Summary

We study the conditions under which input-output networks can dynamically attain a competitive equilibrium, where markets clear and profits are zero. We endow a classical firm network model with minimal dynamical rules that reduce supply/demand imbalances and excess profits. We show that the time needed to reach equilibrium diverges to infinity as the system approaches an instability point beyond which the Hawkins-Simons condition is violated and competitive equilibrium is no longer admissible. We argue that such slow dynamics is a source of excess volatility, through accumulation and amplification of exogenous shocks. Factoring in essential physical constraints absent in our minimal model, such as causality or inventory management, we then propose a dynamically consistent model that displays a rich variety of phenomena. Competitive equilibrium can only be reached after some time and within some restricted region of parameter space, outside of which one observes spontaneous periodic and chaotic dynamics, reminiscent of real business cycles. This suggests an alternative explanation of excess volatility in terms of purely endogenous fluctuations. Diminishing return to scale and increased perishability of goods are found to ease convergence towards equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

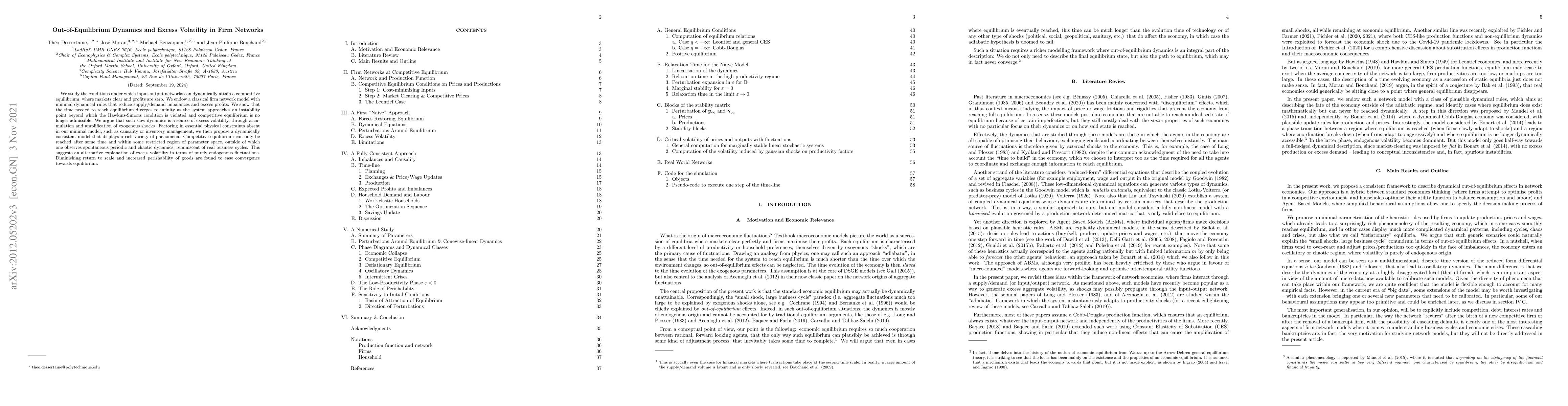

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)