Summary

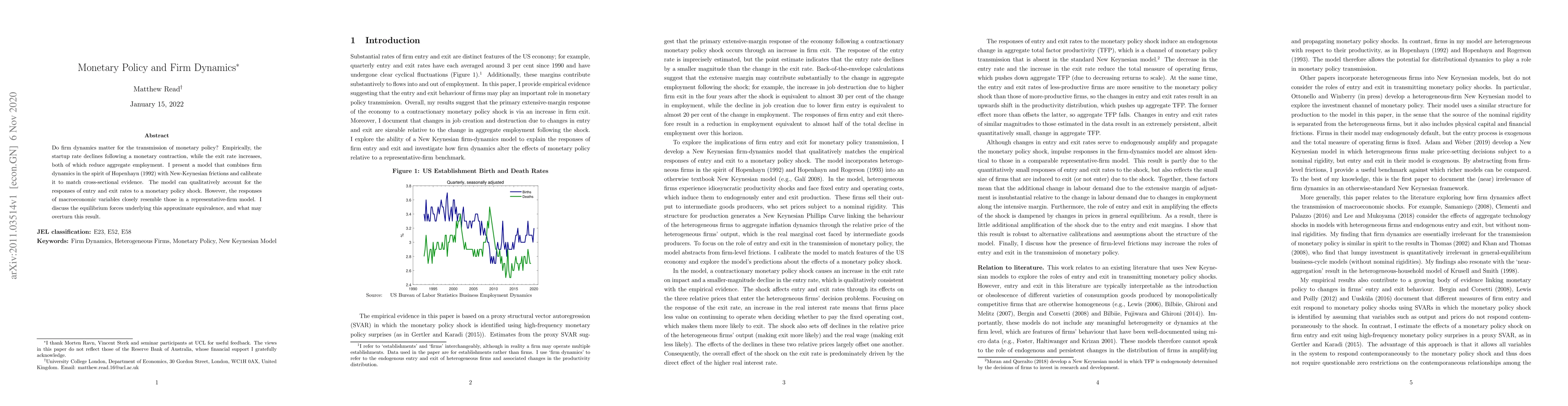

Do firm dynamics matter for the transmission of monetary policy? Empirically, the startup rate declines following a monetary contraction, while the exit rate increases, both of which reduce aggregate employment. I present a model that combines firm dynamics in the spirit of Hopenhayn (1992) with New-Keynesian frictions and calibrate it to match cross-sectional evidence. The model can qualitatively account for the responses of entry and exit rates to a monetary policy shock. However, the responses of macroeconomic variables closely resemble those in a representative-firm model. I discuss the equilibrium forces underlying this approximate equivalence, and what may overturn this result.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)