Summary

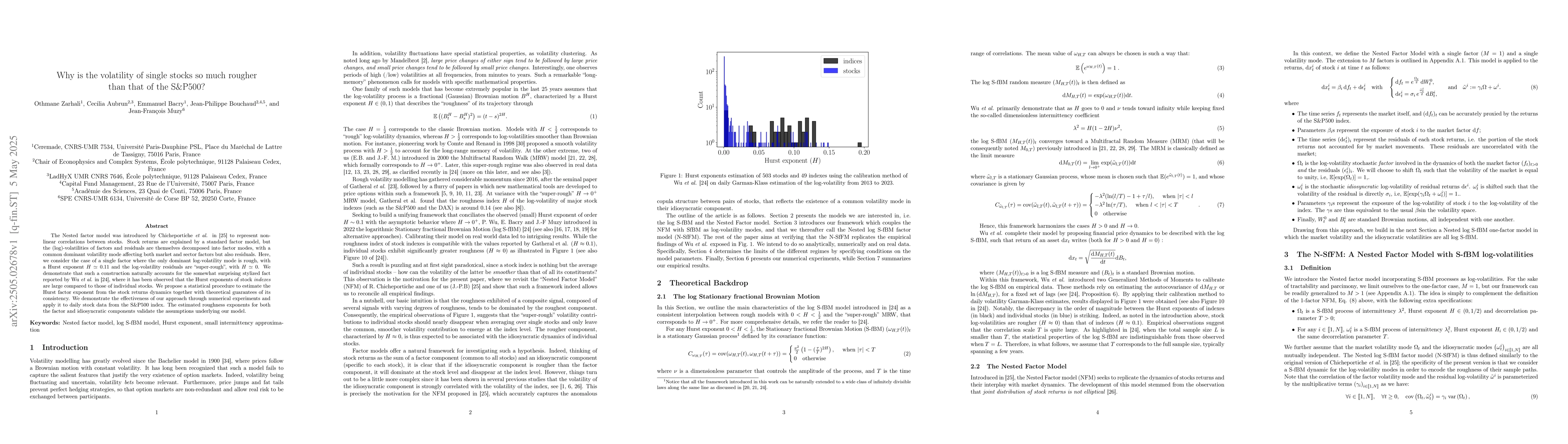

The Nested factor model was introduced by Chicheportiche et al. to represent non-linear correlations between stocks. Stock returns are explained by a standard factor model, but the (log)-volatilities of factors and residuals are themselves decomposed into factor modes, with a common dominant volatility mode affecting both market and sector factors but also residuals. Here, we consider the case of a single factor where the only dominant log-volatility mode is rough, with a Hurst exponent $H \simeq 0.11$ and the log-volatility residuals are ''super-rough'', with $H \simeq 0$. We demonstrate that such a construction naturally accounts for the somewhat surprising stylized fact reported by Wu et al. , where it has been observed that the Hurst exponents of stock indexes are large compared to those of individual stocks. We propose a statistical procedure to estimate the Hurst factor exponent from the stock returns dynamics together with theoretical guarantees of its consistency. We demonstrate the effectiveness of our approach through numerical experiments and apply it to daily stock data from the S&P500 index. The estimated roughness exponents for both the factor and idiosyncratic components validate the assumptions underlying our model.

AI Key Findings

Generated May 28, 2025

Methodology

The research employs the Nested Factor Model, introducing Stationary Fractional Brownian Motions (fBms) as log-volatilities to explain stock returns. It validates the model through synthetic time series and empirical data from S&P500 stocks.

Key Results

- The model successfully reproduces the empirical finding that single stocks have lower Hurst exponents than indexes, attributing this to the 'super-rough' idiosyncratic component of stock dynamics.

- The study demonstrates that the roughness of individual stocks stems from their idiosyncratic components, which average out in index dynamics.

- Synthetic time series generated under relevant regimes match the empirical roughness observed in both stocks and indexes.

Significance

This research contributes to understanding the different levels of roughness between stocks and indexes, providing insights into volatility modeling and financial time series analysis.

Technical Contribution

The Nested Factor Model with Stationary Fractional Brownian Motions as log-volatilities provides a framework for understanding and reproducing the disparity in roughness between individual stocks and indexes.

Novelty

This work extends previous research by Chicheportiche and Bouchaud, demonstrating that the Nested Factor Model naturally accounts for different levels of roughness between stocks and indexes through a 'super-rough' idiosyncratic component.

Limitations

- The study limits the N-SfFM to a one-factor version without residual factor volatility.

- Future work could investigate the model's performance with additional factors, each having its own residual volatility modes.

Future Work

- Investigate the model's performance with multiple factors, each with its own residual volatility modes.

- Explore how different industry sectors might exhibit particular roughness components.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)