Damien Challet

16 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Equity auction dynamics: latent liquidity models with activity acceleration

Equity auctions display several distinctive characteristics in contrast to continuous trading. As the auction time approaches, the rate of events accelerates causing a substantial liquidity buildup ...

Can ChatGPT Compute Trustworthy Sentiment Scores from Bloomberg Market Wraps?

We used a dataset of daily Bloomberg Financial Market Summaries from 2010 to 2023, reposted on large financial media, to determine how global news headlines may affect stock market movements using C...

Covariance matrix filtering and portfolio optimisation: the Average Oracle vs Non-Linear Shrinkage and all the variants of DCC-NLS

The Average Oracle, a simple and very fast covariance filtering method, is shown to yield superior Sharpe ratios than the current state-of-the-art (and complex) methods, Dynamic Conditional Covarian...

Recurrent Neural Networks with more flexible memory: better predictions than rough volatility

We extend recurrent neural networks to include several flexible timescales for each dimension of their output, which mechanically improves their abilities to account for processes with long memory o...

When is cross impact relevant?

Trading pressure from one asset can move the price of another, a phenomenon referred to as cross impact. Using tick-by-tick data spanning 5 years for 500 assets listed in the United States, we ident...

Price impact in equity auctions: zero, then linear

Using high-quality data, we report several statistical regularities of equity auctions in the Paris stock exchange. First, the average order book density is linear around the auction price at the ti...

Statistical inference of lead-lag at various timescales between asynchronous time series from p-values of transfer entropy

Symbolic transfer entropy is a powerful non-parametric tool to detect lead-lag between time series. Because a closed expression of the distribution of Transfer Entropy is not known for finite-size s...

Dissecting the explanatory power of ESG features on equity returns by sector, capitalization, and year with interpretable machine learning

We systematically investigate the links between price returns and Environment, Social and Governance (ESG) scores in the European equity market. Using interpretable machine learning, we examine whet...

Non-linear shrinkage of the price return covariance matrix is far from optimal for portfolio optimisation

Portfolio optimization requires sophisticated covariance estimators that are able to filter out estimation noise. Non-linear shrinkage is a popular estimator based on how the Oracle eigenvalues can ...

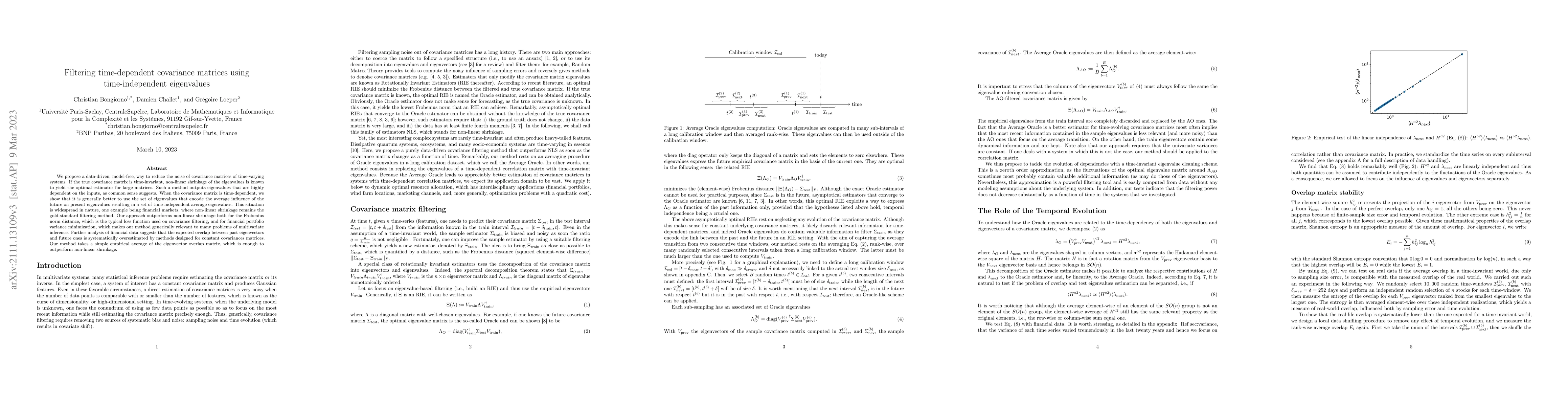

Cleaning the covariance matrix of strongly nonstationary systems with time-independent eigenvalues

We propose a data-driven way to reduce the noise of covariance matrices of nonstationary systems. In the case of stationary systems, asymptotic approaches were proved to converge to the optimal solu...

