Summary

Trading pressure from one asset can move the price of another, a phenomenon referred to as cross impact. Using tick-by-tick data spanning 5 years for 500 assets listed in the United States, we identify the features that make cross-impact relevant to explain the variance of price returns. We show that price formation occurs endogenously within highly liquid assets. Then, trades in these assets influence the prices of less liquid correlated products, with an impact velocity constrained by their minimum trading frequency. We investigate the implications of such a multidimensional price formation mechanism on interest rate markets. We find that the 10-year bond future serves as the primary liquidity reservoir, influencing the prices of cash bonds and futures contracts within the interest rate curve. Such behaviour challenges the validity of the theory in Financial Economics that regards long-term rates as agents anticipations of future short term rates.

AI Key Findings

Generated Sep 04, 2025

Methodology

The study uses a cross-impact model to analyze the relationship between price increments and predicted price increments for each asset.

Key Results

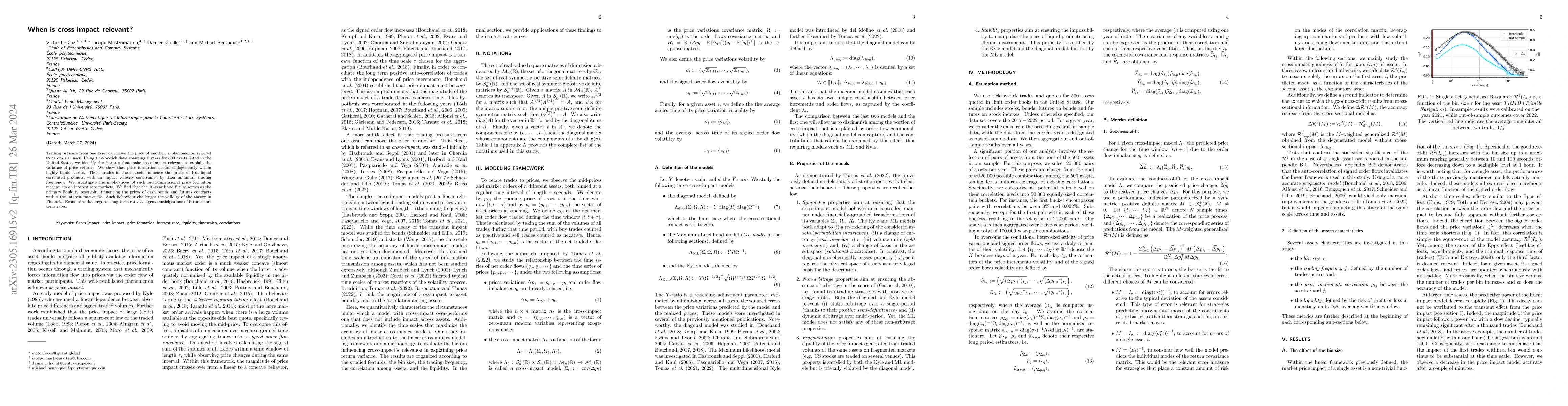

- The R2 value of the cross-impact model is significantly higher than that of the propagator model.

- The auto-correlation structure of signed order flows is well-documented in financial markets.

- The study finds significant improvements in goodness-of-fit using the cross-impact model compared to the propagator model.

Significance

This research is important because it provides a new framework for analyzing the relationship between price increments and predicted price increments, which can help improve trading strategies.

Technical Contribution

The study introduces a new cross-impact model that captures the dependence on past order flows, which is a key feature of financial markets.

Novelty

This research is novel because it provides a new framework for analyzing the relationship between price increments and predicted price increments, which can help improve trading strategies.

Limitations

- The study only analyzes a limited number of assets and time periods.

- The use of a cross-impact model may not be generalizable to all financial markets.

Future Work

- Further analysis of the relationship between price increments and predicted price increments for a larger number of assets and time periods.

- Development of more advanced models that can handle long memory in signed order flows.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhen is nonreciprocity relevant?

Michel Fruchart, Vincenzo Vitelli, Giulio Biroli et al.

When is Mean-Field Reinforcement Learning Tractable and Relevant?

Niao He, Batuhan Yardim, Artur Goldman

| Title | Authors | Year | Actions |

|---|

Comments (0)