Summary

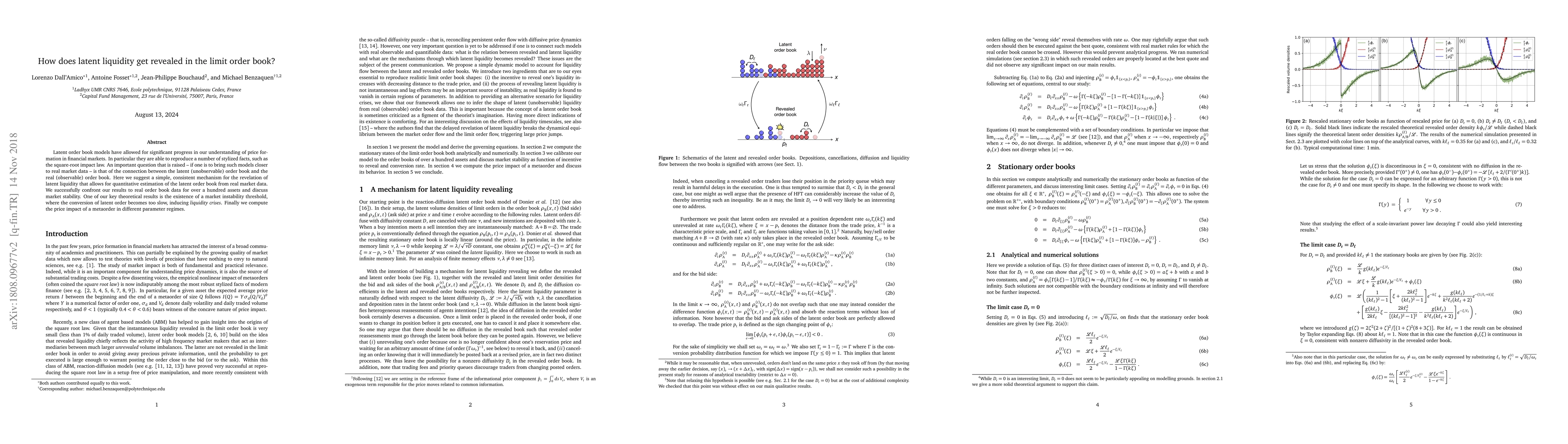

Latent order book models have allowed for significant progress in our understanding of price formation in financial markets. In particular they are able to reproduce a number of stylized facts, such as the square-root impact law. An important question that is raised -- if one is to bring such models closer to real market data -- is that of the connection between the latent (unobservable) order book and the real (observable) order book. Here we suggest a simple, consistent mechanism for the revelation of latent liquidity that allows for quantitative estimation of the latent order book from real market data. We successfully confront our results to real order book data for over a hundred assets and discuss market stability. One of our key theoretical results is the existence of a market instability threshold, where the conversion of latent order becomes too slow, inducing liquidity crises. Finally we compute the price impact of a metaorder in different parameter regimes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)