Summary

Using high-quality data, we report several statistical regularities of equity auctions in the Paris stock exchange. First, the average order book density is linear around the auction price at the time of auction clearing and has a large peak at the auction price. While the peak is due to slow traders, the order density shape is the result of subtle dynamics. The impact of a new market order or cancellation at the auction time can be decomposed into three parts as a function of the size of the additional order: (1) zero impact, caused by the discrete nature of prices, sometimes up to a surprisingly large additional volume relative to the auction volume (2) linear impact for additional orders up to a large fraction of the auction volume (3) for even larger orders price impact is non-linear, frequently super-linear.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

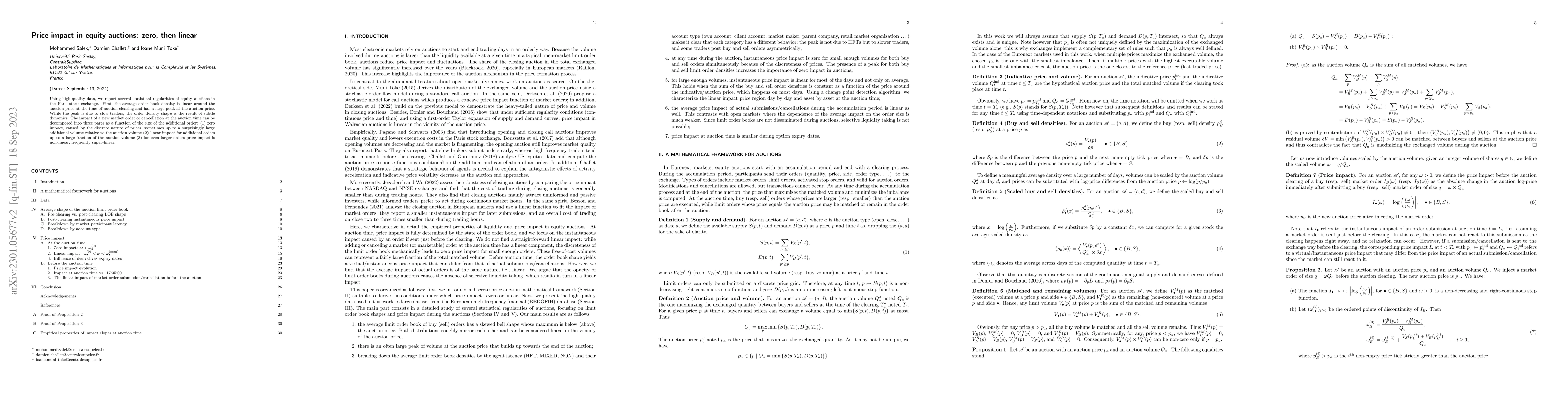

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

| Title | Authors | Year | Actions |

|---|

Comments (0)