Summary

We propose a data-driven way to reduce the noise of covariance matrices of nonstationary systems. In the case of stationary systems, asymptotic approaches were proved to converge to the optimal solutions. Such methods produce eigenvalues that are highly dependent on the inputs, as common sense would suggest. Our approach proposes instead to use a set of eigenvalues totally independent from the inputs and that encode the long-term averaging of the influence of the future on present eigenvalues. Such an influence can be the predominant factor in nonstationary systems. Using real and synthetic data, we show that our data-driven method outperforms optimal methods designed for stationary systems for the filtering of both covariance matrix and its inverse, as illustrated by financial portfolio variance minimization, which makes out method generically relevant to many problems of multivariate inference.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

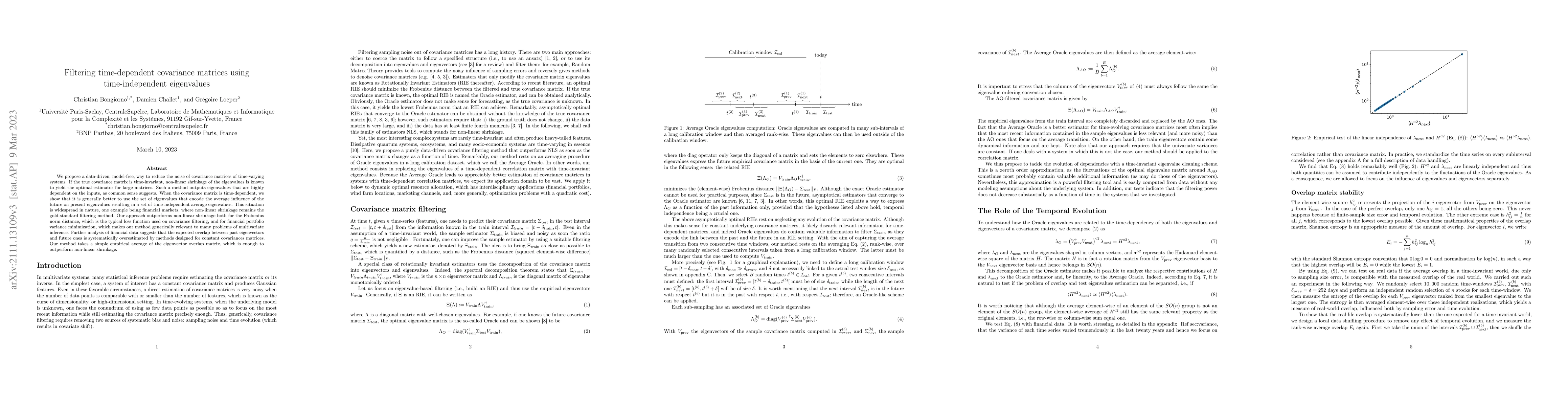

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInverse covariance operators of multivariate nonstationary time series

Jonas Krampe, Suhasini Subba Rao

Quantifying the information lost in optimal covariance matrix cleaning

Christian Bongiorno, Lamia Lamrani

| Title | Authors | Year | Actions |

|---|

Comments (0)