Summary

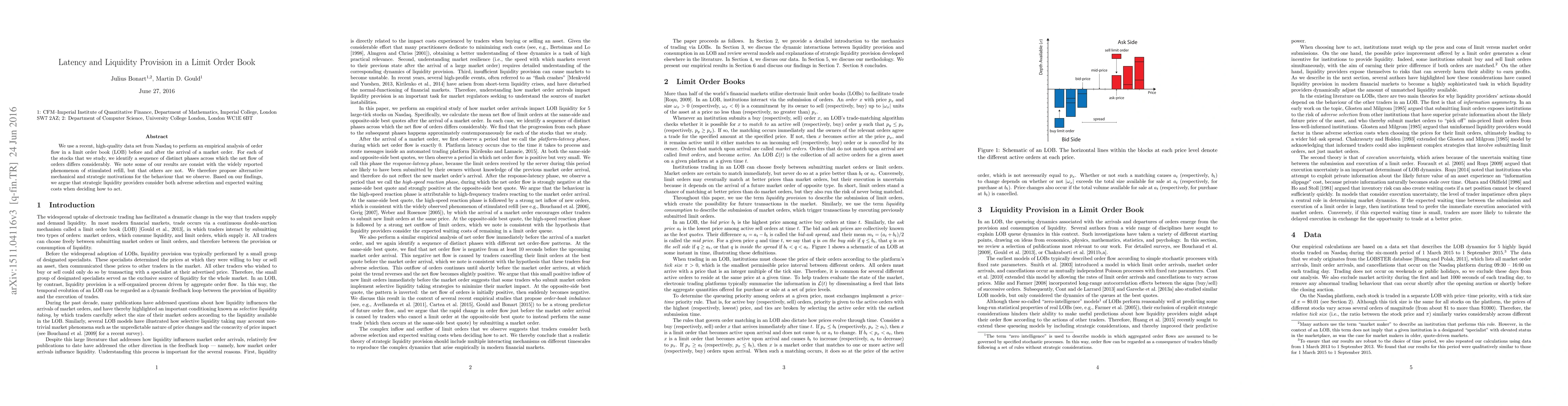

We use a recent, high-quality data set from Nasdaq to perform an empirical analysis of order flow in a limit order book (LOB) before and after the arrival of a market order. For each of the stocks that we study, we identify a sequence of distinct phases across which the net flow of orders differs considerably. We note some of our results are consist with the widely reported phenomenon of stimulated refill, but that others are not. We therefore propose alternative mechanical and strategic motivations for the behaviour that we observe. Based on our findings, we argue that strategic liquidity providers consider both adverse selection and expected waiting costs when deciding how to act.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal incentives in a limit order book: a SPDE control approach

Philippe Bergault, Bastien Baldacci

| Title | Authors | Year | Actions |

|---|

Comments (0)