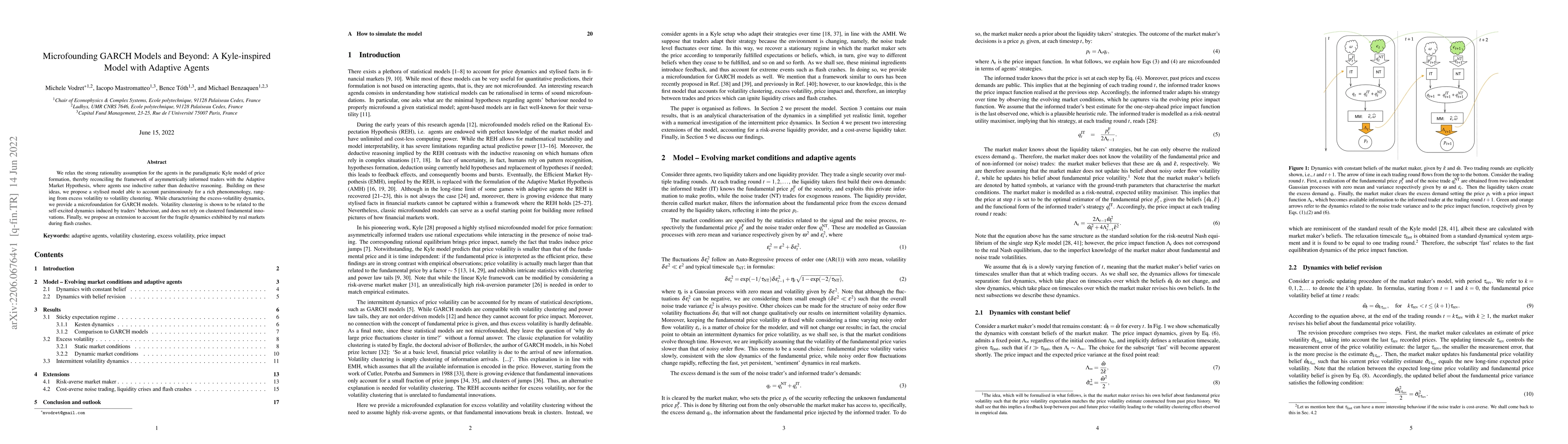

Microfounding GARCH Models and Beyond: A Kyle-inspired Model with Adaptive Agents

We relax the strong rationality assumption for the agents in the paradigmatic Kyle model of price formation, thereby reconciling the framework of asymmetrically informed traders with the Adaptive Ma...

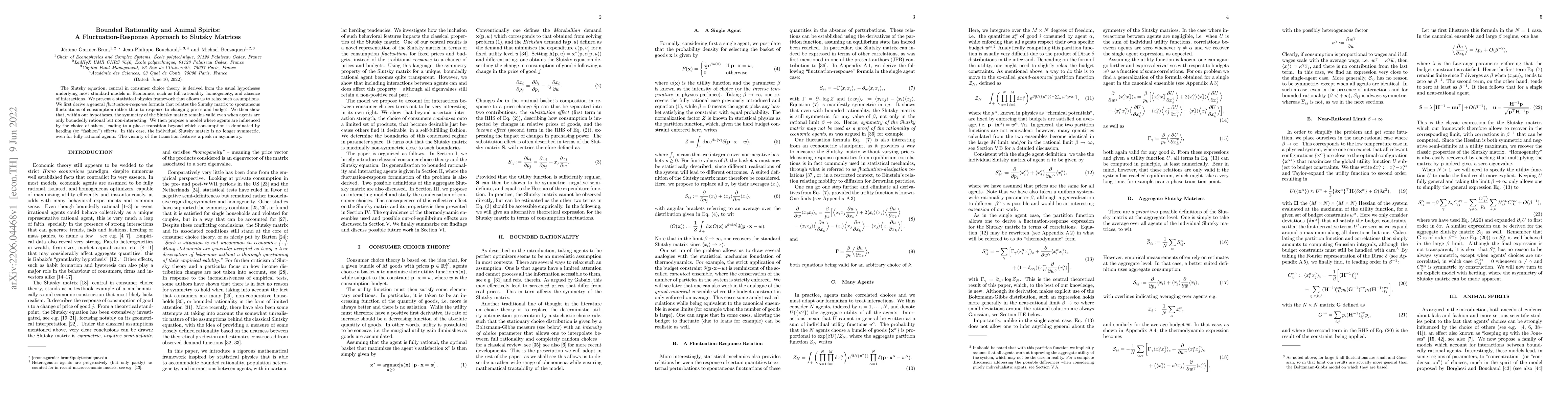

Bounded Rationality and Animal Spirits: A Fluctuation-Response Approach to Slutsky Matrices

The Slutsky equation, central in consumer choice theory, is derived from the usual hypotheses underlying most standard models in Economics, such as full rationality, homogeneity, and absence of inte...

