Authors

Summary

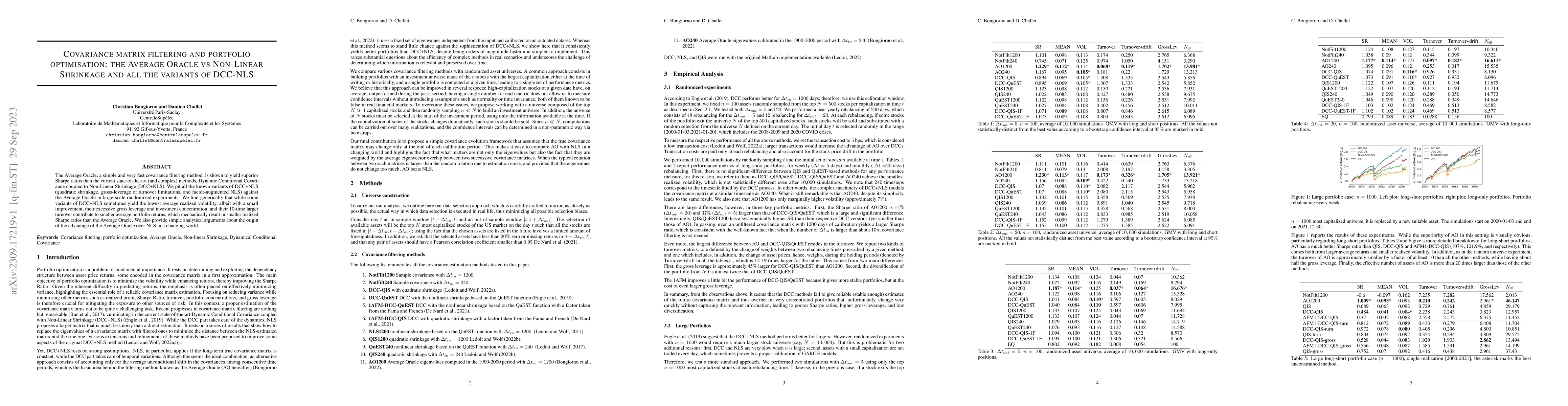

The Average Oracle, a simple and very fast covariance filtering method, is shown to yield superior Sharpe ratios than the current state-of-the-art (and complex) methods, Dynamic Conditional Covariance coupled to Non-Linear Shrinkage (DCC+NLS). We pit all the known variants of DCC+NLS (quadratic shrinkage, gross-leverage or turnover limitations, and factor-augmented NLS) against the Average Oracle in large-scale randomized experiments. We find generically that while some variants of DCC+NLS sometimes yield the lowest average realized volatility, albeit with a small improvement, their excessive gross leverage and investment concentration, and their 10-time larger turnover contribute to smaller average portfolio returns, which mechanically result in smaller realized Sharpe ratios than the Average Oracle. We also provide simple analytical arguments about the origin of the advantage of the Average Oracle over NLS in a changing world.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNon-linear shrinkage of the price return covariance matrix is far from optimal for portfolio optimisation

Damien Challet, Christian Bongiorno

Linear shrinkage of sample covariance matrix or matrices under elliptical distributions: a review

Esa Ollila

| Title | Authors | Year | Actions |

|---|

Comments (0)