Summary

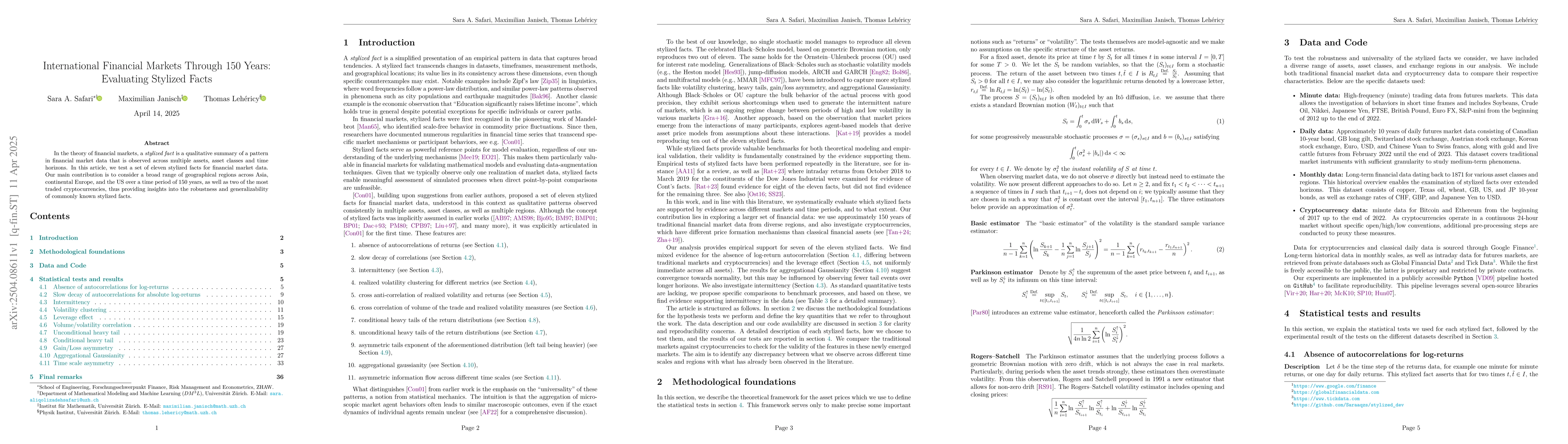

In the theory of financial markets, a stylized fact is a qualitative summary of a pattern in financial market data that is observed across multiple assets, asset classes and time horizons. In this article, we test a set of eleven stylized facts for financial market data. Our main contribution is to consider a broad range of geographical regions across Asia, continental Europe, and the US over a time period of 150 years, as well as two of the most traded cryptocurrencies, thus providing insights into the robustness and generalizability of commonly known stylized facts.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research tests a set of eleven stylized facts for financial market data across various geographical regions including Asia, continental Europe, and the US over a 150-year period, as well as incorporating two major cryptocurrencies.

Key Results

- Evaluation of eleven stylized facts for financial markets over a 150-year span.

- Analysis of data from diverse geographical regions and asset classes, including cryptocurrencies.

Significance

This study provides insights into the robustness and generalizability of stylized facts across different markets and time periods, contributing to a broader understanding of financial market behavior.

Technical Contribution

The article presents a comprehensive analysis of stylized facts in international financial markets, extending the examination to a 150-year timeline and incorporating cryptocurrencies.

Novelty

This research distinguishes itself by its extensive temporal coverage and geographical scope, offering a more global perspective on stylized facts in financial markets.

Limitations

- The paper does not discuss specific limitations within its content.

- Results might be influenced by data availability and quality over such a long historical period.

Future Work

- Further investigation into additional stylized facts or market characteristics.

- Exploration of the impact of regulatory changes on stylized facts over time.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRevisiting Cont's Stylized Facts for Modern Stock Markets

Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow et al.

No citations found for this paper.

Comments (0)