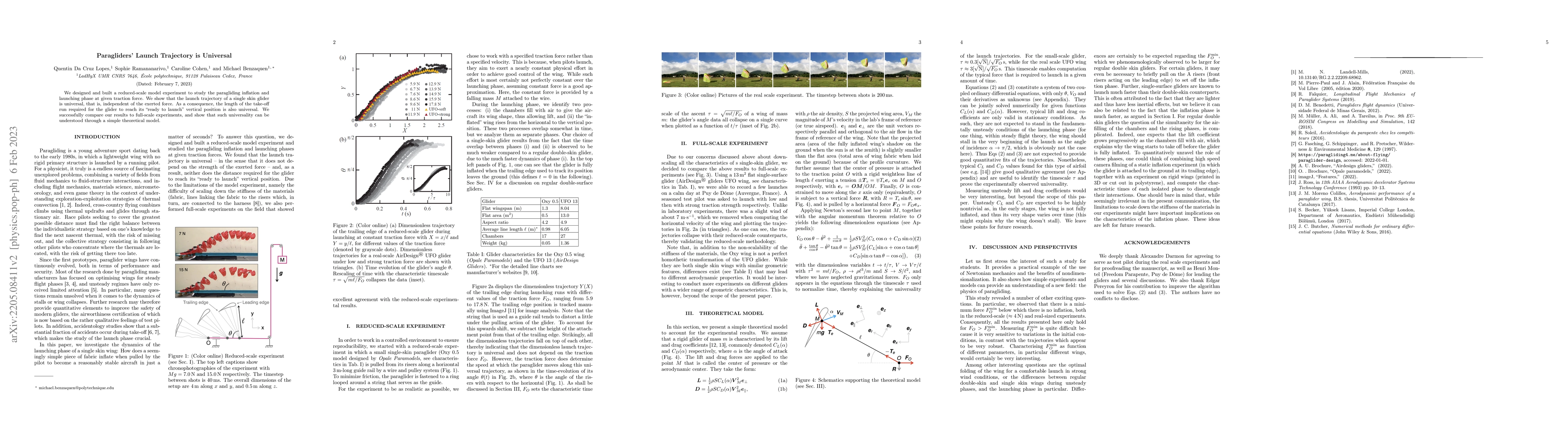

Paragliders' Launch Trajectory is Universal

We designed and built a reduced-scale model experiment to study the paragliding inflation and launching phase at given traction force. We show that the launch trajectory of a single skin glider is u...

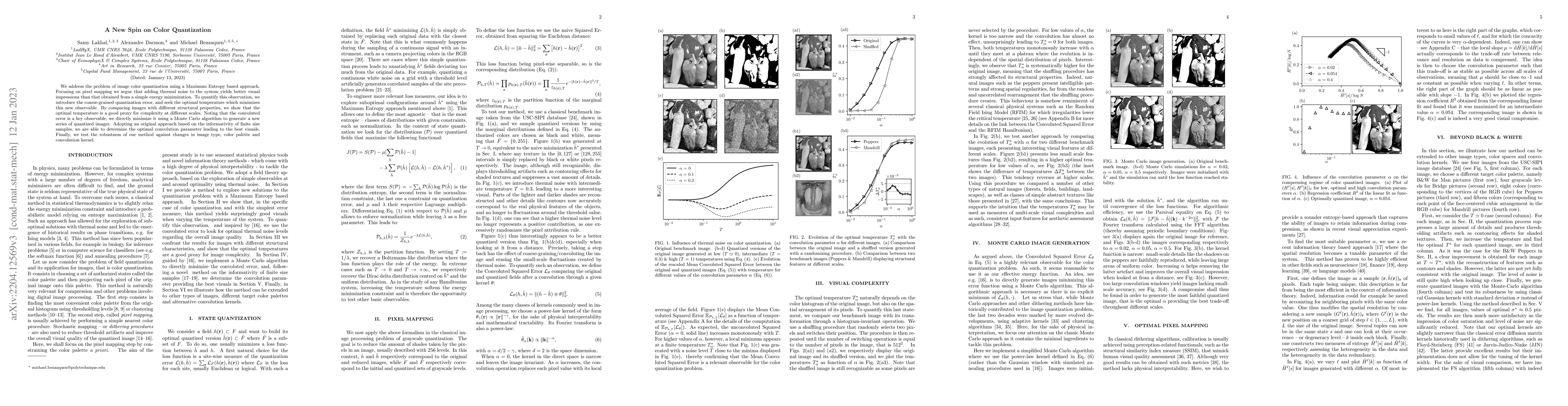

A New Spin on Color Quantization

We address the problem of image color quantization using a Maximum Entropy based approach. Focusing on pixel mapping we argue that adding thermal noise to the system yields better visual impressions...

