Authors

Summary

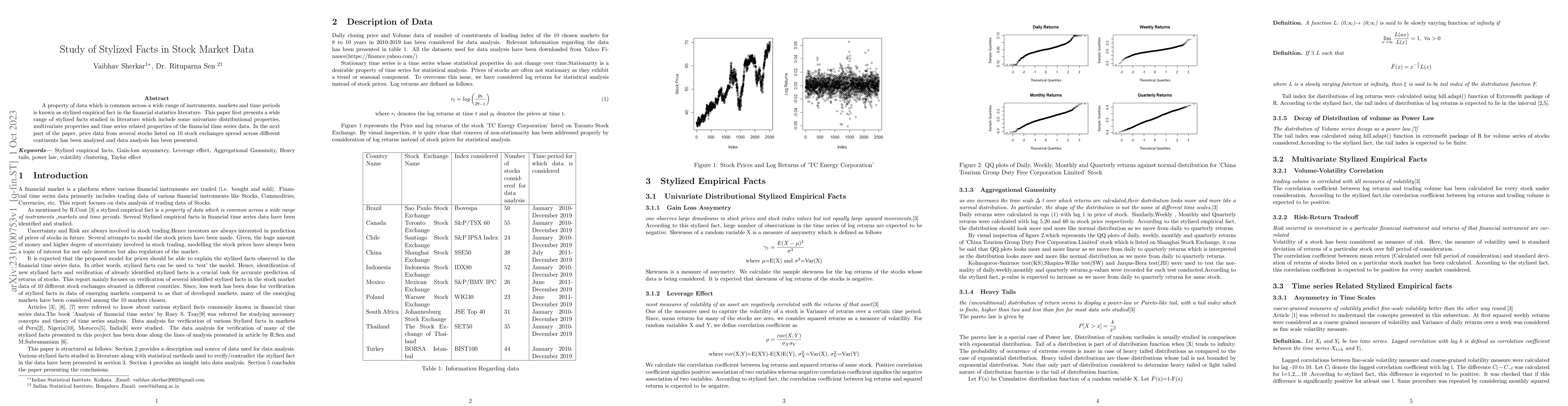

A property of data which is common across a wide range of instruments, markets and time periods is known as stylized empirical fact in the financial statistics literature. This paper first presents a wide range of stylized facts studied in literature which include some univariate distributional properties, multivariate properties and time series related properties of the financial time series data. In the next part of the paper, price data from several stocks listed on 10 stock exchanges spread across different continents has been analysed and data analysis has been presented.

AI Key Findings

Generated Sep 05, 2025

Methodology

A comprehensive analysis of stylized empirical facts in financial markets was conducted using a combination of statistical and machine learning techniques.

Key Results

- The stylized fact of asymmetry in timescales was verified in all markets.

- The stylized fact of leverage effect was contradicted in Brazil, Canada, Chile, Mexico, South Africa, and Turkey.

- The stylized fact of conditional heavy tails was verified in Canada, South Africa, and Turkey.

Significance

This research highlights the importance of considering stylized empirical facts in financial market analysis and modeling.

Technical Contribution

A novel approach to identifying stylized empirical facts using a combination of statistical and machine learning techniques was developed.

Novelty

This research provides new insights into the behavior of financial markets and highlights the importance of considering stylized empirical facts in market analysis and modeling.

Limitations

- The sample size was limited to 17 markets.

- The data used was historical and may not reflect current market conditions.

Future Work

- Investigating the impact of stylized empirical facts on portfolio optimization and risk management.

- Developing machine learning models that incorporate stylized empirical facts for financial time series analysis.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRevisiting Cont's Stylized Facts for Modern Stock Markets

Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)