Summary

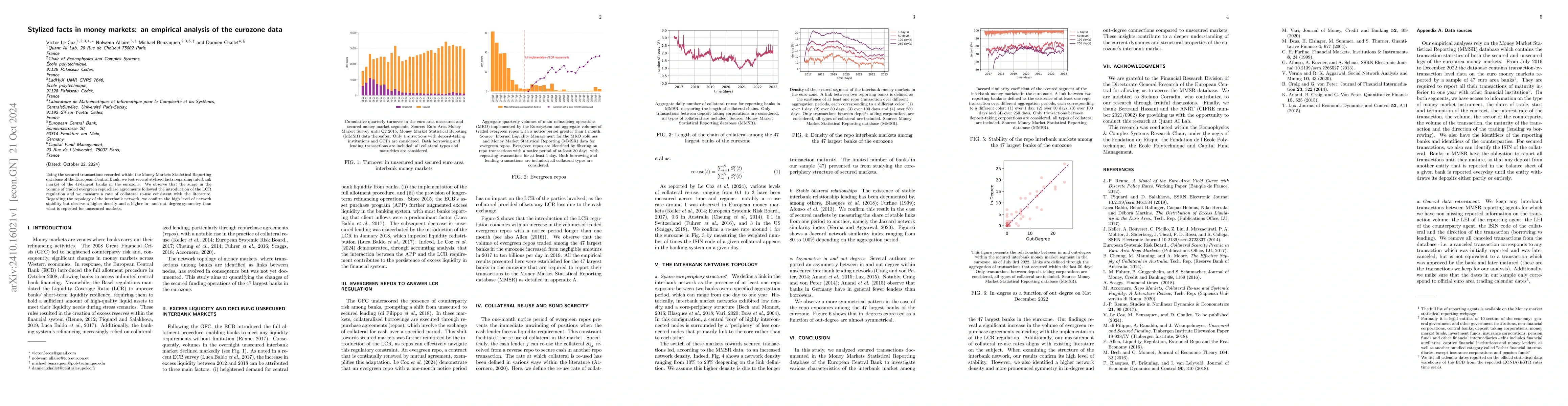

Using the secured transactions recorded within the Money Markets Statistical Reporting database of the European Central Bank, we test several stylized facts regarding interbank market of the 47 largest banks in the eurozone. We observe that the surge in the volume of traded evergreen repurchase agreements followed the introduction of the LCR regulation and we measure a rate of collateral re-use consistent with the literature. Regarding the topology of the interbank network, we confirm the high level of network stability but observe a higher density and a higher in- and out-degree symmetry than what is reported for unsecured markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRevisiting Cont's Stylized Facts for Modern Stock Markets

Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow et al.

International Financial Markets Through 150 Years: Evaluating Stylized Facts

Maximilian Janisch, Thomas Lehéricy, Sara A. Safari

No citations found for this paper.

Comments (0)