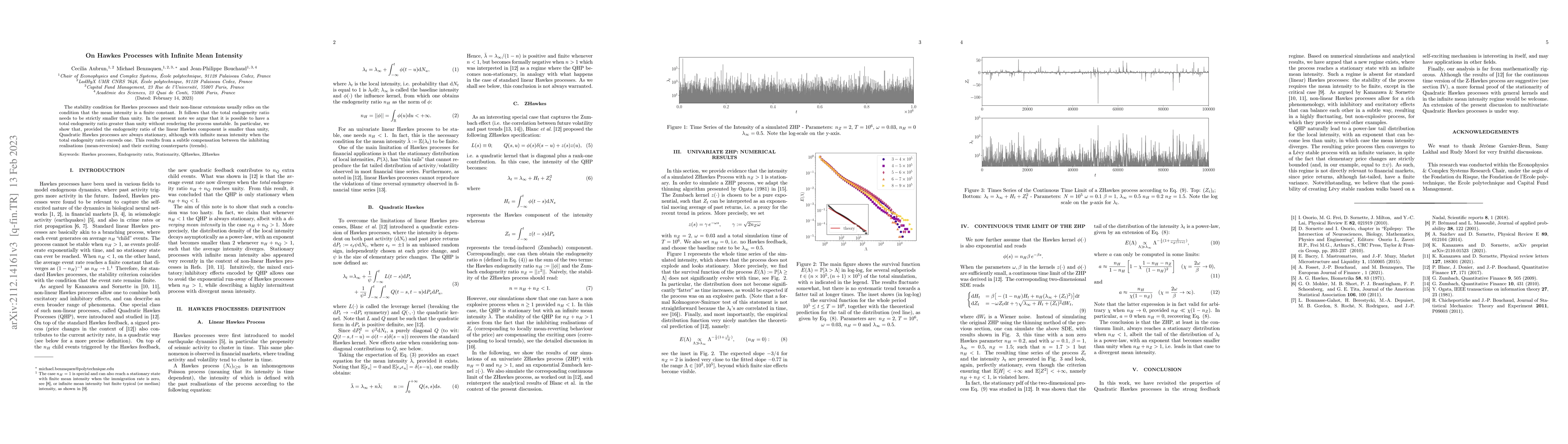

On Hawkes Processes with Infinite Mean Intensity

The stability condition for Hawkes processes and their non-linear extensions usually relies on the condition that the mean intensity is a finite constant. It follows that the total endogeneity ratio...

Do fundamentals shape the price response? A critical assessment of linear impact models

We compare the predictions of the stationary Kyle model, a microfounded multi-step linear price impact model in which market prices forecast fundamentals through information encoded in the order flo...

Exploration of the Parameter Space in Macroeconomic Agent-Based Models

Agent-Based Models (ABM) are computational scenario-generators, which can be used to predict the possible future outcomes of the complex system they represent. To better understand the robustness of...

Capital Demand Driven Business Cycles: Mechanism and Effects

We develop a tractable macroeconomic model that captures dynamic behaviors across multiple timescales, including business cycles. The model is anchored in a dynamic capital demand framework reflecti...

Exogenous and Endogenous Price Jumps Belong to Different Dynamical Classes

Synchronising a database of stock specific news with 5 years worth of order book data on 300 stocks, we show that abnormal price movements following news releases (exogenous) exhibit markedly differ...

Cross impact in derivative markets

Trading a financial asset pushes its price as well as the prices of other assets, a phenomenon known as cross-impact. The empirical estimation of this effect on complex financial instruments, such a...

Out-of-Equilibrium Dynamics and Excess Volatility in Firm Networks

We study the conditions under which input-output networks can dynamically attain a competitive equilibrium, where markets clear and profits are zero. We endow a classical firm network model with min...

Alignment and scattering of colliding active droplets

Active droplets emit a chemical solute at their surface that modifies their local interfacial tension. They exploit the nonlinear coupling of the convective transport of solute to the resulting Mara...

Unsteady Wave Drag on a Disturbance Moving Along an Arbitrary Trajectory

We derive analytical formulas for the wake and wave drag of a disturbance moving arbitrarily at the air-water interface. We show that, provided a constant velocity is reached in finite time, the uns...

