Authors

Summary

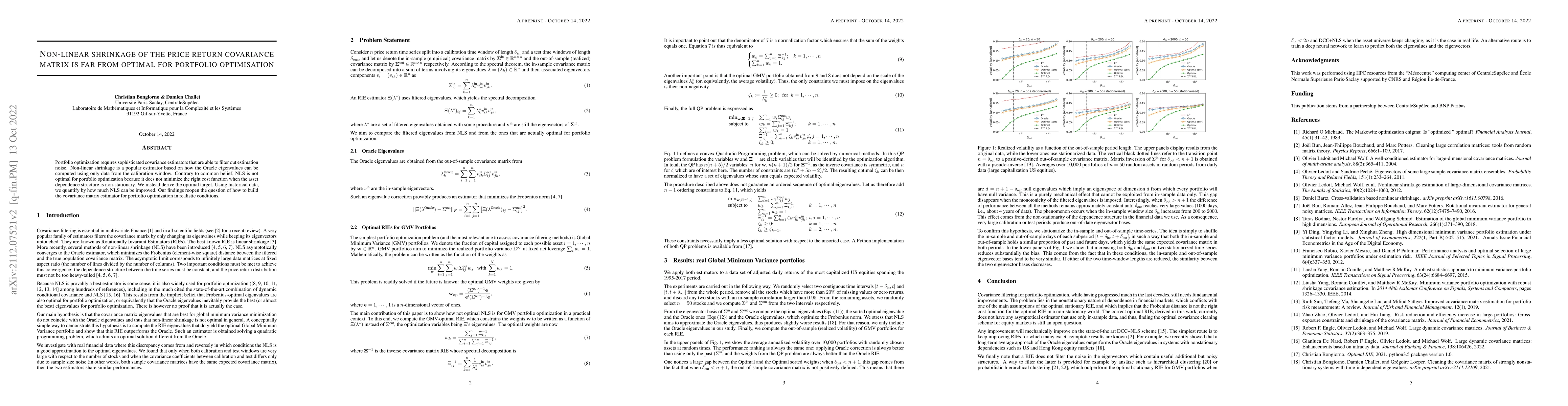

Portfolio optimization requires sophisticated covariance estimators that are able to filter out estimation noise. Non-linear shrinkage is a popular estimator based on how the Oracle eigenvalues can be computed using only data from the calibration window. Contrary to common belief, NLS is not optimal for portfolio optimization because it does not minimize the right cost function when the asset dependence structure is non-stationary. We instead derive the optimal target. Using historical data, we quantify by how much NLS can be improved. Our findings reopen the question of how to build the covariance matrix estimator for portfolio optimization in realistic conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCovariance matrix filtering and portfolio optimisation: the Average Oracle vs Non-Linear Shrinkage and all the variants of DCC-NLS

Damien Challet, Christian Bongiorno

| Title | Authors | Year | Actions |

|---|

Comments (0)