Summary

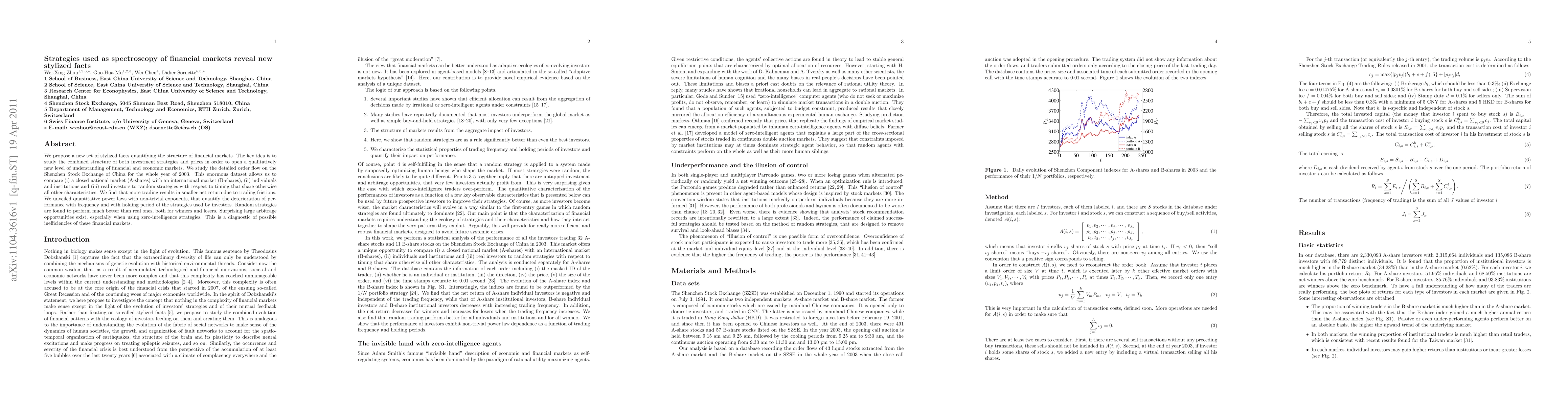

We propose a new set of stylized facts quantifying the structure of financial markets. The key idea is to study the combined structure of both investment strategies and prices in order to open a qualitatively new level of understanding of financial and economic markets. We study the detailed order flow on the Shenzhen Stock Exchange of China for the whole year of 2003. This enormous dataset allows us to compare (i) a closed national market (A-shares) with an international market (B-shares), (ii) individuals and institutions and (iii) real investors to random strategies with respect to timing that share otherwise all other characteristics. We find that more trading results in smaller net return due to trading frictions. We unveiled quantitative power laws with non-trivial exponents, that quantify the deterioration of performance with frequency and with holding period of the strategies used by investors. Random strategies are found to perform much better than real ones, both for winners and losers. Surprising large arbitrage opportunities exist, especially when using zero-intelligence strategies. This is a diagnostic of possible inefficiencies of these financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInternational Financial Markets Through 150 Years: Evaluating Stylized Facts

Maximilian Janisch, Thomas Lehéricy, Sara A. Safari

Revisiting Cont's Stylized Facts for Modern Stock Markets

Ethan Ratliff-Crain, Colin M. Van Oort, James Bagrow et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)