Summary

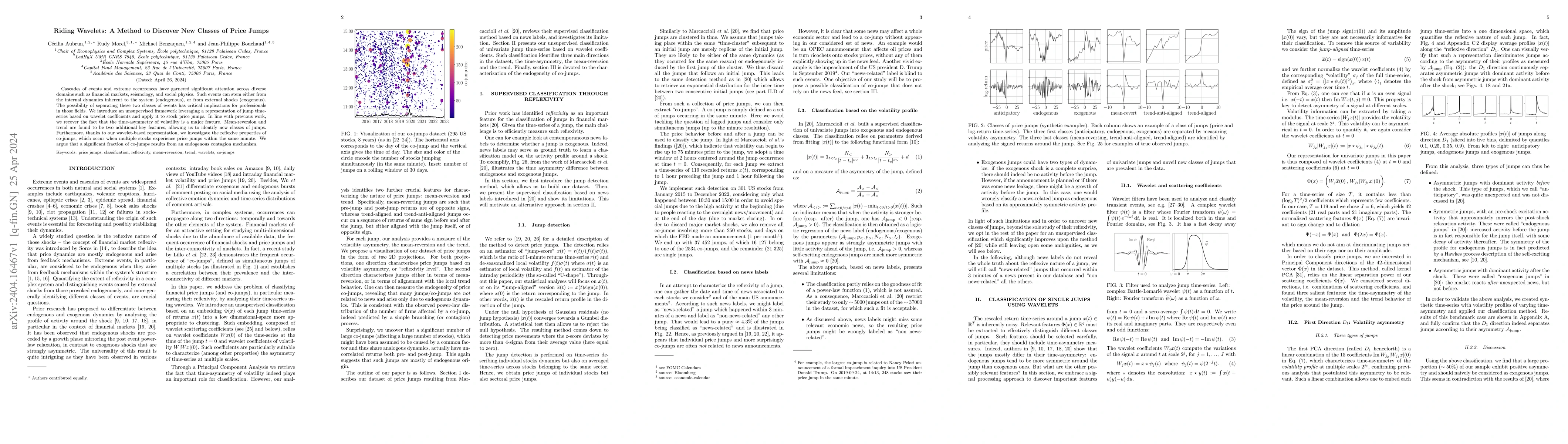

Cascades of events and extreme occurrences have garnered significant attention across diverse domains such as financial markets, seismology, and social physics. Such events can stem either from the internal dynamics inherent to the system (endogenous), or from external shocks (exogenous). The possibility of separating these two classes of events has critical implications for professionals in those fields. We introduce an unsupervised framework leveraging a representation of jump time-series based on wavelet coefficients and apply it to stock price jumps. In line with previous work, we recover the fact that the time-asymmetry of volatility is a major feature. Mean-reversion and trend are found to be two additional key features, allowing us to identify new classes of jumps. Furthermore, thanks to our wavelet-based representation, we investigate the reflexive properties of co-jumps, which occur when multiple stocks experience price jumps within the same minute. We argue that a significant fraction of co-jumps results from an endogenous contagion mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExogenous and Endogenous Price Jumps Belong to Different Dynamical Classes

Michael Benzaquen, Jean-Philippe Bouchaud, Riccardo Marcaccioli

| Title | Authors | Year | Actions |

|---|

Comments (0)