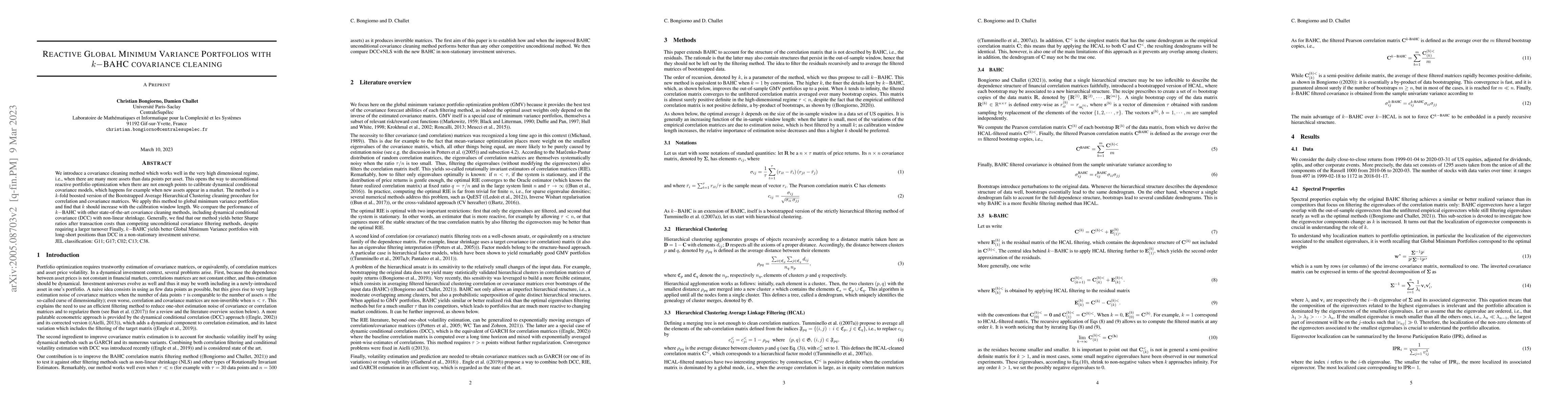

Reactive Global Minimum Variance Portfolios with $k-$BAHC covariance cleaning

We introduce a $k$-fold boosted version of our Boostrapped Average Hierarchical Clustering cleaning procedure for correlation and covariance matrices. We then apply this method to global minimum var...

