Authors

Summary

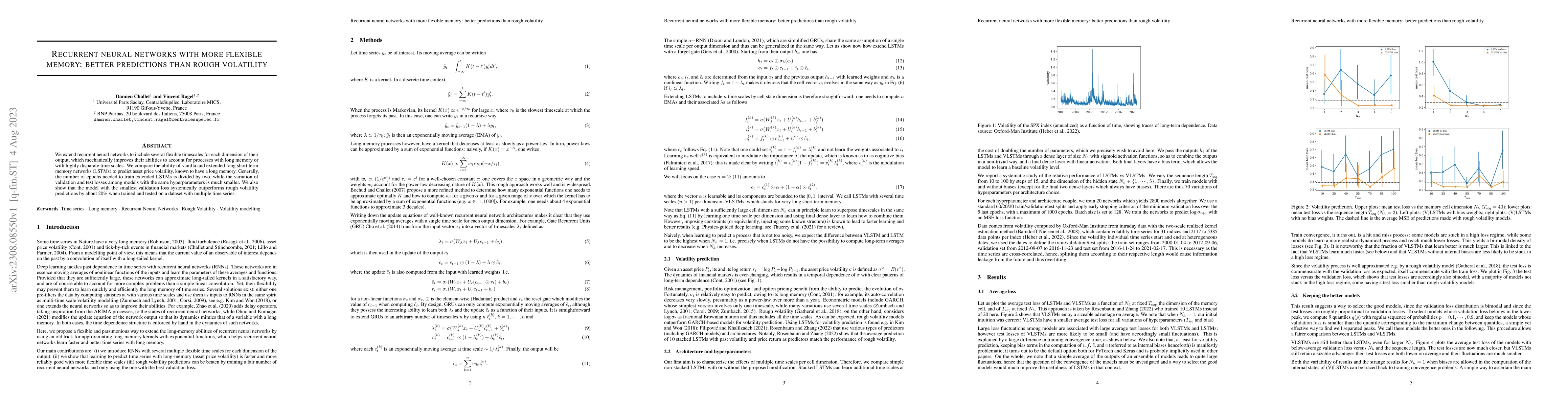

We extend recurrent neural networks to include several flexible timescales for each dimension of their output, which mechanically improves their abilities to account for processes with long memory or with highly disparate time scales. We compare the ability of vanilla and extended long short term memory networks (LSTMs) to predict asset price volatility, known to have a long memory. Generally, the number of epochs needed to train extended LSTMs is divided by two, while the variation of validation and test losses among models with the same hyperparameters is much smaller. We also show that the model with the smallest validation loss systemically outperforms rough volatility predictions by about 20% when trained and tested on a dataset with multiple time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMemory Capacity of Recurrent Neural Networks with Matrix Representation

Rohitash Chandra, Animesh Renanse, Alok Sharma

Learning Quantum Processes with Memory -- Quantum Recurrent Neural Networks

Viktoria-S. Schmiesing, Robert Salzmann, Dmytro Bondarenko

| Title | Authors | Year | Actions |

|---|

Comments (0)