Summary

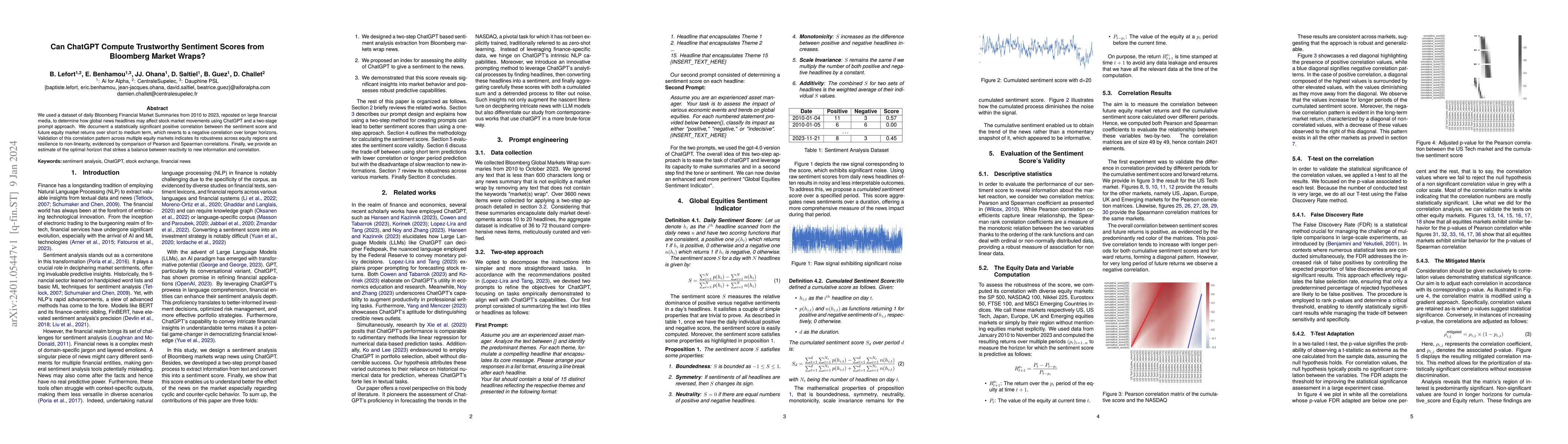

We used a dataset of daily Bloomberg Financial Market Summaries from 2010 to 2023, reposted on large financial media, to determine how global news headlines may affect stock market movements using ChatGPT and a two-stage prompt approach. We document a statistically significant positive correlation between the sentiment score and future equity market returns over short to medium term, which reverts to a negative correlation over longer horizons. Validation of this correlation pattern across multiple equity markets indicates its robustness across equity regions and resilience to non-linearity, evidenced by comparison of Pearson and Spearman correlations. Finally, we provide an estimate of the optimal horizon that strikes a balance between reactivity to new information and correlation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPotential of ChatGPT in predicting stock market trends based on Twitter Sentiment Analysis

Ummara Mumtaz, Summaya Mumtaz

Transforming Sentiment Analysis in the Financial Domain with ChatGPT

Georgios Makridis, Georgios Fatouros, John Soldatos et al.

ChatGPT and Deepseek: Can They Predict the Stock Market and Macroeconomy?

Jian Chen, Guofu Zhou, Guohao Tang et al.

Predicting stock prices with ChatGPT-annotated Reddit sentiment

Jan Kocoń, Mateusz Kmak, Kamil Chmurzyński et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)