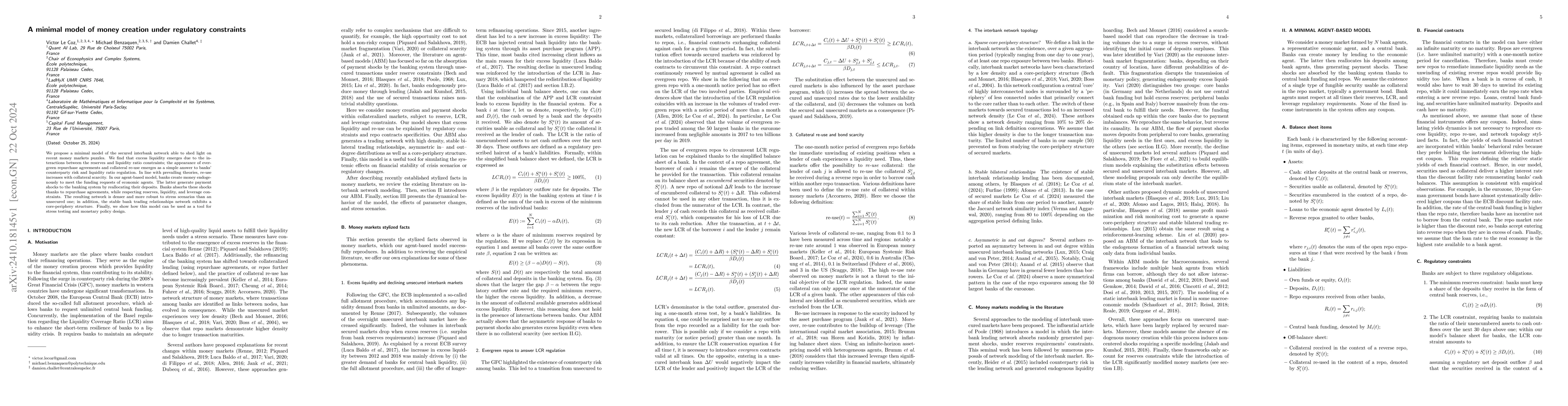

A minimal model of money creation under regulatory constraints

We propose a minimal model of the secured interbank network able to shed light on recent money markets puzzles. We find that excess liquidity emerges due to the interactions between the reserves and l...

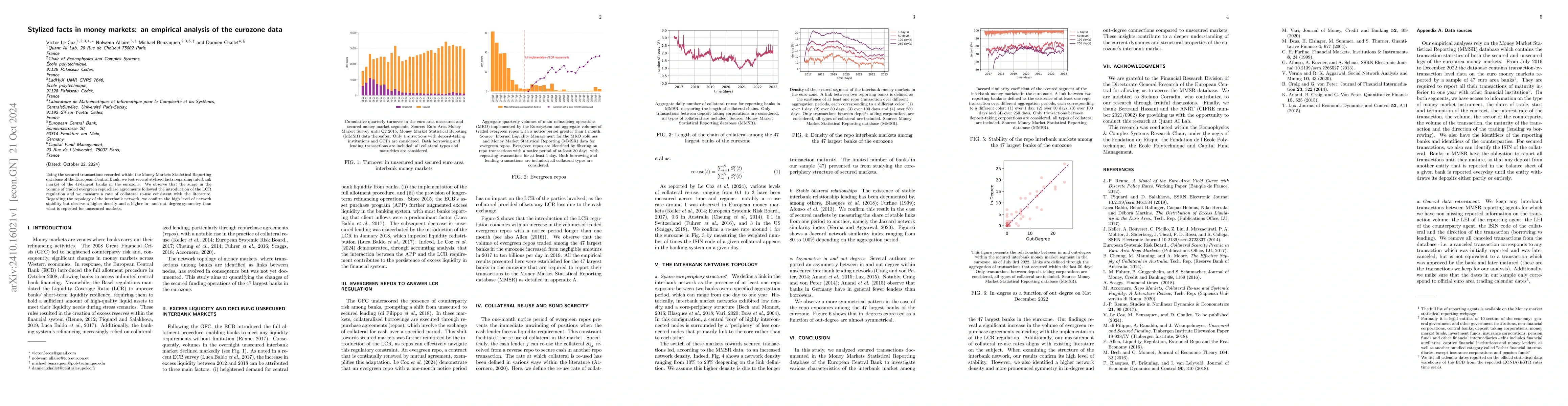

Stylized facts in money markets: an empirical analysis of the eurozone data

Using the secured transactions recorded within the Money Markets Statistical Reporting database of the European Central Bank, we test several stylized facts regarding interbank market of the 47 larges...

Data time travel and consistent market making: taming reinforcement learning in multi-agent systems with anonymous data

Reinforcement learning works best when the impact of the agent's actions on its environment can be perfectly simulated or fully appraised from available data. Some systems are however both hard to sim...

Optimal risk-aware interest rates for decentralized lending protocols

Decentralized lending protocols within the decentralized finance ecosystem enable the lending and borrowing of crypto-assets without relying on traditional intermediaries. Interest rates in these prot...

Learning the Spoofability of Limit Order Books With Interpretable Probabilistic Neural Networks

This paper investigates real-time detection of spoofing activity in limit order books, focusing on cryptocurrency centralized exchanges. We first introduce novel order flow variables based on multi-sc...