How to build a cross-impact model from first principles: Theoretical requirements and empirical results

Trading a financial instrument pushes its price and those of other assets, a phenomenon known as cross-impact. To be of use, cross-impact models must fit data and be well-behaved so they can be appl...

The Structure of Occupational Mobility in France

In an era of rapid technological advancements and macroeconomic shifts, worker reallocation is necessary, yet responses to labor market shocks remain sluggish, making it crucial to identify bottleneck...

Mitigating Farmland Biodiversity Loss: A Bio-Economic Model of Land Consolidation and Pesticide Use

Biodiversity loss driven by agricultural intensification is a pressing global issue, with significant implications for ecosystem stability and human well-being. We design an integrated bio-economic ag...

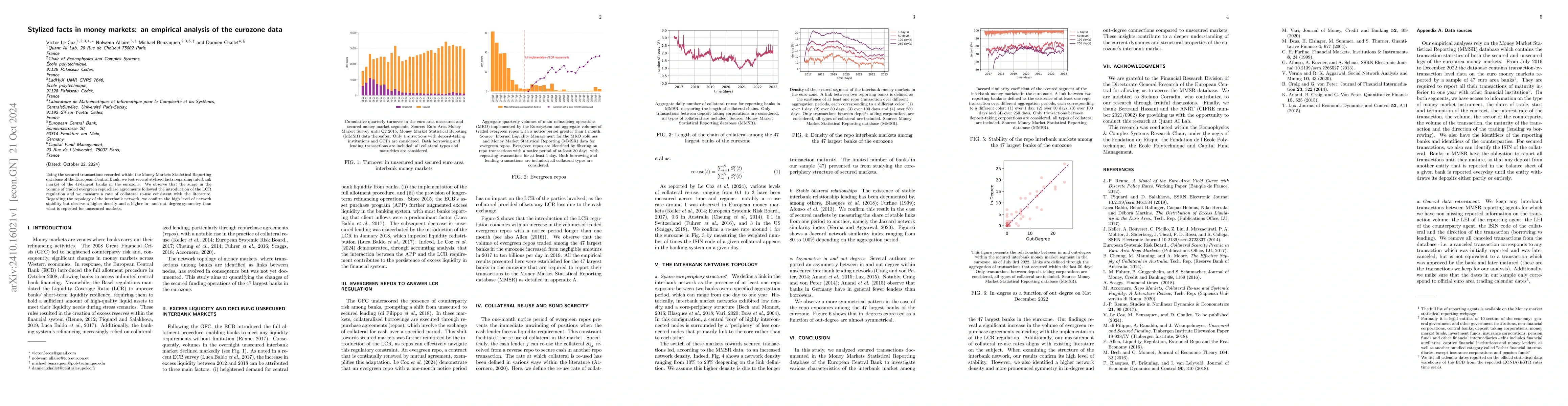

A minimal model of money creation under regulatory constraints

We propose a minimal model of the secured interbank network able to shed light on recent money markets puzzles. We find that excess liquidity emerges due to the interactions between the reserves and l...

Stylized facts in money markets: an empirical analysis of the eurozone data

Using the secured transactions recorded within the Money Markets Statistical Reporting database of the European Central Bank, we test several stylized facts regarding interbank market of the 47 larges...

