Summary

The phenomenology of the forward rate curve (FRC) can be accurately understood by the fluctuations of a stiff elastic string (Le Coz and Bouchaud, 2024). By relating the exogenous shocks driving such fluctuations to the surprises in the order flows, we elevate the model from purely describing price variations to a microstructural model that incorporates the joint dynamics of prices and order flows, accounting for both impact and cross-impact effects. Remarkably, this framework allows for at least the same explanatory power as existing cross-impact models, while using significantly fewer parameters. In addition, our model generates liquidity-dependent correlations between the forward rate of one tenor and the order flow of another, consistent with recent empirical findings. We show that the model also account for the non-martingale behavior of prices at short timescales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

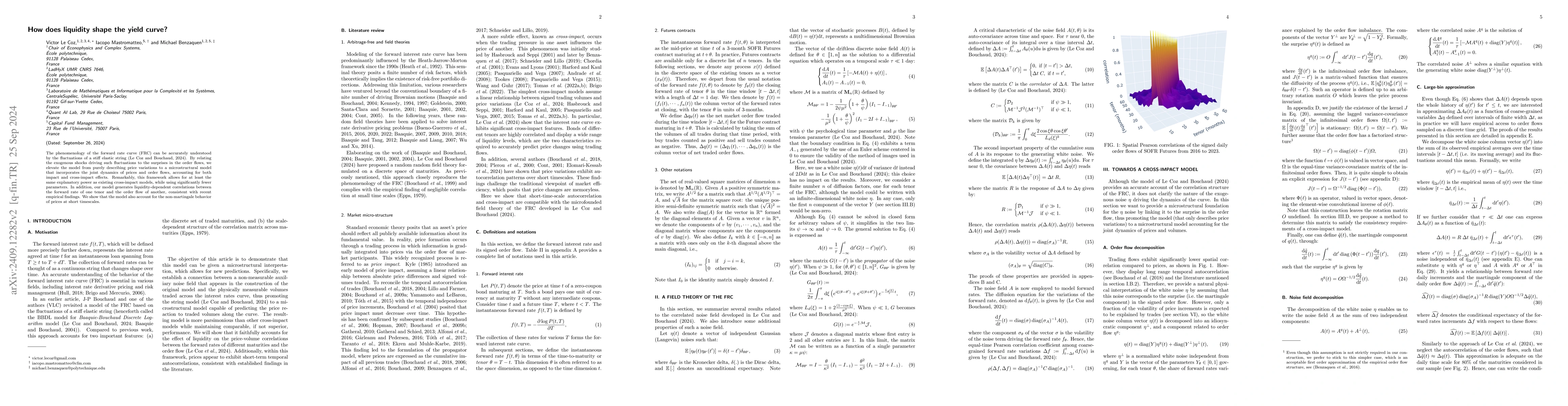

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDetecting Depegs: Towards Safer Passive Liquidity Provision on Curve Finance

Thomas N. Cintra, Maxwell P. Holloway

No citations found for this paper.

Comments (0)