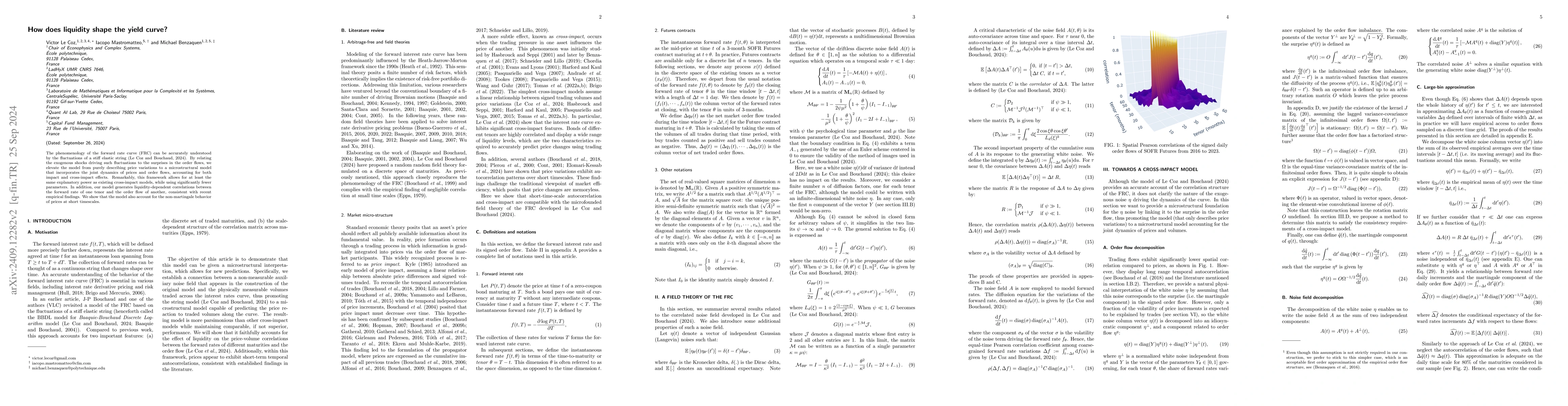

How does liquidity shape the yield curve?

The phenomenology of the forward rate curve (FRC) can be accurately understood by the fluctuations of a stiff elastic string (Le Coz and Bouchaud, 2024). By relating the exogenous shocks driving such ...

From Nonequilibrium to Equilibrium: Insights from a Two-Population Occupation Model

In socioeconomic systems, nonequilibrium dynamics naturally stem from the generically non-reciprocal interactions between self-interested agents, whereas equilibrium descriptions often only apply to s...

The Diffusive Nature of Housing Prices

We analyze the French housing market prices in the period 1970-2022, with high-resolution data from 2018 to 2022. The spatial correlation of the observed price field exhibits logarithmic decay charact...

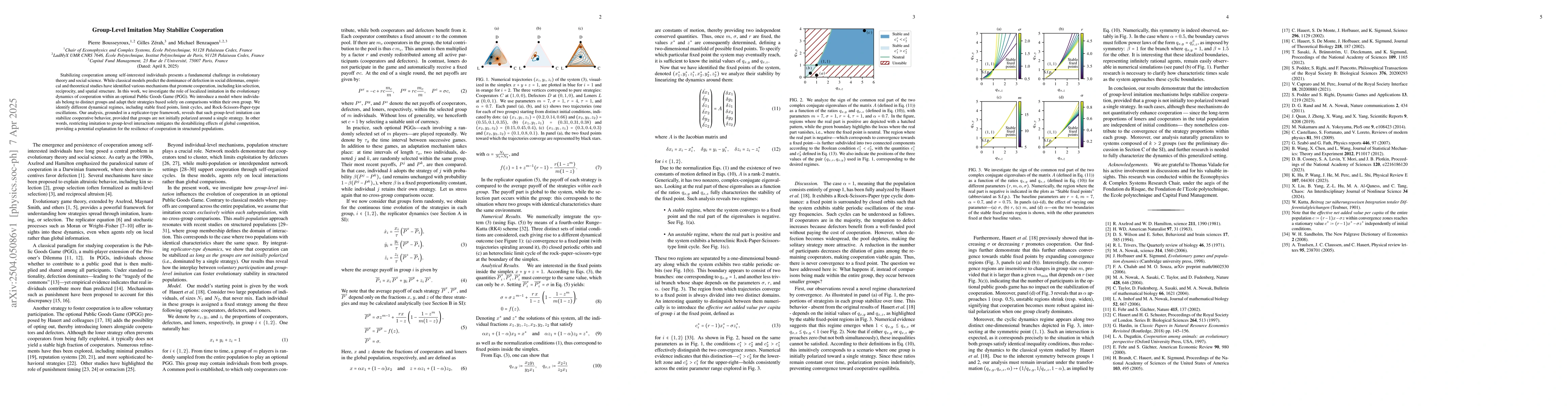

Group-Level Imitation May Stabilize Cooperation

Stabilizing cooperation among self-interested individuals presents a fundamental challenge in evolutionary theory and social science. While classical models predict the dominance of defection in socia...

Farm Size Matters: A Spatially Explicit Ecological-Economic Framework for Biodiversity and Pest Management

The intensification of European agriculture, characterized by increasing farm sizes, landscape simplification and reliance on synthetic pesticides, remains a key driver of biodiversity decline. While ...

Harmonious Color Pairings: Insights from Human Preference and Natural Hue Statistics

While color harmony has long been studied in art and design, a clear consensus remains elusive, as most models are grounded in qualitative insights or limited datasets. In this work, we present a quan...

Multivariate Quadratic Hawkes Processes -- Part II: Non-Parametric Empirical Calibration

This is the second part of our work on Multivariate Quadratic Hawkes (MQHawkes) Processes, devoted to the calibration of the model defined and studied analytically in Aubrun, C., Benzaquen, M., & Bouc...